Question

D. Long-Term Assets If Lidia is able to obtain the new loan, she is looking to purchase a company cargo van to help haul the

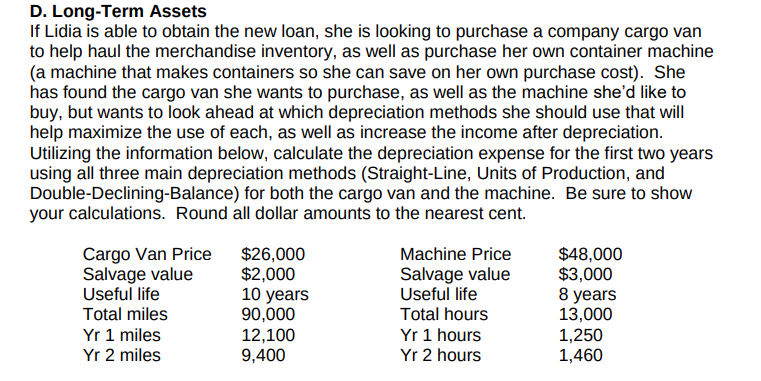

D. Long-Term Assets If Lidia is able to obtain the new loan, she is looking to purchase a company cargo van to help haul the merchandise inventory, as well as purchase her own container machine (a machine that makes containers so she can save on her own purchase cost). She has found the cargo van she wants to purchase, as well as the machine she'd like to buy, but wants to look ahead at which depreciation methods she should use that will help maximize the use of each, as well as increase the income after depreciation. Utilizing the information below, calculate the depreciation expense for the first two years using all three main depreciation methods (Straight-Line, Units of Production, and

D. Long-Term Assets If Lidia is able to obtain the new loan, she is looking to purchase a company cargo van to help haul the merchandise inventory, as well as purchase her own container machine (a machine that makes containers so she can save on her own purchase cost). She has found the cargo van she wants to purchase, as well as the machine she'd like to buy, but wants to look ahead at which depreciation methods she should use that will help maximize the use of each, as well as increase the income after depreciation. Utilizing the information below, calculate the depreciation expense for the first two years using all three main depreciation methods (Straight-Line, Units of Production, and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started