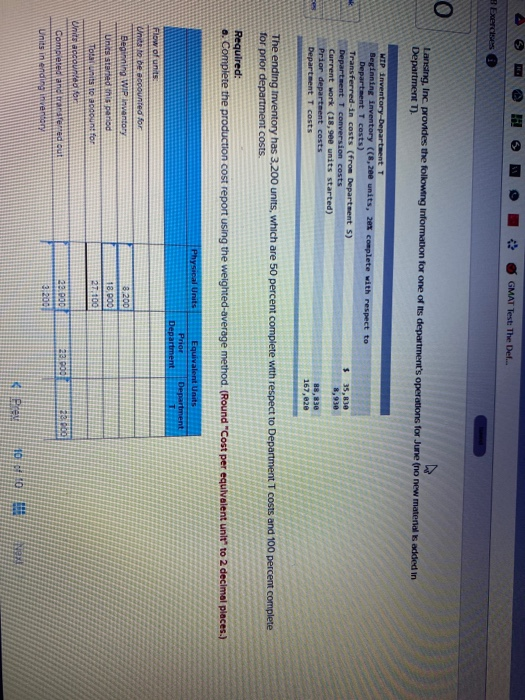

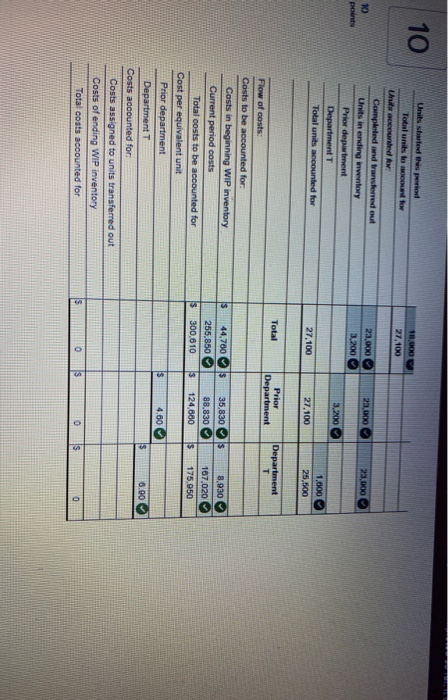

D e GMAT Test The Del Exercises Lansing, Inc. provides the following information for one of its department's operations for Jun Department T) WIP inventory-Departeent T Beginning inventory (8,200 units, 201 complete with respect to Department T costs) Transferred-in costs (from Department s) Department T conversion costs Current work (18,9ee units started) Prior department costs Department T costs 35,830 8,930 167,020 The ending Inventory has 3,200 units, which are 50 percent complete with respect to Department T costs and 100 percent complete for prior department costs. Required: o. Complete the production cost report using the weighted-average method. (Round "Cost per equivalent unit to 2 decimal places.) Physical Units Equivalent Units Department Prior Department Flow of units Une to be accounted for Beginning WIR Inventory 8.200 Unes started this period Toats to account for Unite account for Completed and are red but Units in ending inverter 20 IPHONE 10 27.100 L Units started this period Total units too low ed Completed and transferred out Unitsin ending inventory Prior department Department T Total units accounted for 23.000 3.200 23.000 23,000 points 3.200 27.100 27.100 1.000 25,00 Total Prior Department Department $ $ 44,760 255,850 300,610 35,830 88,830 124,880 8,030 167,020 175,950 3 $ Flow of costs: Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit Prior department Department Costs accounted for: Costs assigned to units transferred out Costs of ending WIP inventory Total costs accounted for $ 4.60 $ 0.00 S O O S D e GMAT Test The Del Exercises Lansing, Inc. provides the following information for one of its department's operations for Jun Department T) WIP inventory-Departeent T Beginning inventory (8,200 units, 201 complete with respect to Department T costs) Transferred-in costs (from Department s) Department T conversion costs Current work (18,9ee units started) Prior department costs Department T costs 35,830 8,930 167,020 The ending Inventory has 3,200 units, which are 50 percent complete with respect to Department T costs and 100 percent complete for prior department costs. Required: o. Complete the production cost report using the weighted-average method. (Round "Cost per equivalent unit to 2 decimal places.) Physical Units Equivalent Units Department Prior Department Flow of units Une to be accounted for Beginning WIR Inventory 8.200 Unes started this period Toats to account for Unite account for Completed and are red but Units in ending inverter 20 IPHONE 10 27.100 L Units started this period Total units too low ed Completed and transferred out Unitsin ending inventory Prior department Department T Total units accounted for 23.000 3.200 23.000 23,000 points 3.200 27.100 27.100 1.000 25,00 Total Prior Department Department $ $ 44,760 255,850 300,610 35,830 88,830 124,880 8,030 167,020 175,950 3 $ Flow of costs: Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit Prior department Department Costs accounted for: Costs assigned to units transferred out Costs of ending WIP inventory Total costs accounted for $ 4.60 $ 0.00 S O O S