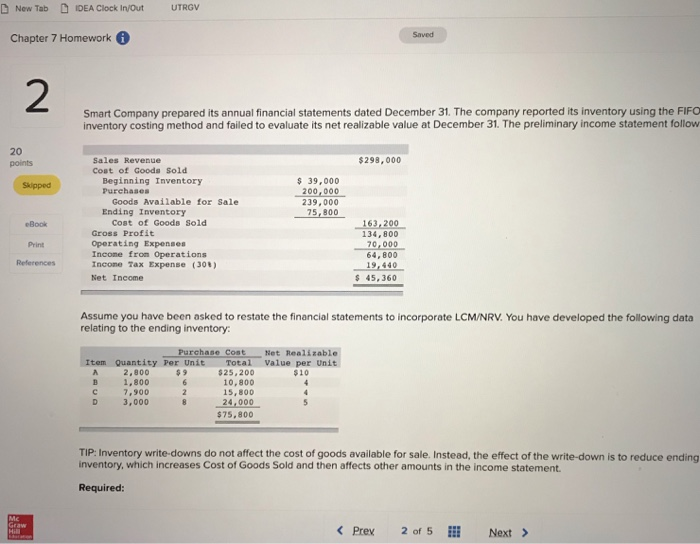

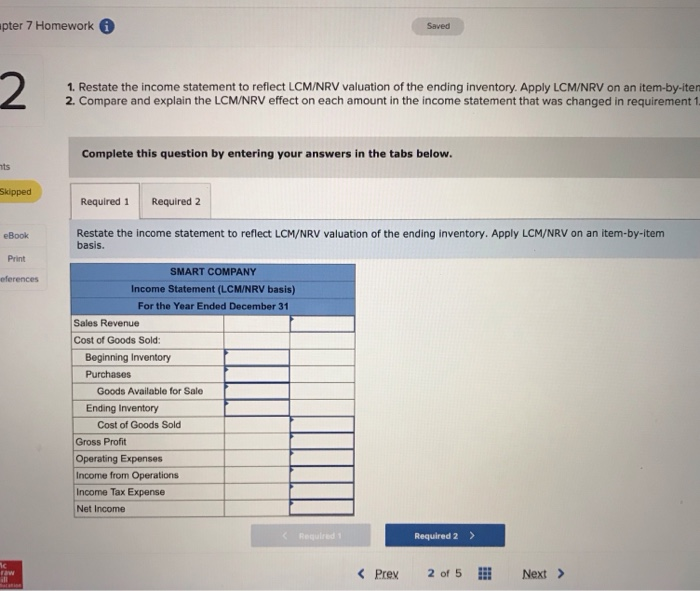

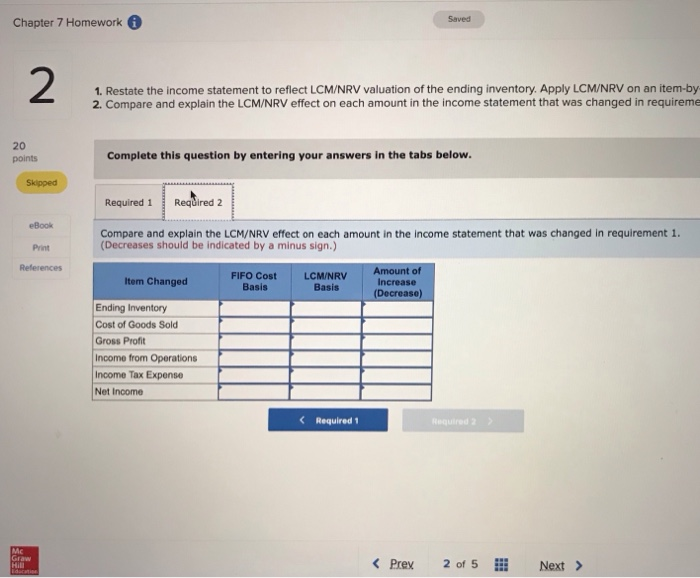

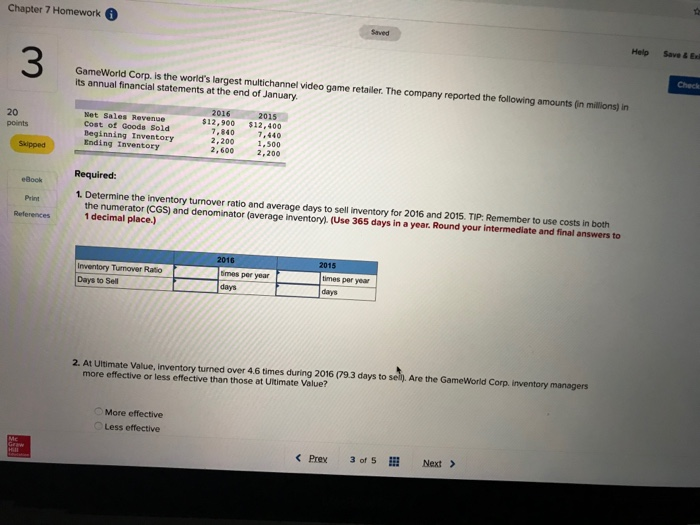

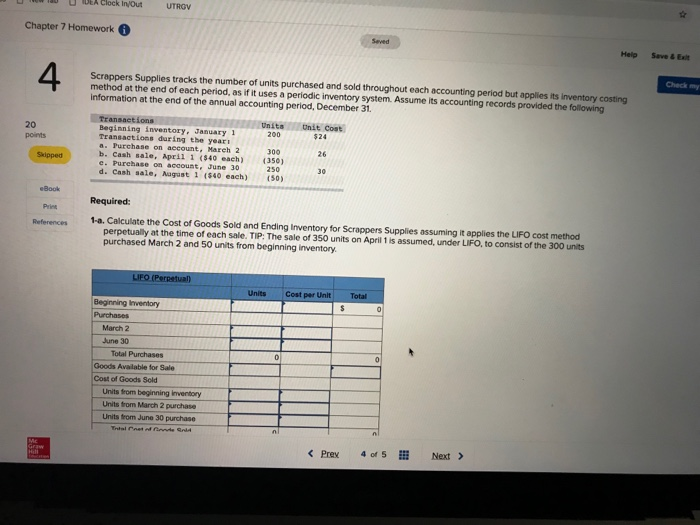

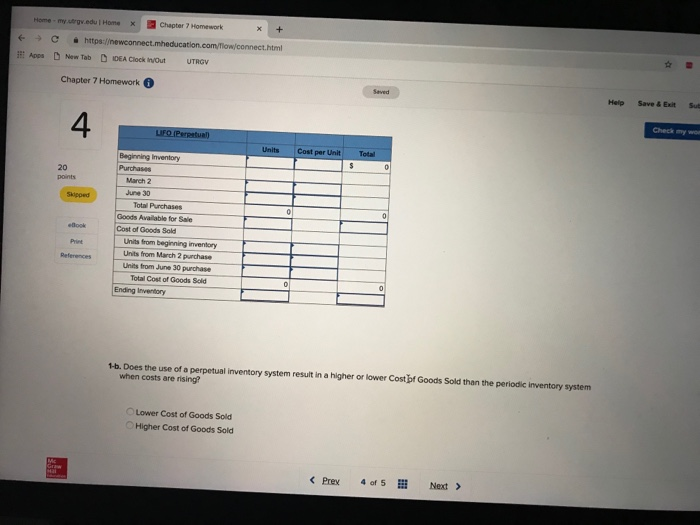

D New Tab IDEA Clock In/Out UTRGV Chapter 7 Homework Saved 2 Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary income statement follow 20 points Sales Revenue Cost of Goods Sold $298,000 Beginning Inventory Purchases s 39,000 Skipped Goods Available for Sale 239,000 75,800 Ending Inventory Cost of Goods Sold eBook Print References Gross Profit Operating Expenses Incone from Operations Income Tax Expense (30) Net Income 163,200 134,800 70,000 64, 800 19,440 45,360 Assume you have been asked to restate the financial statements to incorporate LCM/NRV. You have developed the following data relating to the ending inventory Purchase Cost Net Realizable Item Quantity Per Unit Total Value per Unit A. 2,800 1,800 7,900 3,000 $ 9 25,200 10,800 15,800 24,000 $75,800 $10 TIP: Inventory write-downs do not affect the cost of goods available for sale. Instead, the effect of the write-down is to reduce ending inventory, which increases Cost of Goods Sold and then affects other amounts in the income statement Required: pter 7 Homework 6 Saved 2 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-iten 2. Compare and explain the LCM/NRV effect on each amount in the income statement that was changed in requirement 1 Complete this question by entering your answers in the tabs below. ts Skipped Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. eBook Print eferences SMART COMPANY Income Statement (LCM/NRV basis) For the Year Ended December 31 Sales Revenue Cost of Goods Sold: Beginning Inventory Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Income from Operations Income Tax Expense Net Income Required 2 > Chapter 7 Homework Saved 2 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by 2. Compare and explain the LCM/NRV effect on each amount in the income statement that was changed in requireme 20 points Complete this question by entering your answers in the tabs below Skipped Required 1 Required 2 eBook Print References Compare and explain the LCM/NRV effect on each amount in the income statement that was changed in requirement 1. (Decreases should be indicated by a minus sign.) of Increase Basis (Decrease) FIFO Cost LCM/NRV Item Changed Basis Ending Inventory Cost of Goods Sol Gross Profit Income from Operations Income Tax Expense Net Income Chapter 7 Homework Saved Help Save & Ex 3 st multichannel video game retailer. The company reported the following amounts (in millions) in its annual financial statements at the end of January 2016 2 Net Sales Revenue Cost of Goods Sold Beginning Inventory Ending Inventory 2015 7,440 2,200 20 points $12,900 $12,400 7,840 2,200 2,600 Skipped Required: eBook 1. Determine the inventory turnover ratio and average days to sell inventory for 2016 and 2015. TIP: Remember to use costs in both Print the numerator (CGS) and denominator (average inventory) (Use 365 days in a year. Round your intermediate and final answers to 1 decimal place.) Inventory Turnover Rato Days to Sell omes per year days times per year days 2. At Ultimate Value, inventory turned over 4.6 times during 2016 (79.3 days to selj. Are the GameWorld Corp. inventory managers more effective or less effective than those at Ultimate Value? More effective Less effective u DEA Clock InvoutUTRGV Chapter 7 Homework Seved Help Save &Ext Check my Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31 20 points Beginning inventory, January 1 Transactions during the yeari ts Unit Cost 200 $24 Purchase on account, March 2 300 b. Cash sale, April 1 (40 each) 350) 250 d. Cash sale, Nagust 1 (40 each) (50) 26 Skipped e. Purehase on accoust, June 30 eBook Prine Required: Pries 1-a. Calculate the Cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. TIP: The sale of 350 units on April 1 is assumed, under LIFO, to consist of the 300 units purchased March 2 and 50 units from beginning inventory Units Cost per Unit Beginning Inventory March 2 June 30 Total Purchases Goods Available for Sale Cost of Goods Sold Units from beginning inventory Units from March 2 purchase Units ftrom June 30 purchase K Prex 4 of S Next Home - my utrgv.eduI Home x https:/e Chapter 7 Homework : Apps New Tab IDEA Clock in/Out UTRGV Chapter 7 Homework Help Save & Exit Sut Check my wo 4 Cost per Unit Beginning Inventory 20 points March 2 June 30 Skipped Total Purchases Goods Available for Sale Cost of Goods Sold Units from beginning inventory Units from March 2 purchase Units from June 30 purchase Total Cost of Goods Sold Print References Ending Inventory 1-b. Does the use of a perpetual inventory system result in a higher or lower Costof Goods Sold than the periodic inventory system when costs are rising? Lower Cost of Goods Sold Higher Cost of Goods Sold Prex 4 of 5 Next >