Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d ) Journalize the following adjusting entries using the following information: An employee was short paid $ 5 0 0 for the month of January

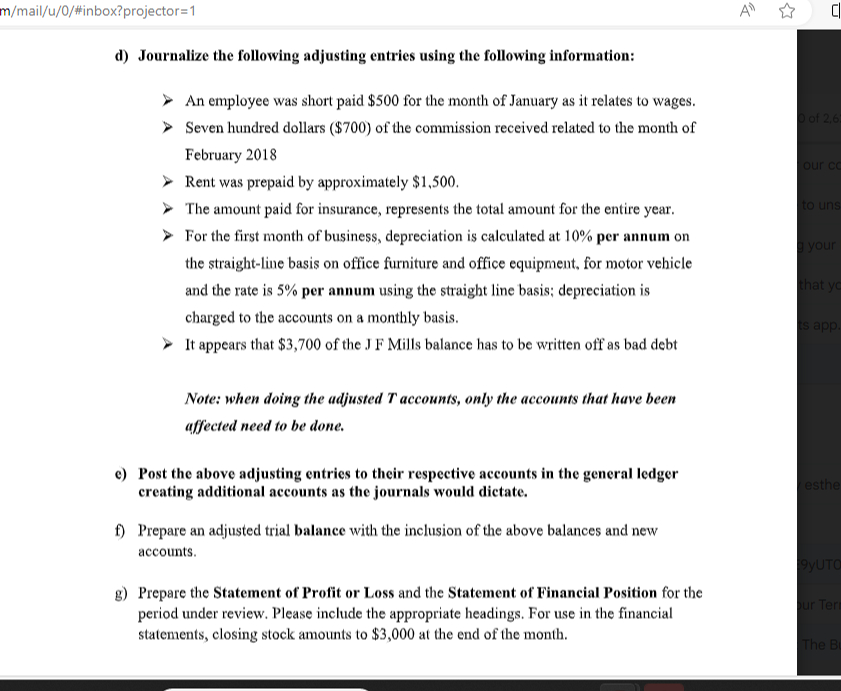

d Journalize the following adjusting entries using the following information:

An employee was short paid $ for the month of January as it relates to wages.

Seven hundred dollars $ of the commission received related to the month of

February

Rent was prepaid by approximately $

The amount paid for insurance, represents the total amount for the entire year.

For the first month of business, depreciation is calculated at per annum on

the straightline basis on office furniture and office equipment, for motor vehicle

and the rate is per annum using the straight line basis; depreciation is

charged to the accounts on a monthly basis.

It appears that $ of the J F Mills balance has to be written off as bad debt

Note: when doing the adjusted accounts, only the accounts that have been

affected need to be done.

e Post the above adjusting entries to their respective accounts in the general ledger

creating additional accounts as the journals would dictate.

f Prepare an adjusted trial balance with the inclusion of the above balances and new

accounts.

g Prepare the Statement of Profit or Loss and the Statement of Financial Position for the

period under review. Please include the appropriate headings. For use in the financial

statements, closing stock amounts to $ at the end of the month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started