Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d IS T peen T mo Question 7 of 75. Major Winters, a member of the Army Reserve, traveled to a location 250 miles from

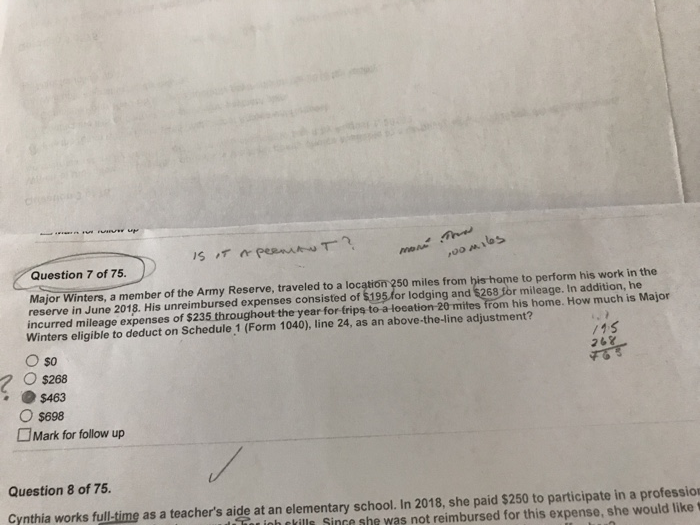

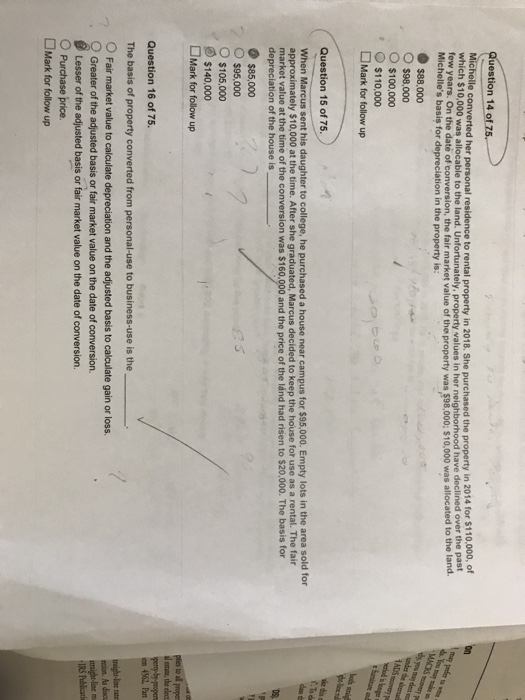

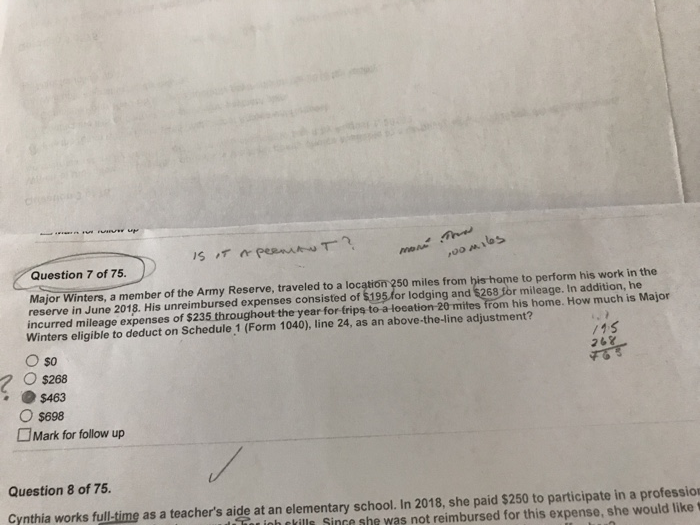

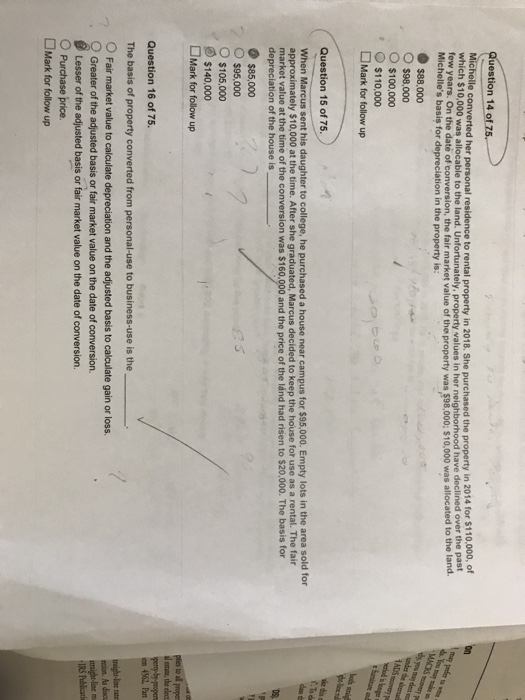

d IS T peen T mo Question 7 of 75. Major Winters, a member of the Army Reserve, traveled to a location 250 miles from his home to perform his work in the reserve in June 2018. His unreimbursed expenses consisted of $195.for lodging and $268 for mileage. In addition, he incurred mileage expenses of $235 throughout the year for frips to a-ocation 20 mites from his home. How much is Major Winters eligible to deduct on Schedule 1 (Form 1040), line 24, as an above-the-line adjustment? O so 26 $268 $463 O $698 Mark for follow up / Question 8 of 75 Cynthia works full-time as a teacher's aide at an elementary school. In 2018, she paid $250 to participate in a profession R ioh ekills Since she was not reimbursed for this expense, she would like Question 14 of 75. on may pedr o wd You may m -MACRS my eyou may dea t Michelle converted her personal residence to rental property in 2018. She purchased the property in 2014 for $110.000, of rew years. On the date of conversion, the fair market value of the property was $98.000: $10,000 was allocated to the land. Michelle's basis for depreciation in the property is 0 was allocable to the land. Unfortunately, property values in her neighborhood have declined over the past unda he mai ADS mvery pet rod is longe t fminu and $88,000 $98,000 $100,000 $110,000 Mark for follow up tTo de dan dh When Marcus sent his daughter to college, he purchased a house near campus for $95,000. Empty lots in the area sold for approximately $10,000 at the time. After she graduated, Marcus decided to keep the house for use as a rental. The fair market value at the time of the conversion was $160,000 and the price of the lnd had risen to $20,000. The basis for depreciation of the house is Question 15 of 75 $85,000 $95,000 $105,000 $140,000 ples to al propert al estane, the elect perry-by-peopera m 4562 Pan Mark for follow up Question 16 of 75. ight line rate ion As discu migh-line m IRS Publicatia The basis of property converted from personal-use to business-use is the Fair market value to calculate depreciation and the adjusted basis to calculate gain or loss. Greater of the adjusted basis or fair market value on the date of conversion. Lesser of the adjusted basis or fair market value on the date of conversion. Purchase price Mark for follow up

d IS T peen T mo Question 7 of 75. Major Winters, a member of the Army Reserve, traveled to a location 250 miles from his home to perform his work in the reserve in June 2018. His unreimbursed expenses consisted of $195.for lodging and $268 for mileage. In addition, he incurred mileage expenses of $235 throughout the year for frips to a-ocation 20 mites from his home. How much is Major Winters eligible to deduct on Schedule 1 (Form 1040), line 24, as an above-the-line adjustment? O so 26 $268 $463 O $698 Mark for follow up / Question 8 of 75 Cynthia works full-time as a teacher's aide at an elementary school. In 2018, she paid $250 to participate in a profession R ioh ekills Since she was not reimbursed for this expense, she would like Question 14 of 75. on may pedr o wd You may m -MACRS my eyou may dea t Michelle converted her personal residence to rental property in 2018. She purchased the property in 2014 for $110.000, of rew years. On the date of conversion, the fair market value of the property was $98.000: $10,000 was allocated to the land. Michelle's basis for depreciation in the property is 0 was allocable to the land. Unfortunately, property values in her neighborhood have declined over the past unda he mai ADS mvery pet rod is longe t fminu and $88,000 $98,000 $100,000 $110,000 Mark for follow up tTo de dan dh When Marcus sent his daughter to college, he purchased a house near campus for $95,000. Empty lots in the area sold for approximately $10,000 at the time. After she graduated, Marcus decided to keep the house for use as a rental. The fair market value at the time of the conversion was $160,000 and the price of the lnd had risen to $20,000. The basis for depreciation of the house is Question 15 of 75 $85,000 $95,000 $105,000 $140,000 ples to al propert al estane, the elect perry-by-peopera m 4562 Pan Mark for follow up Question 16 of 75. ight line rate ion As discu migh-line m IRS Publicatia The basis of property converted from personal-use to business-use is the Fair market value to calculate depreciation and the adjusted basis to calculate gain or loss. Greater of the adjusted basis or fair market value on the date of conversion. Lesser of the adjusted basis or fair market value on the date of conversion. Purchase price Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started