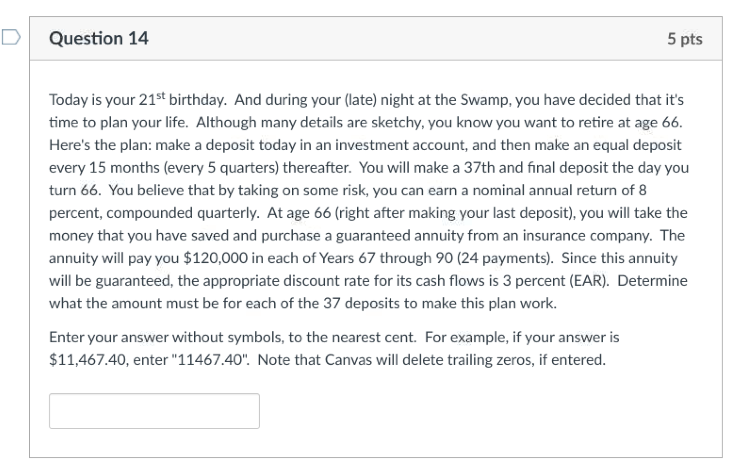

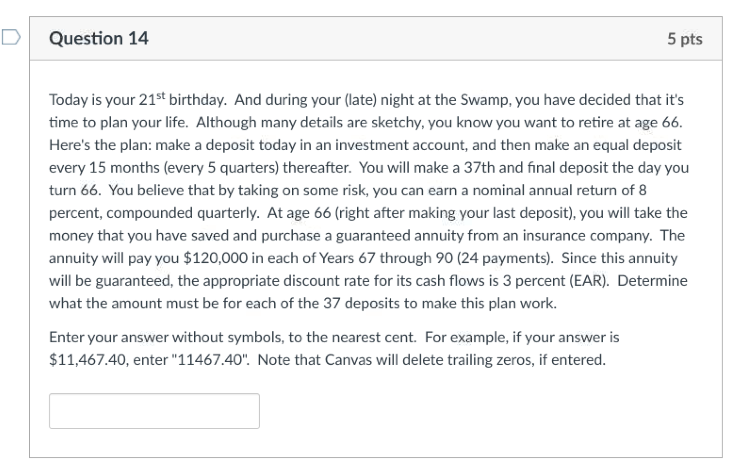

D Question 14 5 pts Today is your 21st birthday. And during your (late) night at the Swamp, you have decided that it's time to plan your life. Although many details are sketchy, you know you want to retire at age 66. Here's the plan: make a deposit today in an investment account, and then make an equal deposit every 15 months (every 5 quarters) thereafter. You will make a 37th and final deposit the day you turn 66. You believe that by taking on some risk, you can earn a nominal annual return of 8 percent, compounded quarterly. At age 66 (right after making your last deposit), you will take the money that you have saved and purchase a guaranteed annuity from an insurance company. The annuity will pay you $120,000 in each of Years 67 through 90 (24 payments). Since this annuity will be guaranteed, the appropriate discount rate for its cash flows is 3 percent (EAR). Determine what the amount must be for each of the 37 deposits to make this plan work. Enter your answer without symbols, to the nearest cent. For example, if your answer is $11,467.40, enter "11467.40". Note that Canvas will delete trailing zeros, if entered. D Question 14 5 pts Today is your 21st birthday. And during your (late) night at the Swamp, you have decided that it's time to plan your life. Although many details are sketchy, you know you want to retire at age 66. Here's the plan: make a deposit today in an investment account, and then make an equal deposit every 15 months (every 5 quarters) thereafter. You will make a 37th and final deposit the day you turn 66. You believe that by taking on some risk, you can earn a nominal annual return of 8 percent, compounded quarterly. At age 66 (right after making your last deposit), you will take the money that you have saved and purchase a guaranteed annuity from an insurance company. The annuity will pay you $120,000 in each of Years 67 through 90 (24 payments). Since this annuity will be guaranteed, the appropriate discount rate for its cash flows is 3 percent (EAR). Determine what the amount must be for each of the 37 deposits to make this plan work. Enter your answer without symbols, to the nearest cent. For example, if your answer is $11,467.40, enter "11467.40". Note that Canvas will delete trailing zeros, if entered