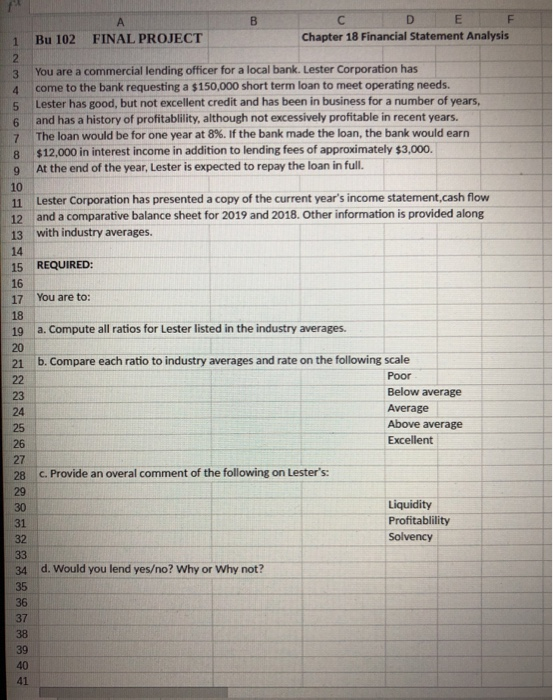

D E F Bu 102 FINAL PROJECT Chapter 18 Financial Statement Analysis 2 3 You are a commercial lending officer for a local bank. Lester Corporation has 4 come to the bank requesting a $150,000 short term loan to meet operating needs. 5 Lester has good, but not excellent credit and has been in business for a number of years, 6 and has a history of profitablility, although not excessively profitable in recent years, 7 The loan would be for one year at 8%. If the bank made the loan, the bank would earn 8 $12,000 in interest income in addition to lending fees of approximately $3,000 9 At the end of the year, Lester is expected to repay the loan in full. 10 11 Lester Corporation has presented a copy of the current year's income statement,cash flow 12 and a comparative balance sheet for 2019 and 2018. Other information is provided along 13 with industry averages. 14 15 REQUIRED: 16 17 You are to: 18 19 a. Compute all ratios for Lester listed in the industry averages. 20 21 b. Compare each ratio to industry averages and rate on the following scale 22 Poor 23 Below average 24 Average 25 Above average 26 Excellent 27 28 c. Provide an overal comment of the following on Lester's: 29 30 Liquidity 31 Profitablility 32 Solvency 33 34 d. Would you lend yeso? Why or Why not? 35 36 37 38 39 40 41 D E F Bu 102 FINAL PROJECT Chapter 18 Financial Statement Analysis 2 3 You are a commercial lending officer for a local bank. Lester Corporation has 4 come to the bank requesting a $150,000 short term loan to meet operating needs. 5 Lester has good, but not excellent credit and has been in business for a number of years, 6 and has a history of profitablility, although not excessively profitable in recent years, 7 The loan would be for one year at 8%. If the bank made the loan, the bank would earn 8 $12,000 in interest income in addition to lending fees of approximately $3,000 9 At the end of the year, Lester is expected to repay the loan in full. 10 11 Lester Corporation has presented a copy of the current year's income statement,cash flow 12 and a comparative balance sheet for 2019 and 2018. Other information is provided along 13 with industry averages. 14 15 REQUIRED: 16 17 You are to: 18 19 a. Compute all ratios for Lester listed in the industry averages. 20 21 b. Compare each ratio to industry averages and rate on the following scale 22 Poor 23 Below average 24 Average 25 Above average 26 Excellent 27 28 c. Provide an overal comment of the following on Lester's: 29 30 Liquidity 31 Profitablility 32 Solvency 33 34 d. Would you lend yeso? Why or Why not? 35 36 37 38 39 40 41