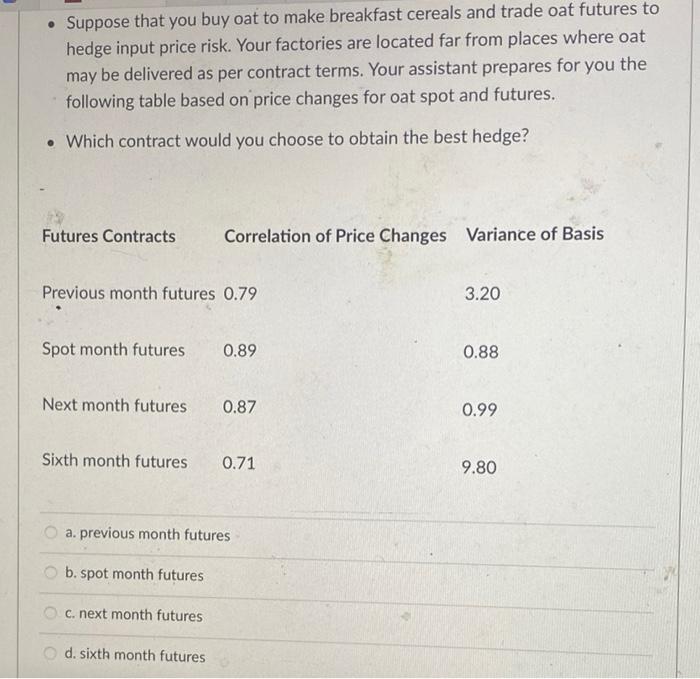

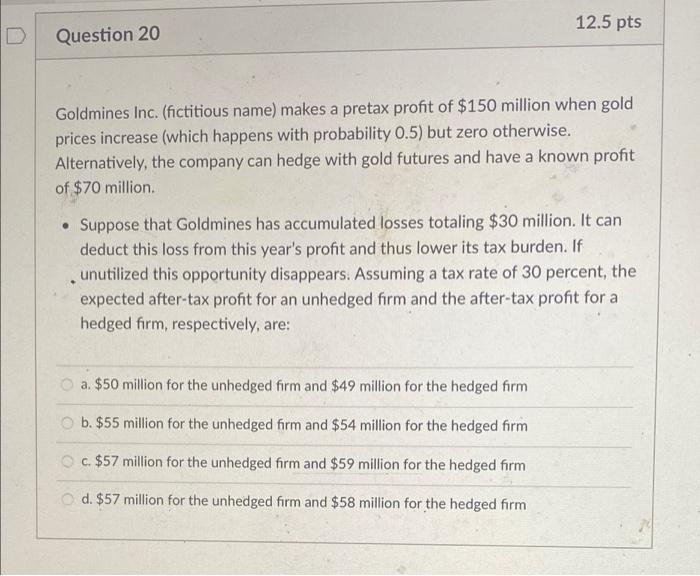

D Question 16 12.5 pts Let the spot price of gold today be $1,500 per ounce. A gold miner sets up a selling hedge by going short gold futures. The basis is - $50 today and - $5 on the day the company lifts the hedge by selling gold in the spot market and buying the futures. The company's effective selling price for gold is a. $1,505 b. $1,545 c. $1,550 d. $1,555 Suppose that you buy oat to make breakfast cereals and trade oat futures to hedge input price risk. Your factories are located far from places where oat may be delivered as per contract terms. Your assistant prepares for you the following table based on price changes for oat spot and futures. Which contract would you choose to obtain the best hedge? Futures Contracts Correlation of Price Changes Variance of Basis Previous month futures 0.79 3.20 Spot month futures 0.89 0.88 Next month futures 0.87 0.99 Sixth month futures 0.71 9.80 a. previous month futures b. spot month futures c. next month futures d. sixth month futures 12.5 pts Question 18 Hedging with forwards and futures contracts is different due to the nature of the two contracts. Which of the following statements is INCORRECT in terms of a comparison of the two derivatives? a. Forward contracts are better at reducing legal risk. b. Futures contracts are better at reducing transaction costs. c. Futures contracts are better at reducing credit risk. d. Futures contracts are more standardized. 12.5 pts Question 19 Which of the following statements related to the hedging of fuel price risk by airlines is INCORRECT? A. All airlines hedge price risk of between 55 to 100 percent of their fuel purchase. B. Fuel is a major cost of the airline business C. What Southwest Airlines characterizes as their successful derivatives hedging program was some combination of hedging and speculation that worked well for a time. D. An airlines decision to charge for checked-in baggage is a natural hedge because loss of revenue from losing customers is offset by money received from the fees and making airplanes lighter (which are cheaper to fly). 12.5 pts Question 20 Goldmines Inc. (fictitious name) makes a pretax profit of $150 million when gold prices increase (which happens with probability 0.5) but zero otherwise. Alternatively, the company can hedge with gold futures and have a known profit of $70 million. . Suppose that Goldmines has accumulated losses totaling $30 million. It can deduct this loss from this year's profit and thus lower its tax burden. If unutilized this opportunity disappears. Assuming a tax rate of 30 percent, the expected after-tax profit for an unhedged firm and the after-tax profit for a hedged firm, respectively, are: a. $50 million for the unhedged firm and $49 million for the hedged firm b. $55 million for the unhedged firm and $54 million for the hedged firm c. $57 million for the unhedged firm and $59 million for the hedged firm d. $57 million for the unhedged firm and $58 million for the hedged firm