Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d) Given the betas of these securities in part (c), your manager also wants you to calculate the required rate of return on these three

d) Given the betas of these securities in part (c), your manager also wants you to calculate the required rate of return on these three stocks and determine the underpriced, overpriced, and correctly-priced securities. e) If you need to choose one of these stocks for investment, decide which one you choose and briefly explain why you choose that stock.

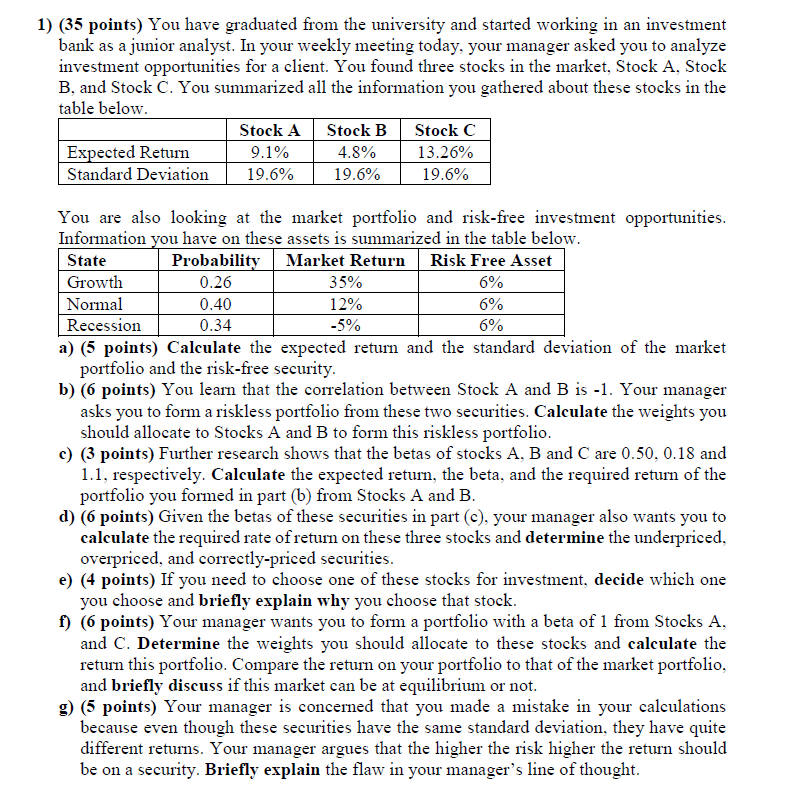

1) (35 points) You have graduated from the university and started working in an investment bank as a junior analyst. In your weekly meeting today, your manager asked you to analyze investment opportunities for a client. You found three stocks in the market, Stock A, Stock B, and Stock C. You summarized all the information you gathered about these stocks in the table below. Stock A Stock C Stock B 4.8% Expected Return 9.1% 13.26% Standard Deviation 19.6% 19.6% 19.6% You are also looking at the market portfolio and risk-free investment opportunities. Information you have on these assets is summarized in the table below. State Probability Market Return Risk Free Asset Growth 0.26 35% 6% Normal 0.40 12% 6% Recession 0.34 -5% 6% a) (5 points) Calculate the expected return and the standard deviation of the market portfolio and the risk-free security. b) (6 points) You learn that the correlation between Stock A and B is -1. Your manager asks you to form a riskless portfolio from these two securities. Calculate the weights you should allocate to Stocks A and B to form this riskless portfolio. c) (3 points) Further research shows that the betas of stocks A, B and C are 0.50, 0.18 and 1.1, respectively. Calculate the expected return, the beta, and the required return of the portfolio you formed in part (b) from Stocks A and B. d) (6 points) Given the betas of these securities in part (c), your manager also wants you to calculate the required rate of return on these three stocks and determine the underpriced, overpriced, and correctly-priced securities. e) (4 points) If you need to choose one of these stocks for investment, decide which one you choose and briefly explain why you choose that stock. f) (6 points) Your manager wants you to form a portfolio with a beta of 1 from Stocks A, and C. Determine the weights you should allocate to these stocks and calculate the return this portfolio. Compare the return on your portfolio to that of the market portfolio, and briefly discuss if this market can be at equilibrium or not. g) (5 points) Your manager is concerned that you made a mistake in your calculations because even though these securities have the same standard deviation, they have quite different returns. Your manager argues that the higher the risk higher the return should be on a security. Briefly explain the flaw in your manager's line of thought. 1) (35 points) You have graduated from the university and started working in an investment bank as a junior analyst. In your weekly meeting today, your manager asked you to analyze investment opportunities for a client. You found three stocks in the market, Stock A, Stock B, and Stock C. You summarized all the information you gathered about these stocks in the table below. Stock A Stock C Stock B 4.8% Expected Return 9.1% 13.26% Standard Deviation 19.6% 19.6% 19.6% You are also looking at the market portfolio and risk-free investment opportunities. Information you have on these assets is summarized in the table below. State Probability Market Return Risk Free Asset Growth 0.26 35% 6% Normal 0.40 12% 6% Recession 0.34 -5% 6% a) (5 points) Calculate the expected return and the standard deviation of the market portfolio and the risk-free security. b) (6 points) You learn that the correlation between Stock A and B is -1. Your manager asks you to form a riskless portfolio from these two securities. Calculate the weights you should allocate to Stocks A and B to form this riskless portfolio. c) (3 points) Further research shows that the betas of stocks A, B and C are 0.50, 0.18 and 1.1, respectively. Calculate the expected return, the beta, and the required return of the portfolio you formed in part (b) from Stocks A and B. d) (6 points) Given the betas of these securities in part (c), your manager also wants you to calculate the required rate of return on these three stocks and determine the underpriced, overpriced, and correctly-priced securities. e) (4 points) If you need to choose one of these stocks for investment, decide which one you choose and briefly explain why you choose that stock. f) (6 points) Your manager wants you to form a portfolio with a beta of 1 from Stocks A, and C. Determine the weights you should allocate to these stocks and calculate the return this portfolio. Compare the return on your portfolio to that of the market portfolio, and briefly discuss if this market can be at equilibrium or not. g) (5 points) Your manager is concerned that you made a mistake in your calculations because even though these securities have the same standard deviation, they have quite different returns. Your manager argues that the higher the risk higher the return should be on a security. Briefly explain the flaw in your manager's line of thought

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started