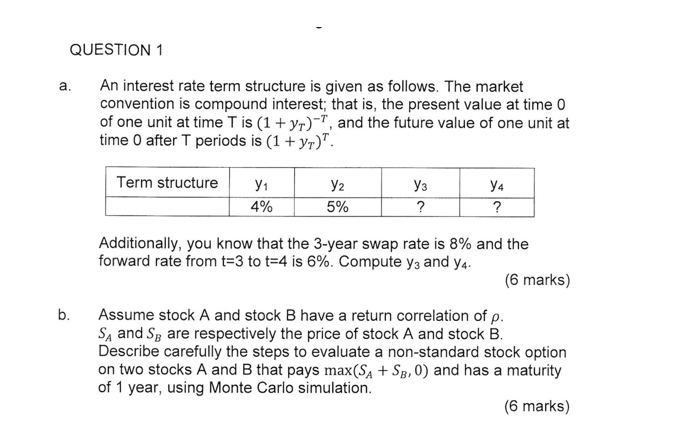

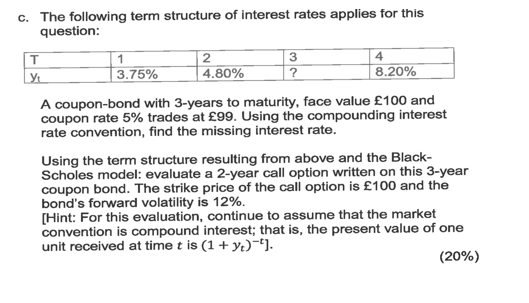

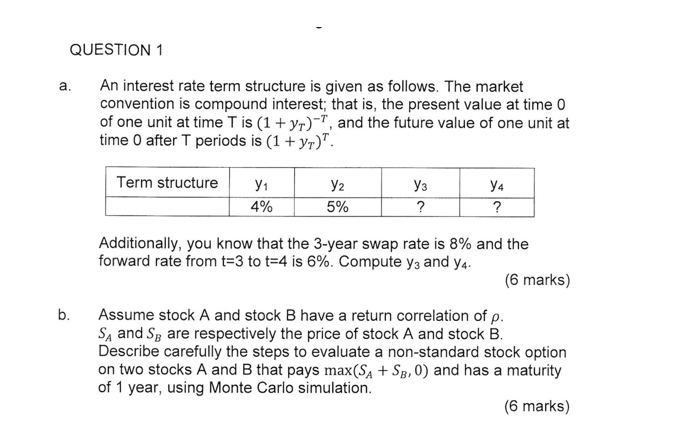

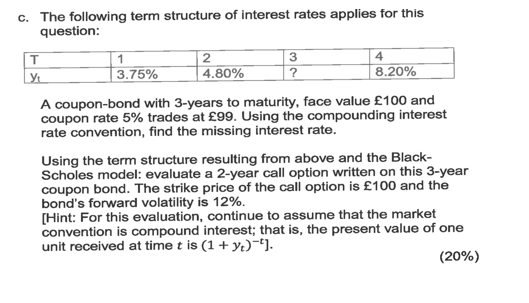

An interest rate term structure is given as follows. The market convention is compound interest; that is, the present value at time 0 of one unit at time T is (1 + y_T)^-T, and the future value of one unit at time 0 after T periods is (1 + y_T)^T. Additionally, you know that the 3-year swap rate is 8% and the forward rate from t=3 to t=4 is 6%. Compute y_3 and y_4. Assume stock A and stock B have a return correlation of rho. S_A and S_B are respectively the price of stock A and stock B. Describe carefully the steps to evaluate a non-standard stock option on two stocks A and B that pays max(S_A + S_B, 0) and has a maturity of 1 year, using Monte Carlo simulation. The following term structure of interest rates applies for this question: A coupon-bond with 3-years to maturity, face value pound 100 and coupon rate 5% trades at pound 99. Using the compounding interest rate convention, find the missing interest rate. Using the term structure resulting from above and the Black-School model: evaluate a 2-year call option written on this 3-year coupon bond. The strike price of the call option is pound 100 and the bond's forward volatility is 12%. An interest rate term structure is given as follows. The market convention is compound interest; that is, the present value at time 0 of one unit at time T is (1 + y_T)^-T, and the future value of one unit at time 0 after T periods is (1 + y_T)^T. Additionally, you know that the 3-year swap rate is 8% and the forward rate from t=3 to t=4 is 6%. Compute y_3 and y_4. Assume stock A and stock B have a return correlation of rho. S_A and S_B are respectively the price of stock A and stock B. Describe carefully the steps to evaluate a non-standard stock option on two stocks A and B that pays max(S_A + S_B, 0) and has a maturity of 1 year, using Monte Carlo simulation. The following term structure of interest rates applies for this question: A coupon-bond with 3-years to maturity, face value pound 100 and coupon rate 5% trades at pound 99. Using the compounding interest rate convention, find the missing interest rate. Using the term structure resulting from above and the Black-School model: evaluate a 2-year call option written on this 3-year coupon bond. The strike price of the call option is pound 100 and the bond's forward volatility is 12%