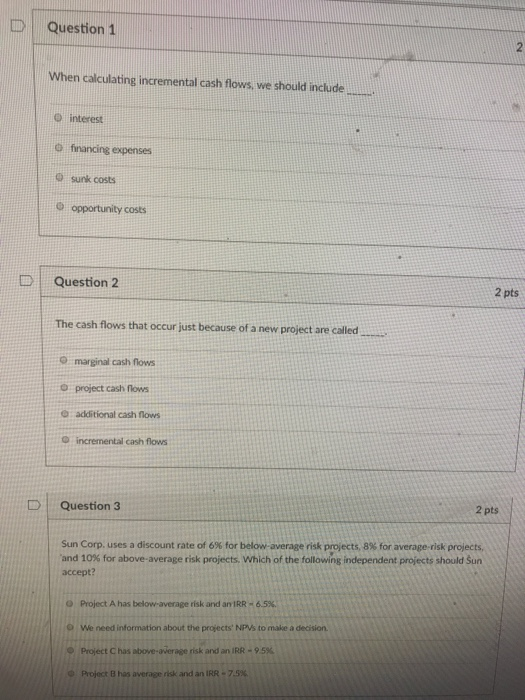

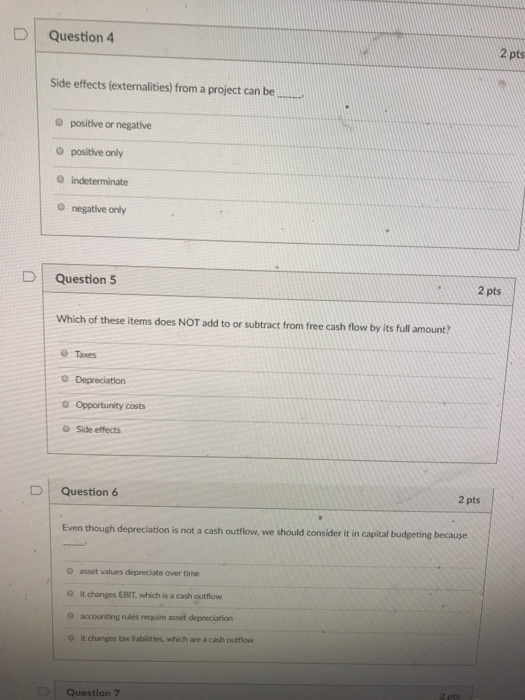

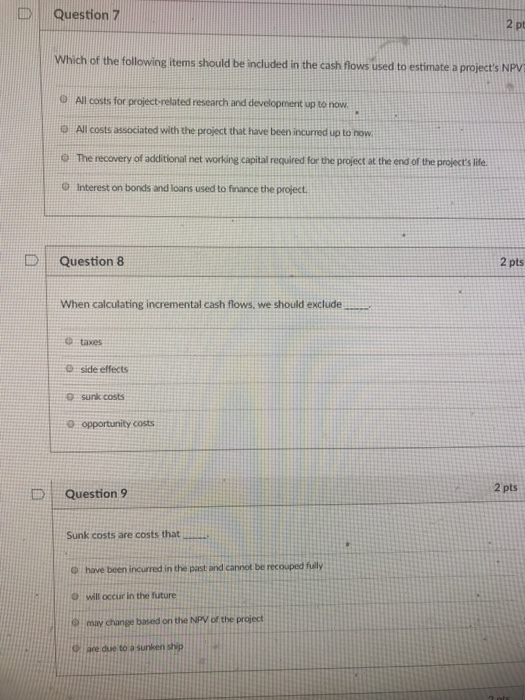

D l Question 1 When calculating incremental cash flows, we should include O interest O financing expenses Q sunk costs opportunity costs | Question 2 2 pts The cash flows that occur just because of a new project are called O marginal cash flows o project cash flos e additional cash flows O incremental cash flows 2 pts D | Question 3 Sun Corp. uses a discount rate of 6% for below-average risk projects, 8% for average-risk projects, and 10% for above-average risk projects, which of the following independent projects should Sun accept? Project A has below-average risk and an IRR-65%. O We need information about the projects' NPVs to make a decision. Project C has above-overage risk and an IRR-95% Project B has average risk and an IRR-7.5% D | Question 4 2 pts Side effects (externalities) from a project can be u O positive or negative O positive only O negative only D Question 5 2 pts Which of these items does NOT add to or subtract from free cash flow by its full amount Taxes O Opportunity costs O Side effects 2 pts DQuestion 6 Even though depreciation is not a cash outflow, we should consider it in capital budgeting because o asset values depreciate over time O it changes EBIT, which is a cash outflow O accounting rules require asset depreciation it changes tax liabities, which are a cash outnow Question 7 | Question 7 2 pt Which of the following tems should be included in the cash fows used to estinate a project's NPV O All costs for project-related research and developiment up to now 0 All costs associated with the project that have been incurred up to now O The recovery of additional net working capital required for the project at the end of the project's life Interest on bonds and loans used to finance the project D | Question 8 2 pts When calculating incremental cash flows, we should exclude taxes e side effects sunk costs e opportunity costs 2 pts Question 9 Sunk costs are costs that- O have been incurred in the past and cannot be recouped fuly O will occur in the future may change based on the NPV of the project Di are due to a sunken shp Question 10 2 pts When determining relevant cash flows for project evaluation, we should O add back in interest expenses after subracting taxes o ignore interest and other financing expenses o discount interest expenses to the present subtract interest expenses from EBIT O