Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d . Plot the Security Market Line. Select the correct graph. The correct graph is A B . C . e . Suppose you hold

d Plot the Security Market Line.

Select the correct graph.

The correct graph is

A

B

C

e Suppose you hold a large, welldiversified portfolio and are considering adding to that portfolio either Stock or another stock,

Stock which has the same beta as Stock but a higher standard deviation of returns. Stocks and have the same expected

returns:

hat

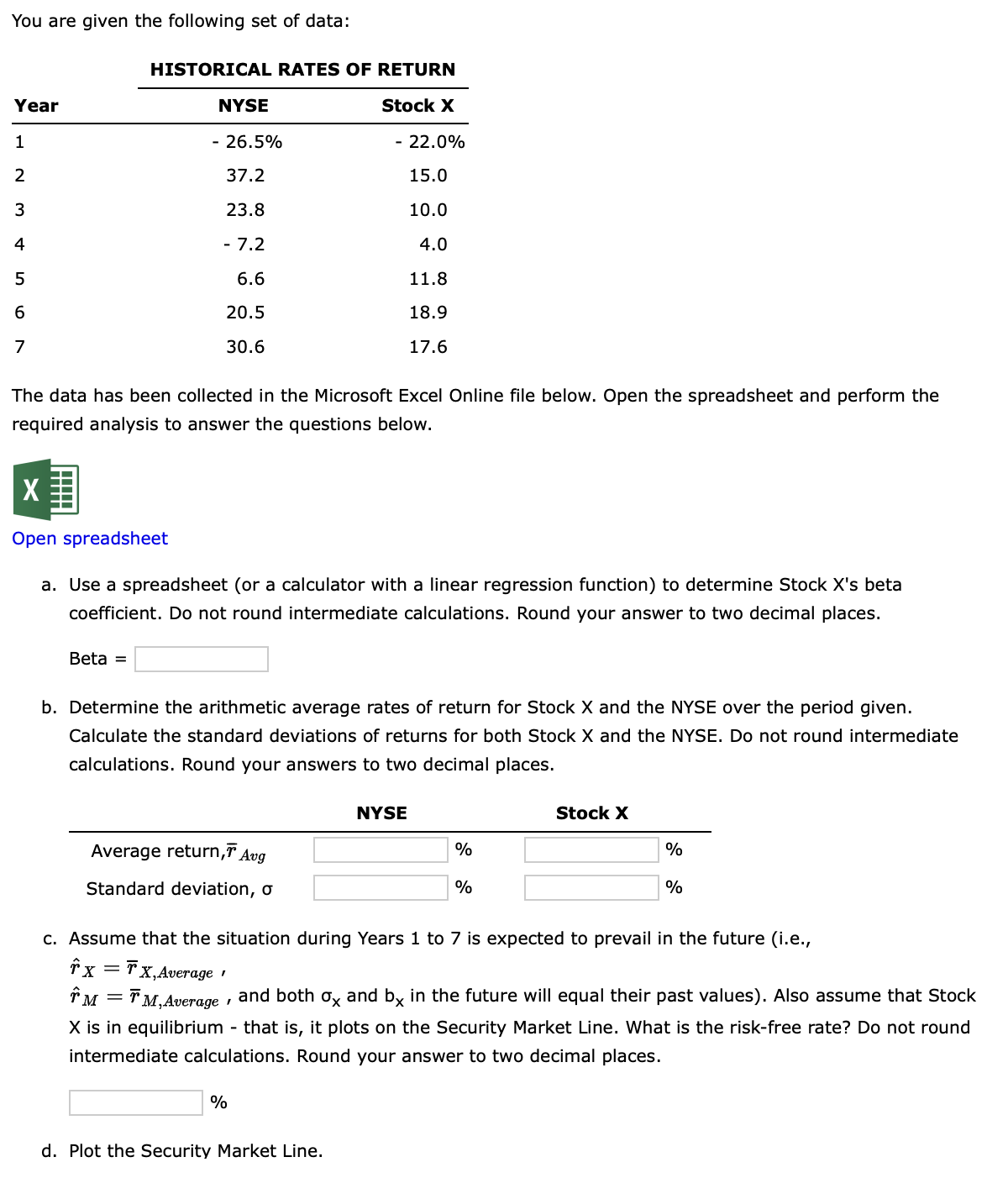

hat Which stock should you choose?You are given the following set of data:

HISTORICAL RATES OF RETURN

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the

required analysis to answer the questions below.

Open spreadsheet

a Use a spreadsheet or a calculator with a linear regression function to determine Stock Xs beta

coefficient. Do not round intermediate calculations. Round your answer to two decimal places.

Beta

b Determine the arithmetic average rates of return for Stock and the NYSE over the period given.

Calculate the standard deviations of returns for both Stock and the NYSE. Do not round intermediate

calculations. Round your answers to two decimal places.

NYSE

Average return,

Standard deviation,

Stock X

c Assume that the situation during Years to is expected to prevail in the future ie

hat

hat and both and in the future will equal their past values Also assume that Stock

X is in equilibrium that is it plots on the Security Market Line. What is the riskfree rate? Do not round

intermediate calculations. Round your answer to two decimal places.

d Plot the Security Market Line.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started