Answered step by step

Verified Expert Solution

Question

1 Approved Answer

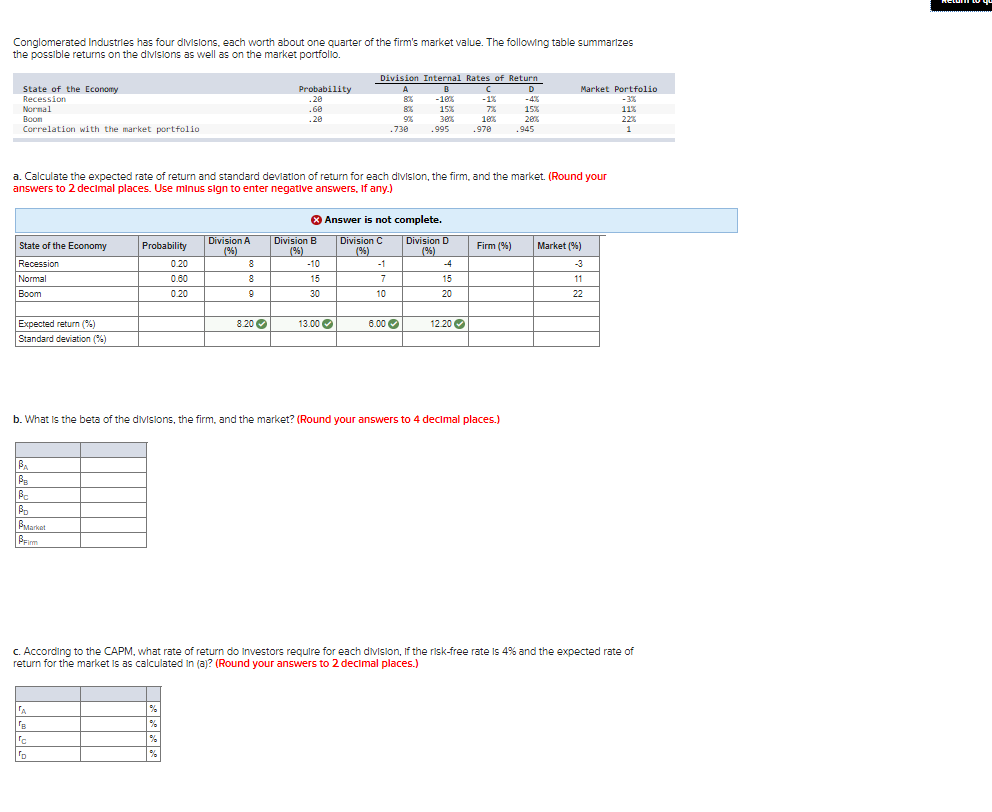

d. If the company was thinking of selling the underperforming divisions, which one(s) should it consider selling? ELOW Conglomerated Industries has four divisions, each worth

d. If the company was thinking of selling the underperforming divisions, which one(s) should it consider selling?

ELOW Conglomerated Industries has four divisions, each worth about one quarter of the firm's market value. The following table summarizes the possible retums on the divisions as well as on the market portfolio. State of the Economy Recession Normal Boom Correlation with the market portfolio Probability .20 .68 .29 Division Internal Rates of Return A B D -185 - 1% -4% 8% 15% 15% 93 3806 163 200 .730 .995 .970 .945 Market Portfolio -3% 11% 22% 1 a. Calculate the expected rate of return and standard deviation of return for each division, the firm, and the market. (Round your answers to 2 decimal places. Use minus sign to enter negative answers. If any.) * Answer is not complete. State of the Economy Probability Division D Firm (%) Recession Norma Boom 0.20 0.60 0.20 Division A (%) 8 8 g 9 Division B (%) -10 15 30 Division C (96) -1 7 10 -4 15 Market (%) 3 11 22 20 8.20 13.00 6.00 12.20 Expected return (%) Standard deviation (%) b. What is the beta of the divisions, the firm, and the market? (Round your answers to 4 decimal places.) ? 4 ) BA BE BC Bp Butarat Beim c. According to the CAPM, what rate of return do investors require for each division, if the risk-free rate is 4% and the expected rate of return for the market is as calculated in (a)? (Round your answers to 2 decimal places.) CA ro ELOW Conglomerated Industries has four divisions, each worth about one quarter of the firm's market value. The following table summarizes the possible retums on the divisions as well as on the market portfolio. State of the Economy Recession Normal Boom Correlation with the market portfolio Probability .20 .68 .29 Division Internal Rates of Return A B D -185 - 1% -4% 8% 15% 15% 93 3806 163 200 .730 .995 .970 .945 Market Portfolio -3% 11% 22% 1 a. Calculate the expected rate of return and standard deviation of return for each division, the firm, and the market. (Round your answers to 2 decimal places. Use minus sign to enter negative answers. If any.) * Answer is not complete. State of the Economy Probability Division D Firm (%) Recession Norma Boom 0.20 0.60 0.20 Division A (%) 8 8 g 9 Division B (%) -10 15 30 Division C (96) -1 7 10 -4 15 Market (%) 3 11 22 20 8.20 13.00 6.00 12.20 Expected return (%) Standard deviation (%) b. What is the beta of the divisions, the firm, and the market? (Round your answers to 4 decimal places.) ? 4 ) BA BE BC Bp Butarat Beim c. According to the CAPM, what rate of return do investors require for each division, if the risk-free rate is 4% and the expected rate of return for the market is as calculated in (a)? (Round your answers to 2 decimal places.) CA ro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started