Answered step by step

Verified Expert Solution

Question

1 Approved Answer

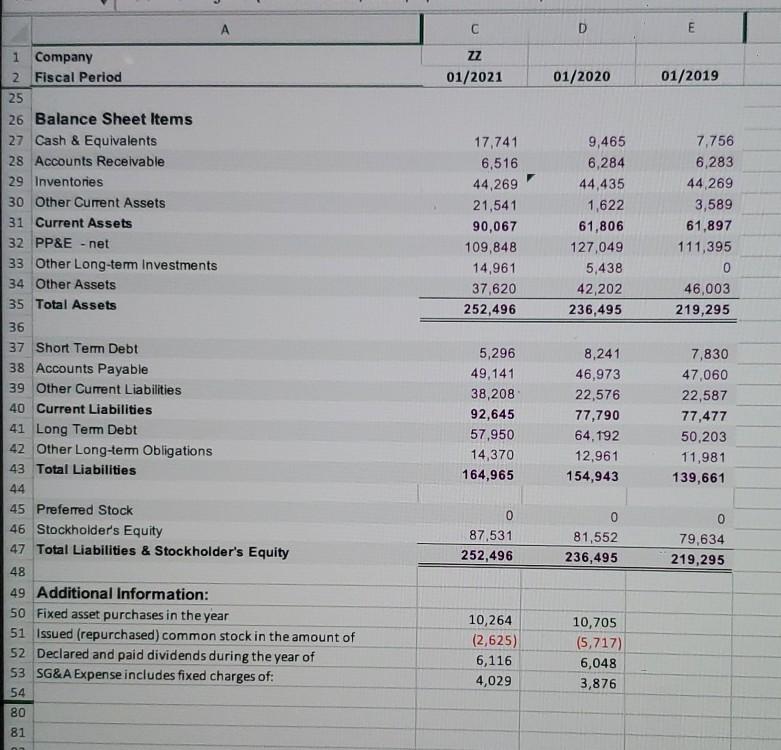

D E ZZ 01/2021 01/2020 01/2019 17,741 6,516 44,269 21,541 90,067 109,848 14,961 37,620 252,496 9,465 6,284 44,435 1,622 61,806 127,049 5,438 42,202 236,495 7,756

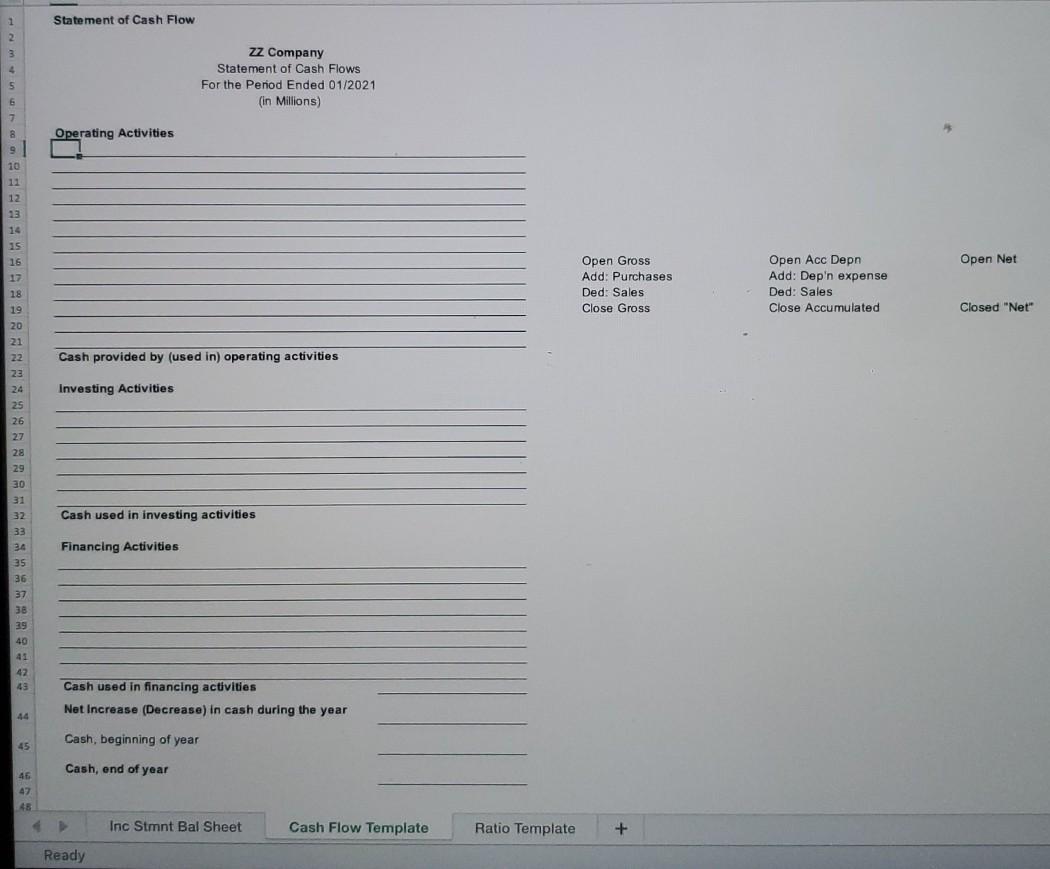

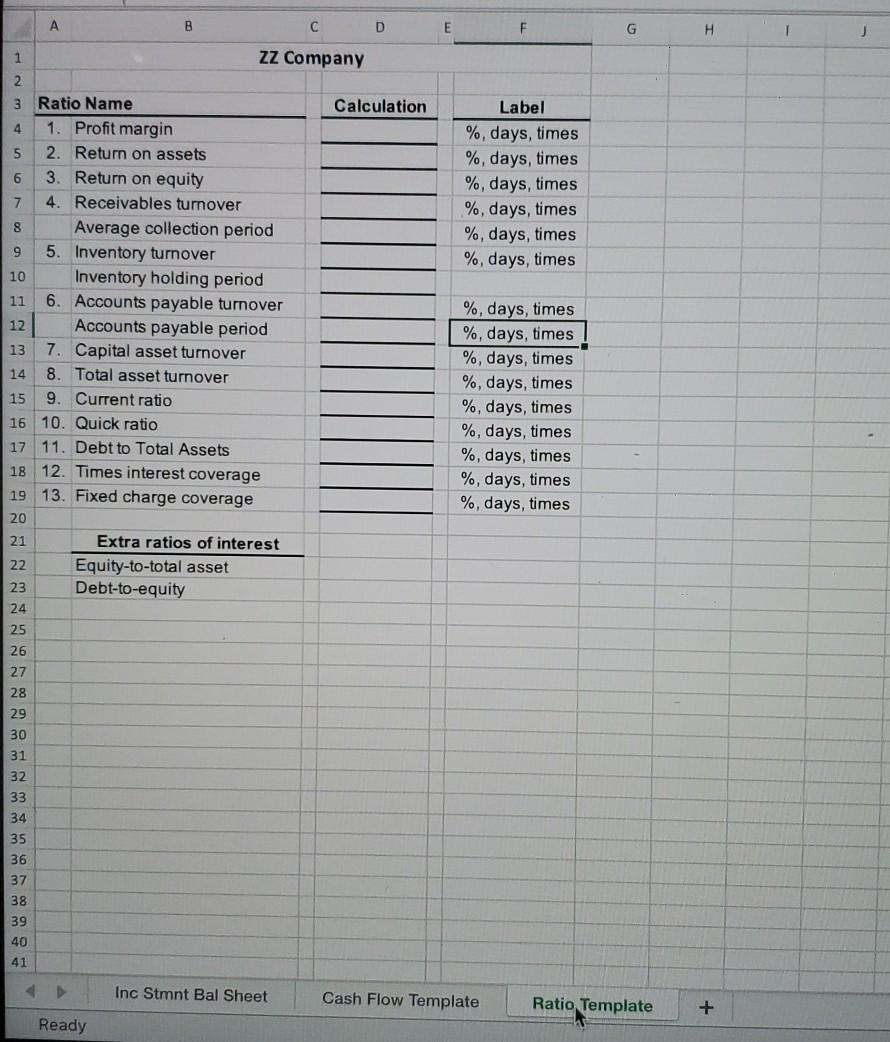

D E ZZ 01/2021 01/2020 01/2019 17,741 6,516 44,269 21,541 90,067 109,848 14,961 37,620 252,496 9,465 6,284 44,435 1,622 61,806 127,049 5,438 42,202 236,495 7,756 6,283 44,269 3,589 61,897 111,395 0 46,003 219,295 1 Company 2 Fiscal Period 25 26 Balance Sheet Items 27 Cash & Equivalents 28 Accounts Receivable 29 Inventories 30 Other Current Assets 31 Current Assets 32 PP&E - net 33 Other Long-term Investments 34 Other Assets 35 Total Assets 36 37 Short Term Debt 38 Accounts Payable 39 Other Current Liabilities 40 Current Liabilities 41 Long Term Debt 42 Other Long-term Obligations 43 Total Liabilities 44 45 Preferred Stock 46 Stockholder's Equity 47 Total Liabilities & Stockholder's Equity 48 49 Additional Information: 50 Fixed asset purchases in the year 51 Issued (repurchased) common stock in the amount of 52 Declared and paid dividends during the year of 53 SG&A Expense includes fixed charges of: 54 5,296 49,141 38,208 92,645 57,950 14,370 164,965 8,241 46,973 22,576 77,790 64,192 12,961 154,943 7,830 47,060 22,587 77,477 50.2 11,981 139,661 0 0 0 87,531 252,496 81,552 236,495 79,634 219,295 10,264 (2,625) 6,116 4,029 10,705 (5,717) 6,048 3,876 80 81 1 Statement of Cash Flow 3 ZZ Company Statement of Cash Flows For the Period Ended 01/2021 (in Millions) Operating Activities 10 12 Open Net 13 14 15 16 17 18 19 20 21 Open Gross Add: Purchases Ded: Sales Close Gross Open Acc Depn Add: Dep'n expense Ded: Sales Close Accumulated Closed "Net" 22 . 23 Cash provided by (used in) operating activities Investing Activities 24 25 26 27 Cash used in investing activities Financing Activities 28 29 30 31 32 34 33 34 35 36 37 38 39 40 41 42 43 Cash used in financing activities Net Increase (Decrease) in cash during the year Cash, beginning of year 45 Cash, end of year 46 47 45 Inc Stmnt Bal Sheet Cash Flow Template Ratio Template + Ready A B D E F G H I u Label %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times 1 ZZ Company 2 3 Ratio Name Calculation 4 1. Profit margin 5 2. Return on assets 6 3. Return on equity 7 4. Receivables turnover 8 Average collection period 9 5. Inventory turnover 10 Inventory holding period 11 6. Accounts payable turnover 12 Accounts payable period 13 7. Capital asset turnover 14 8. Total asset turnover 15 9. Current ratio 16 10. Quick ratio 17 11. Debt to Total Assets 18 12. Times interest coverage 19 13. Fixed charge coverage 20 21 Extra ratios of interest 22 Equity-to-total asset 23 Debt-to-equity 24 %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Inc Stmnt Bal Sheet Cash Flow Template Ratio Template + Ready D E ZZ 01/2021 01/2020 01/2019 17,741 6,516 44,269 21,541 90,067 109,848 14,961 37,620 252,496 9,465 6,284 44,435 1,622 61,806 127,049 5,438 42,202 236,495 7,756 6,283 44,269 3,589 61,897 111,395 0 46,003 219,295 1 Company 2 Fiscal Period 25 26 Balance Sheet Items 27 Cash & Equivalents 28 Accounts Receivable 29 Inventories 30 Other Current Assets 31 Current Assets 32 PP&E - net 33 Other Long-term Investments 34 Other Assets 35 Total Assets 36 37 Short Term Debt 38 Accounts Payable 39 Other Current Liabilities 40 Current Liabilities 41 Long Term Debt 42 Other Long-term Obligations 43 Total Liabilities 44 45 Preferred Stock 46 Stockholder's Equity 47 Total Liabilities & Stockholder's Equity 48 49 Additional Information: 50 Fixed asset purchases in the year 51 Issued (repurchased) common stock in the amount of 52 Declared and paid dividends during the year of 53 SG&A Expense includes fixed charges of: 54 5,296 49,141 38,208 92,645 57,950 14,370 164,965 8,241 46,973 22,576 77,790 64,192 12,961 154,943 7,830 47,060 22,587 77,477 50.2 11,981 139,661 0 0 0 87,531 252,496 81,552 236,495 79,634 219,295 10,264 (2,625) 6,116 4,029 10,705 (5,717) 6,048 3,876 80 81 1 Statement of Cash Flow 3 ZZ Company Statement of Cash Flows For the Period Ended 01/2021 (in Millions) Operating Activities 10 12 Open Net 13 14 15 16 17 18 19 20 21 Open Gross Add: Purchases Ded: Sales Close Gross Open Acc Depn Add: Dep'n expense Ded: Sales Close Accumulated Closed "Net" 22 . 23 Cash provided by (used in) operating activities Investing Activities 24 25 26 27 Cash used in investing activities Financing Activities 28 29 30 31 32 34 33 34 35 36 37 38 39 40 41 42 43 Cash used in financing activities Net Increase (Decrease) in cash during the year Cash, beginning of year 45 Cash, end of year 46 47 45 Inc Stmnt Bal Sheet Cash Flow Template Ratio Template + Ready A B D E F G H I u Label %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times 1 ZZ Company 2 3 Ratio Name Calculation 4 1. Profit margin 5 2. Return on assets 6 3. Return on equity 7 4. Receivables turnover 8 Average collection period 9 5. Inventory turnover 10 Inventory holding period 11 6. Accounts payable turnover 12 Accounts payable period 13 7. Capital asset turnover 14 8. Total asset turnover 15 9. Current ratio 16 10. Quick ratio 17 11. Debt to Total Assets 18 12. Times interest coverage 19 13. Fixed charge coverage 20 21 Extra ratios of interest 22 Equity-to-total asset 23 Debt-to-equity 24 %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Inc Stmnt Bal Sheet Cash Flow Template Ratio Template + Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started