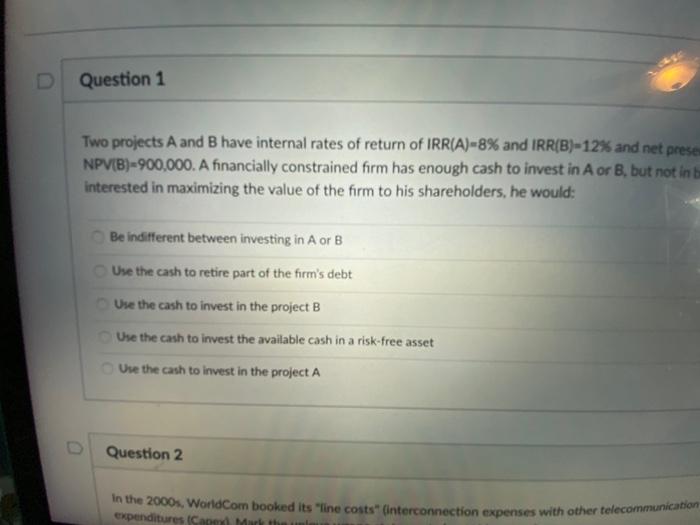

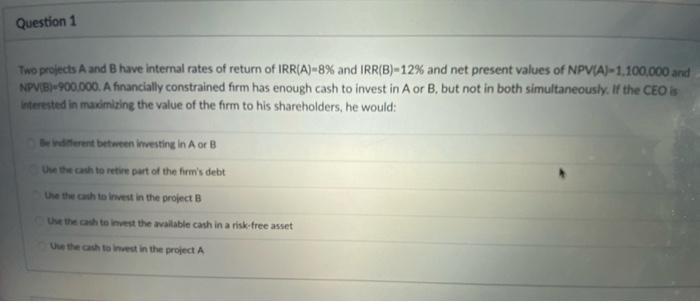

D Question 1 Two projects A and B have internal rates of return of IRR(A)-8% and IRR(B)-12% and net preses NPV(B)=900,000. A financially constrained firm has enough cash to invest in A or B, but not in interested in maximizing the value of the firm to his shareholders, he would: Be indifferent between investing in A or B Use the cash to retire part of the firm's debt Use the cash to invest in the project B Use the cash to invest the available cash in a risk-free asset Use the cash to invest in the project A Question 2 In the 2000s, World Com booked its "line costs* (Interconnection expenses with other telecommunication expenditures Carl Mark the Question 1 Two projects A and B have internal rates of return of IRR(A)-8% and IRR(B)-12% and net present values of NPVIA)-1.100,000 and NPV1B)-900.000. A financially constrained firm has enough cash to invest in A or B, but not in both simultaneously. If the CEO is Interested in maximizing the value of the form to his shareholders, he would: De dierent between investing in A or B Use the cash to retire part of the firm's debt Use the cash to invest in the project B Use the cash to invest the wailable cash in a risk-free asset Ue the cash to invest in the project A D Question 1 Two projects A and B have internal rates of return of IRR(A)-8% and IRR(B)-12% and net preses NPV(B)=900,000. A financially constrained firm has enough cash to invest in A or B, but not in interested in maximizing the value of the firm to his shareholders, he would: Be indifferent between investing in A or B Use the cash to retire part of the firm's debt Use the cash to invest in the project B Use the cash to invest the available cash in a risk-free asset Use the cash to invest in the project A Question 2 In the 2000s, World Com booked its "line costs* (Interconnection expenses with other telecommunication expenditures Carl Mark the Question 1 Two projects A and B have internal rates of return of IRR(A)-8% and IRR(B)-12% and net present values of NPVIA)-1.100,000 and NPV1B)-900.000. A financially constrained firm has enough cash to invest in A or B, but not in both simultaneously. If the CEO is Interested in maximizing the value of the form to his shareholders, he would: De dierent between investing in A or B Use the cash to retire part of the firm's debt Use the cash to invest in the project B Use the cash to invest the wailable cash in a risk-free asset Ue the cash to invest in the project A