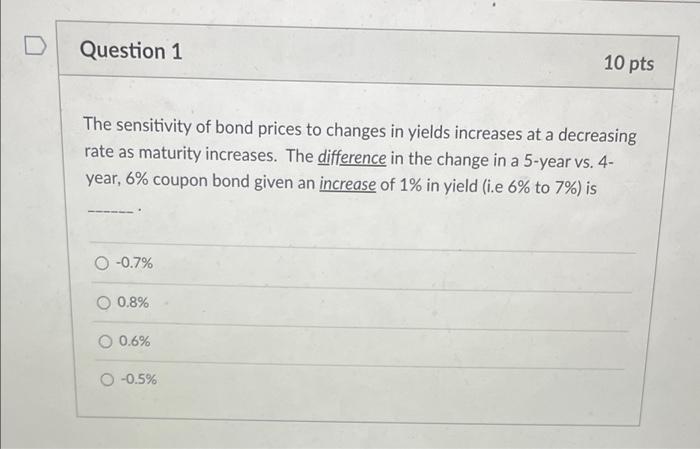

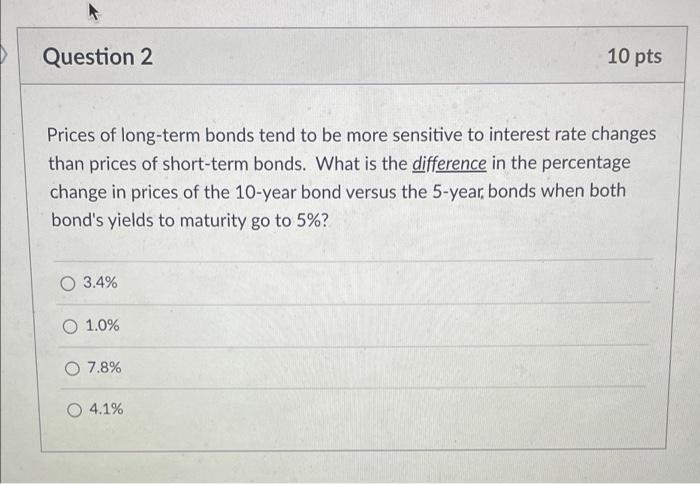

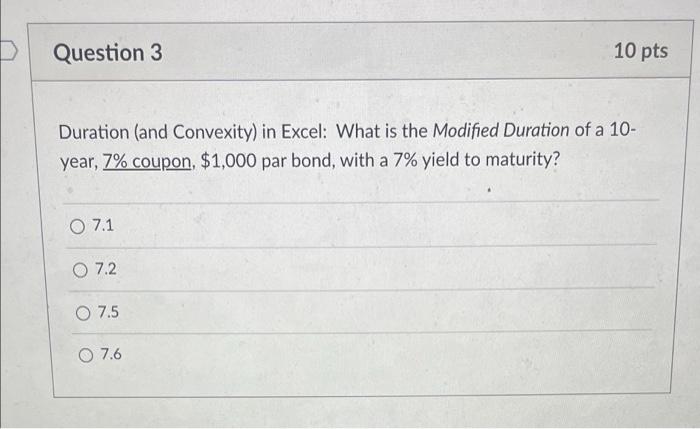

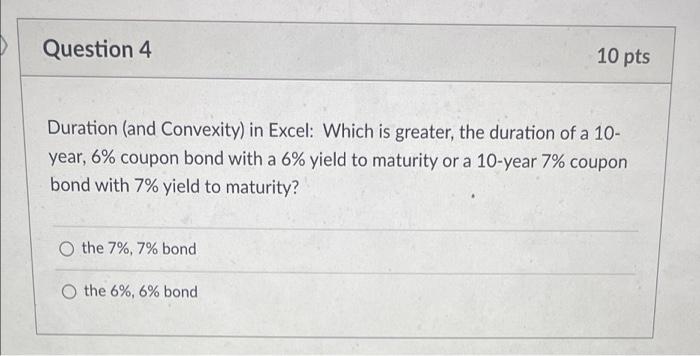

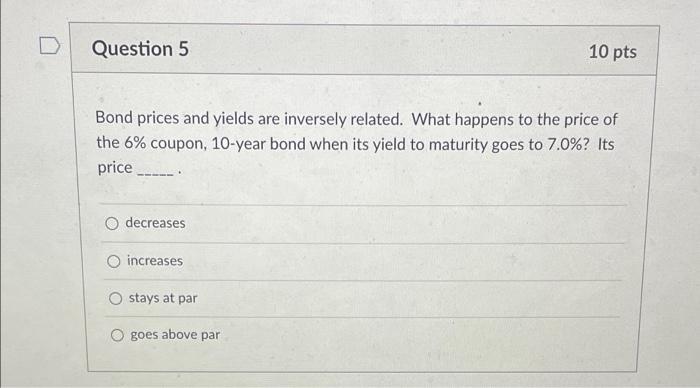

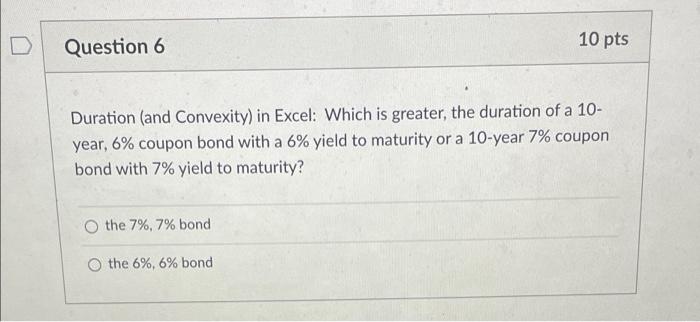

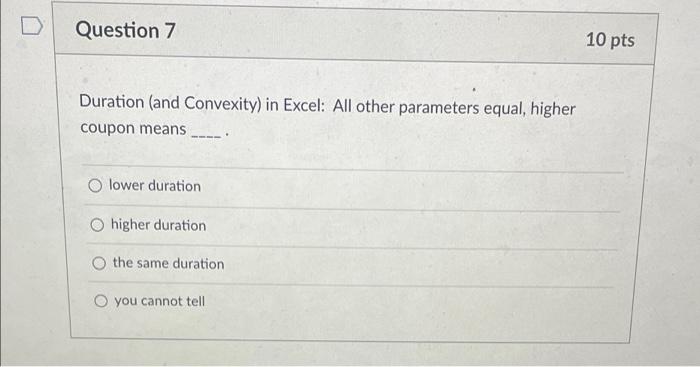

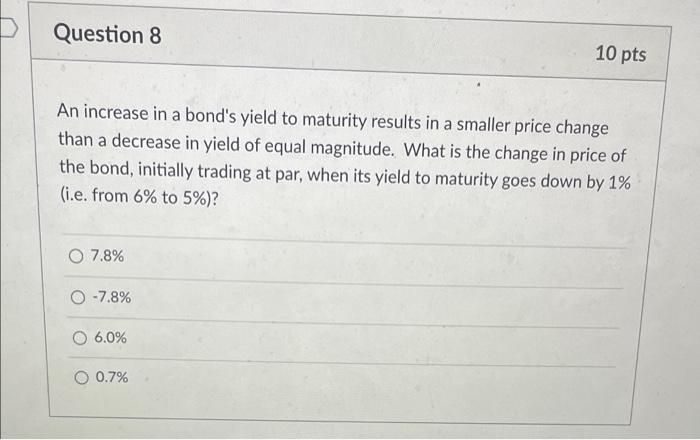

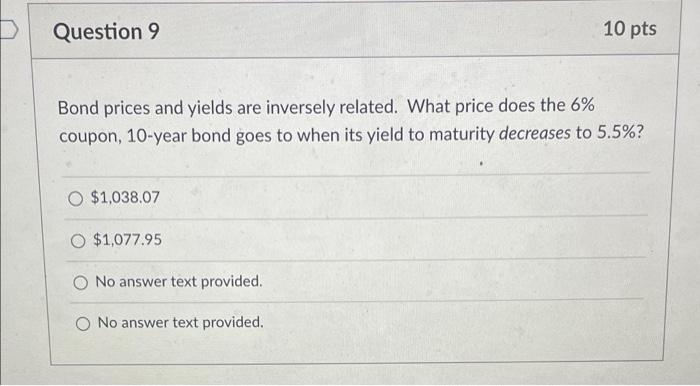

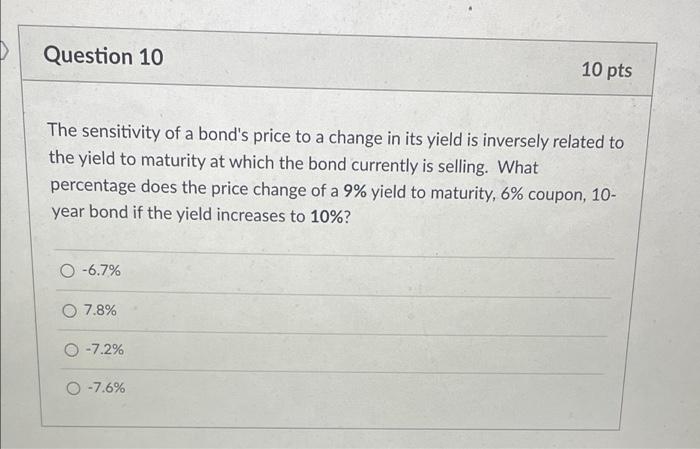

D Question 1 10 pts The sensitivity of bond prices to changes in yields increases at a decreasing rate as maturity increases. The difference in the change in a 5-year vs. 4- year, 6% coupon bond given an increase of 1% in yield (i.e 6% to 7%) is -0.7% 0.8% O 0.6% O-0.5% Question 2 10 pts Prices of long-term bonds tend to be more sensitive to interest rate changes than prices of short-term bonds. What is the difference in the percentage change in prices of the 10-year bond versus the 5-year bonds when both bond's yields to maturity go to 5%? O 3.4% 01.0% O 7.8% 04.1% Question 3 10 pts Duration (and Convexity) in Excel: What is the Modified Duration of a 10- year, 7% coupon, $1,000 par bond, with a 7% yield to maturity? O 7.1 O 7.2 O 7.5 O 7.6 Question 4 10 pts Duration (and Convexity) in Excel: Which is greater, the duration of a 10- year, 6% coupon bond with a 6% yield to maturity or a 10-year 7% coupon bond with 7% yield to maturity? O the 7%, 7% bond O the 6%, 6% bond Question 5 10 pts Bond prices and yields are inversely related. What happens to the price of the 6% coupon, 10-year bond when its yield to maturity goes to 7.0%? Its price O decreases increases stays at par goes above par D Question 6 10 pts Duration (and Convexity) in Excel: Which is greater, the duration of a 10- year, 6% coupon bond with a 6% yield to maturity or a 10-year 7% coupon bond with 7% yield to maturity? the 7%, 7% bond the 6%, 6% bond D Question 7 10 pts Duration (and Convexity) in Excel: All other parameters equal, higher coupon means lower duration higher duration the same duration O you cannot tell Question 8 10 pts An increase in a bond's yield to maturity results in a smaller price change than a decrease in yield of equal magnitude. What is the change in price of the bond, initially trading at par, when its yield to maturity goes down by 1% (i.e. from 6% to 5%)? 7.8% 0 -7.8% 6.0% 0.7% Question 9 10 pts Bond prices and yields are inversely related. What price does the 6% coupon, 10-year bond goes to when its yield to maturity decreases to 5.5%? O $1,038.07 O $1,077.95 No answer text provided. No answer text provided. Question 10 10 pts The sensitivity of a bond's price to a change in its yield is inversely related to the yield to maturity at which the bond currently is selling. What percentage does the price change of a 9% yield to maturity, 6% coupon, 10- year bond if the yield increases to 10%? -6.7% O 7.8% -7.2% O -7.6%