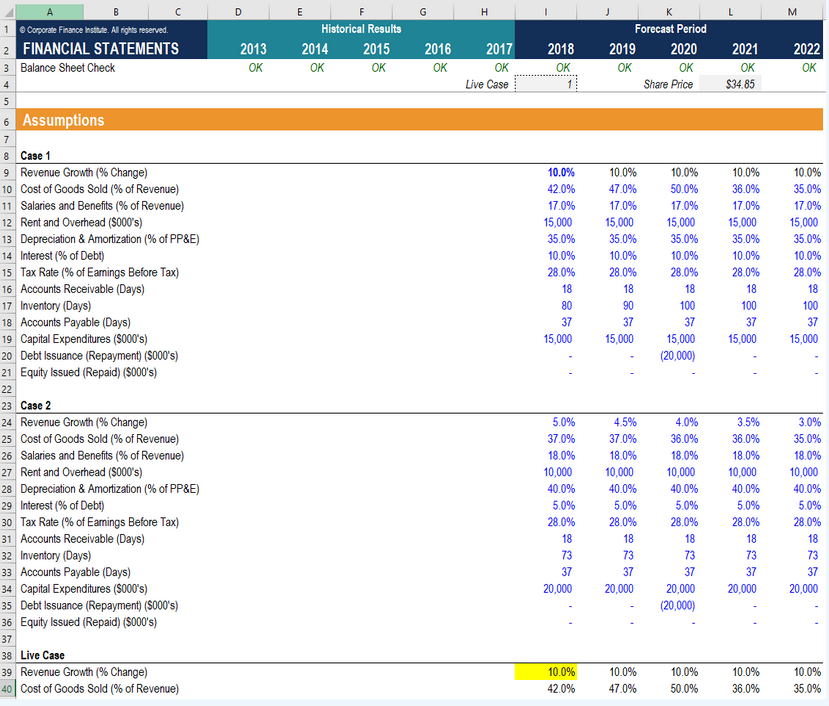

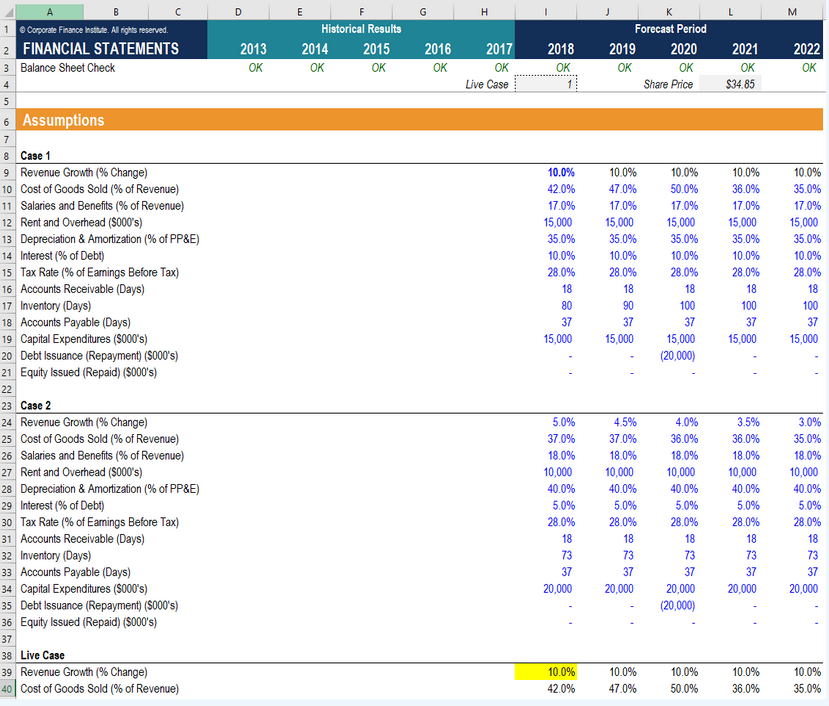

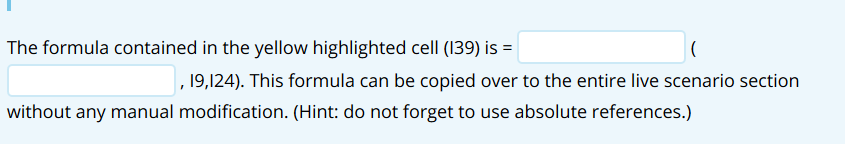

D E F G H ) K M 2013 OK Historical Results 2014 2015 OK OK 2016 OK 2017 OK Live Case 2018 OK Forecast Period 2019 2020 OK OK Share Price 2021 OK $34.85 2022 OK 10.0% 42.0% 17.0% 15,000 35.0% 10.0% 28.0% 18 80 37 15,000 10.0% 47.0% 17.0% 15,000 35.0% 10.0% 28.0% 18 90 37 15,000 10.0% 50.0% 17.0% 15,000 35.0% 10.0% 28.0% 18 100 37 15,000 (20,000) 10.0% 36.0% 17.0% 15,000 35.0% 10.0% 28.0% 18 100 37 15,000 B Corporate Finance Institute. All rights reserved 2 FINANCIAL STATEMENTS 3 Balance Sheet Check 4 5 6 Assumptions 7 8 Case 1 9 Revenue Growth (% Change) 10 Cost of Goods Sold (% of Revenue) 11 Salaries and Benefits % of Revenue) 12 Rent and Overhead (5000's) 13 Depreciation & Amortization (% of PP&E) 14 Interest (% of Debt) 15 Tax Rate (% of Earnings Before Tax) 16 Accounts Receivable (Days) 17 Inventory (Days) 18 Accounts Payable (Days) 19 Capital Expenditures ($000's) 20 Debt Issuance (Repayment) (S000's) 21 Equity Issued (Repaid) ($000's) 22 23 Case 2 24 Revenue Growth (% Change) 25 Cost of Goods Sold (% of Revenue) 26 Salaries and Benefits % of Revenue) 27 Rent and Overhead (S000's) 28 Depreciation & Amortization (% of PP&E) 29 Interest (% of Debt) 30 Tax Rate (% of Earnings Before Tax) 31 Accounts Receivable (Days) 32 Inventory (Days) 33 Accounts Payable (Days) 34 Capital Expenditures ($000's) 35 Debt Issuance (Repayment) (S000's) 36 Equity Issued (Repaid) ($000's) 37 38 Live Case 39 Revenue Growth (% Change) 40 Cost of Goods Sold (% of Revenue) 10.0% 35.0% 17.0% 15,000 35.0% 10.0% 28.0% 18 100 37 15,000 5.0% 37.0% 18.0% 10,000 40.0% 5.0% 28.0% 18 73 37 20,000 4.5% 37.0% 18.0% 10,000 40.0% 5.0% 28.0% 18 73 37 20,000 4.0% 36.0% 18.0% 10,000 40.0% 5.0% 28.0% 18 73 37 20,000 (20,000) 3.5% 36.0% 18.0% 10,000 40.0% 5.0% 28.0% 18 73 37 20,000 3.0% 35.0% 18.0% 10,000 40.0% 5.0% 28.0% 18 73 37 20,000 10.0% 42.0% 10.0% 47.0% 10.0% 50.0% 10.0% 36.0% 10.0% 35.0% ( The formula contained in the yellow highlighted cell (139) is = , 19,124). This formula can be copied over to the entire live scenario section without any manual modification. (Hint: do not forget to use absolute references.)