Question

Consider an economy with three assets A, B and C. Suppose there are three possible states of the world one year from today. You collect

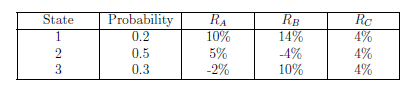

Consider an economy with three assets A, B and C. Suppose there are three possible states of the world one year from today. You collect the following data on the 1-year returns to the three assets contingent on the state, and also the probability of each state.

(a) Find the mean, the variance, and the standard deviation for each asset returns. Find the covariance and the correlation for each pair of asset returns. (b) Today, you buy $100 worth of asset A, short sell $500 worth of asset B, and buy $600 worth of asset C. What is your portfolio weight in each of the three assets? What is the covariance between your portfolio return and the return on asset B? (c) What is the risk-free rate of return in this economy? (d) Characterize the tangency portfolio you can construct using these assets. Specifically, show the composition of the tangency portfolio, and calculate the mean and the standard deviation of its return.

tate 0.2 0.5 10% 5% 2% 14% 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started