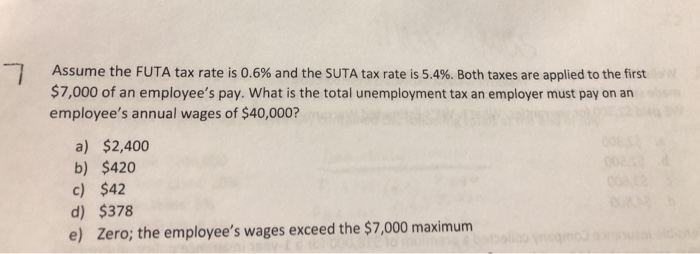

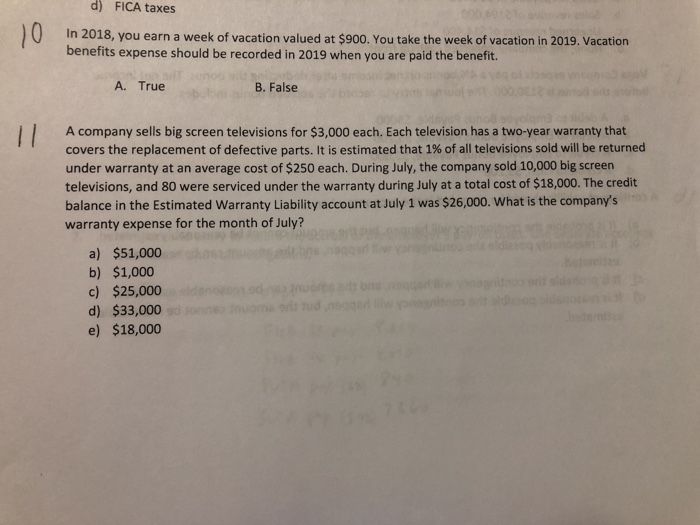

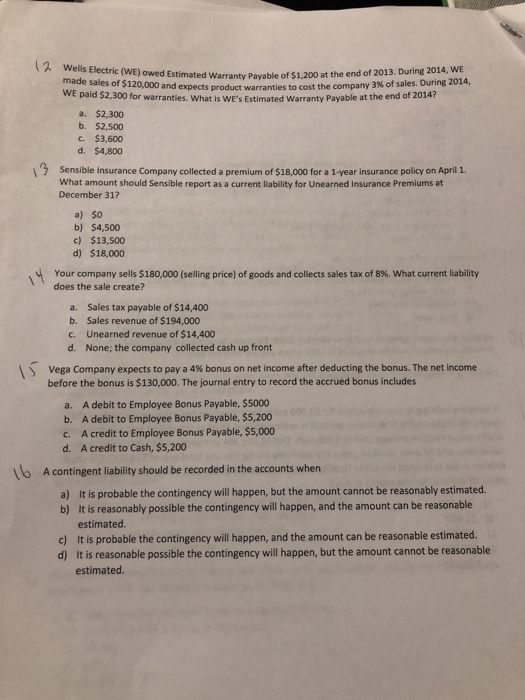

d) FICA taxes In 2018, you earn a week of vacation valued at $900. You take the week of vacation in 2019. Vacation benefits expense should be recorded in 2019 when you are paid the benefit. A. True B. False A company sells big screen televisions for $3,000 each. Each television has a two-year warranty that covers the replacement of defective parts. It is estimated that 1% of all televisions sold will be returned under warranty at an average cost of $250 each. During July, the company sold 10,000 big screen televisions, and 80 were serviced under the warranty during July at a total cost of $18,000. The credit balance in the Estimated Warranty Liability account at July 1 was $26,000. What is the company's warranty expense for the month of July? a) $51,000 b) $1,000 c) $25,000 d) $33,000 e) $18,000 2 Wells Electric (WE) owed Estimated rranty Payable of $1,200 at the end of 2013. During 2014, WE made sales of $ % of sales. During 2014, 120,000 and expects product warranties to cost the company 3 WE paid $2,300 for warranties. What is WE's Estimated Warranty Payable at the end of 2014? a. $2,300 b. $2,500 c. $3,600 d. $4,800 Sensible Insurance Company collected a premium of $18,000 for a 1-year insurance policy on April 1. What amount should Sensible report as a current liability for Unearned Insurance Premiums at December 31? a) $0 b) $4,500 c) $13,500 d) $18,000 Your company sells $180,000 (selling price) of goods and collects sales tax of 8%, what current liability does the sale create? Sales tax payable of $14,400 Sales revenue of $194,000 Unearned revenue of $14,400 None; the company collected cash up front a. b. c. d. Vega Company expects to pay a 4% bonus on net income after deducting the bonus. The net income before the bonus is $130,000. The journal entry to record the accrued bonus includes A debit to Employee Bonus Payable, $5000 A debit to Employee Bonus Payable, $5,200 A credit to Employee Bonus Payable, $5,000 A credit to Cash, $5,200 a. b. c. d. tb A contingent liability should be recorded in the accounts when It is probable the contingency will happen, but the amount cannot be reasonably estimated. It is reasonably possible the contingency will happen, and the amount can be reasonable estimated. lt is probable the contingency will happen, and the amount can be reasonable estimated. It is reasonable possible the contingency will happen, but the amount cannot be reasonable estimated. a) b) c) d)