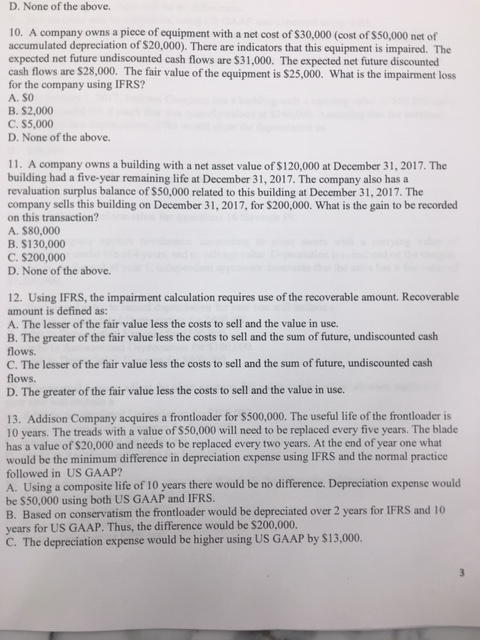

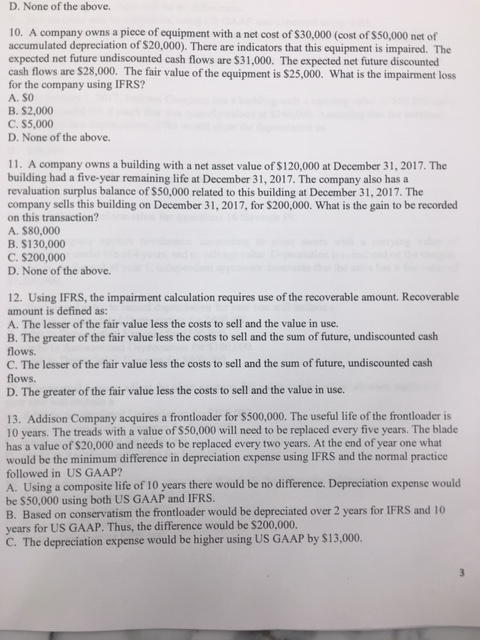

D. None of the above. 10. A company owns a piece of equipment with a net cost of $30,000 (cost of $50,000 net of accumulated depreciation of $20,000). There are indicators that this equipment is impaired. The expected net future undiscounted cash flows are $31.000. The expected net future discounted cash flows are $28,000. The fair value of the equipment is $25,000. What is the impairment loss for the company using IFRS? A. SO B. $2,000 C. $5,000 D. None of the above. 11. A company owns a building with a net asset value of $120,000 at December 31, 2017. The building had a five-year remaining life at December 31, 2017. The company also has a revaluation surplus balance of $50,000 related to this building at December 31, 2017. The company sells this building on December 31, 2017, for $200,000. What is the gain to be recorded on this transaction? A. $80,000 B. $130,000 C. $200,000 D. None of the above. 12. Using IFRS, the impairment calculation requires use of the recoverable amount. Recoverable amount is defined as: A. The lesser of the fair value less the costs to sell and the value in use. B. The greater of the fair value less the costs to sell and the sum of future, undiscounted cash flows. C. The lesser of the fair value less the costs to sell and the sum of future, undiscounted cash flows. D. The greater of the fair value less the costs to sell and the value in use. 13. Addison Company acquires a frontloader for $500,000. The useful life of the frontloader is 10 vears. The treads with a value of $50,000 will need to be replaced every five years. The blade has a value of $20,000 and needs to be replaced every two years. At the end of year one what would be the minimum difference in depreciation expense using IFRS and the normal practice followed in US GAAP? A. Using a composite life of 10 years there would be no difference. Depreciation expense would be $50,000 using both US GAAP and IFRS. B. Based on conservatism the frontloader would be depreciated over 2 years for IFRS and 10 years for US GAAP. Thus, the difference would be $200,000. C. The depreciation expense would be higher using US GAAP by $13,000