Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d ) Financial Analysis a . For the past two years, calculate and discuss the significance of the ratios listed below. Your discussion should not

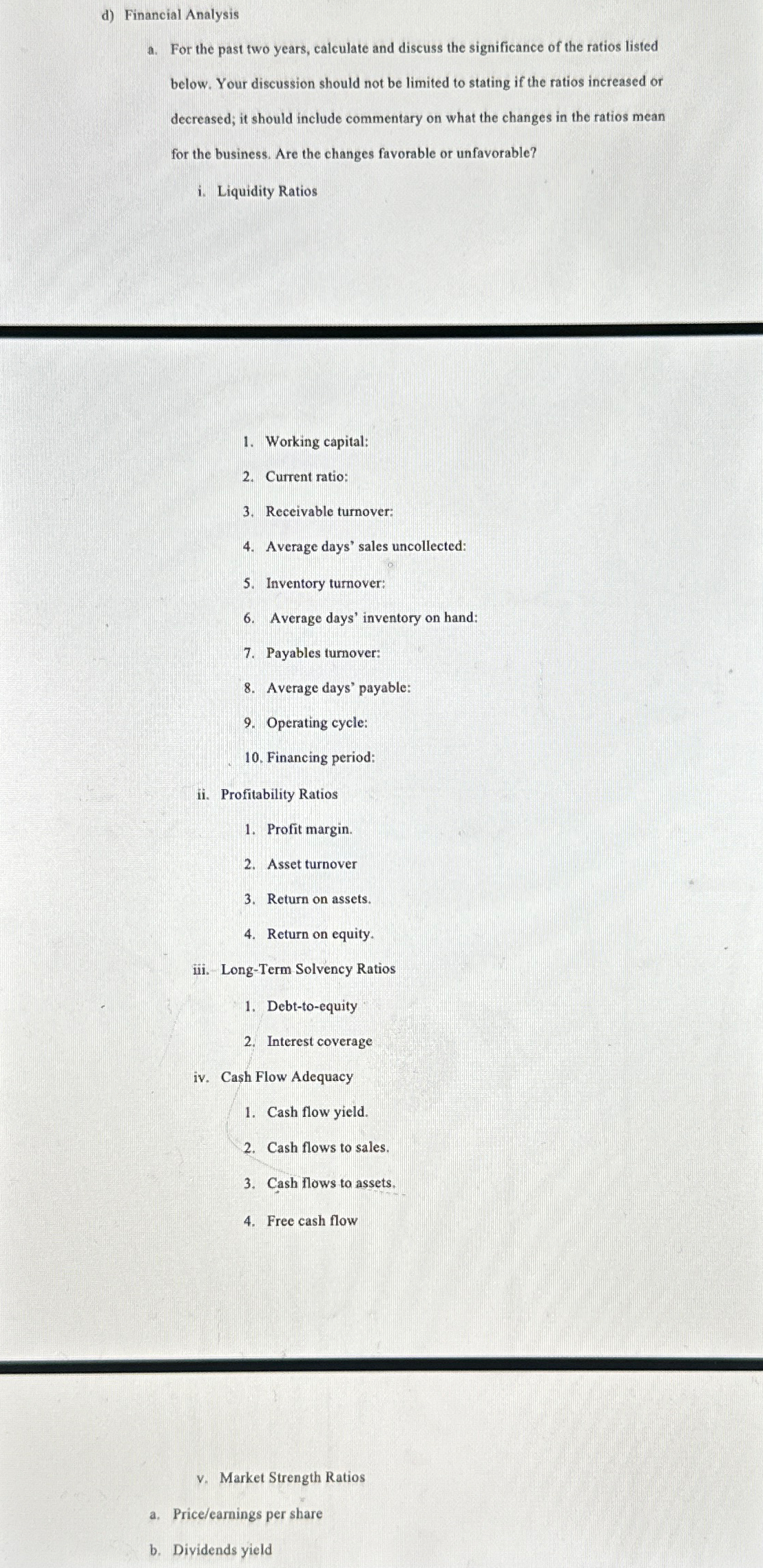

d Financial Analysis

a For the past two years, calculate and discuss the significance of the ratios listed below. Your discussion should not be limited to stating if the ratios increased or decreased; it should include commentary on what the changes in the ratios mean for the business. Are the changes favorable or unfavorable?

i Liquidity Ratios

Working capital:

Current ratio:

Receivable turnover:

Average days' sales uncollected:

Inventory turnover:

Average days' inventory on hand:

Payables turnover:

Average days' payable:

Operating cycle:

Financing period:

ii Profitability Ratios

Profit margin.

Asset turnover

Return on assets.

Return on equity.

iii. LongTerm Solvency Ratios

Debttoequity

Interest coverage

iv Cash Flow Adequacy

Cash flow yield.

Cash flows to sales.

Cash flows to assets.

Free cash flow

v Market Strength Ratios

a Priceearnings per share

b Dividends yield

Please fill this out with the correct Financial information from about the brand Nike.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started