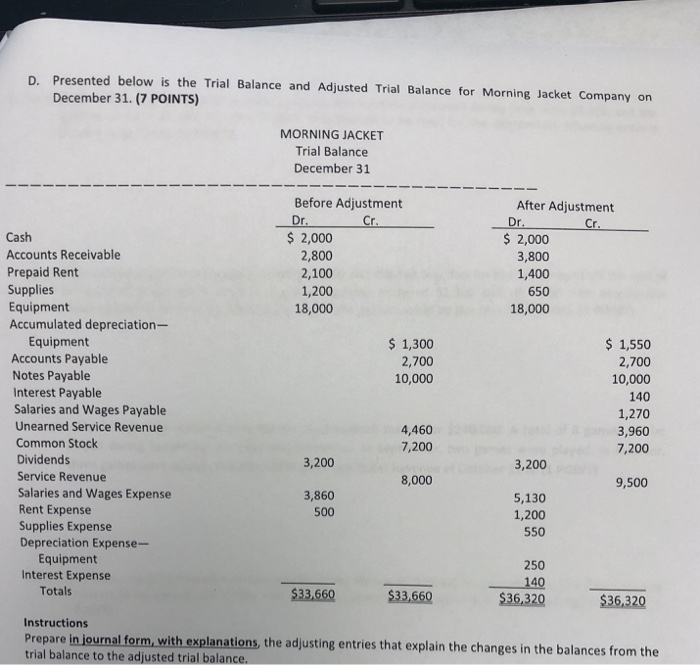

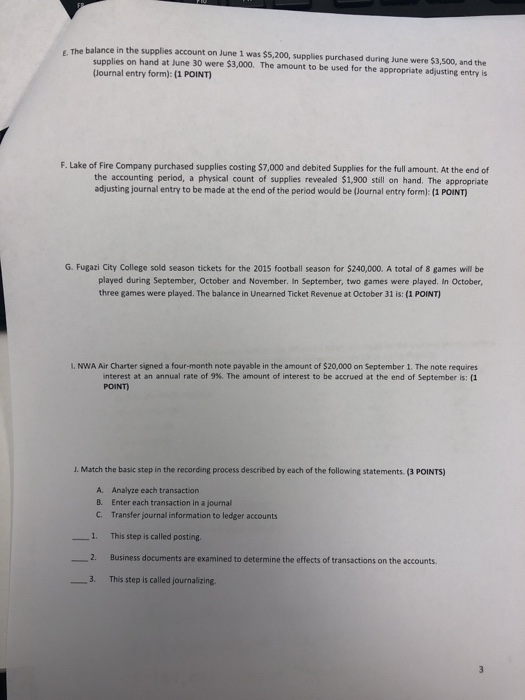

D. Presented below is the Trial Balance and Adjusted Trial Balance for Morning Jacket Company on December 31. (7 POINTS) MORNING JACKET Trial Balance December 31 Before Adjustment After Adjustment Dr Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated depreciation- $2,000 2,000 3,800 1,400 2,800 2,100 1,200 18,000 650 18,000 Equipment Accounts Payable Notes Payable Interest Payable Salaries and Wages Payable Unearned Service Revenue Common Stock Dividends Service Revenue Salaries and Wages Expense Rent Expense Supplies Expense Depreciation Expense- 1,300 2,700 10,000 1,550 2,700 10,000 140 1,270 3,960 7,200 4,460 7,200 3,200 3,200 8,000 9,500 3,860 500 5,130 1,200 550 Equipment 250 4 Interest Expense Totals 33,660 $33,660 $36,320 $36,320 Instructions Prepare trial balance to the adjusted trial balance in journal form, with explanations, the adjusting entries that explain the changes in the balances from the The balance in the supplies account on June 1 was $5,200, supplies purchased during June were $3,500, and the supplies on hand at June 30 were $3,000. The amount to be used for the appropriate adjusting entry is (lournal entry form): (1 POINT) F. Lake of Fire Company purchased supplies costing $7,000 and debited Supplies for the full amount. At the end of the accounting period, a physical count of supplies revealed $1,900 still on hand. The appropriate adjusting journal entry to be made at the end of the period would be (Journal entry form): (1 POINT) G. Fugazi City College sold season tickets for the 201s football season for $240,000. A total of 8 games will be played during September, October and November. In September, two games were played. In October, three games were played. The balance in Unearned Ticket Revenue at October 31 is: (1 POINT) L. NWA Air Charter signed a four-month note payable in the amount of $20,000 on September 1. The note requires interest at an annual rate of 9%. The amount of interest to be accrued at the end of September is: POINT) J. Match the basic step in the recording process described by each of the following statements. (3 POINTS) A. B. C. Analyze each transaction Enter each transaction in a journal Transfer journal information to ledger accounts 1. This step is alled ostinge 2. Business documents are examined to determine the effects of transactions on the accounts. 3. This step is called journalizing