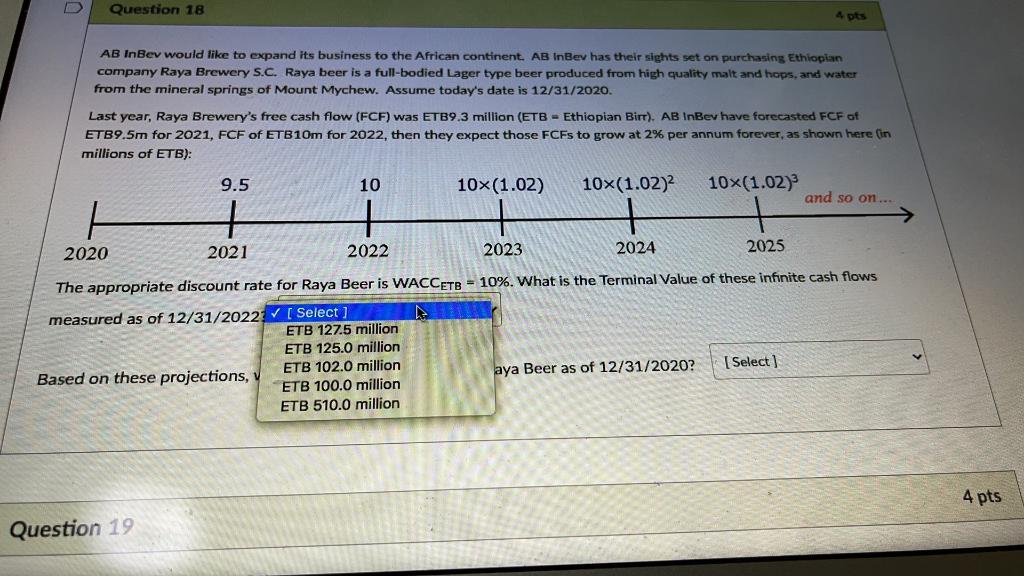

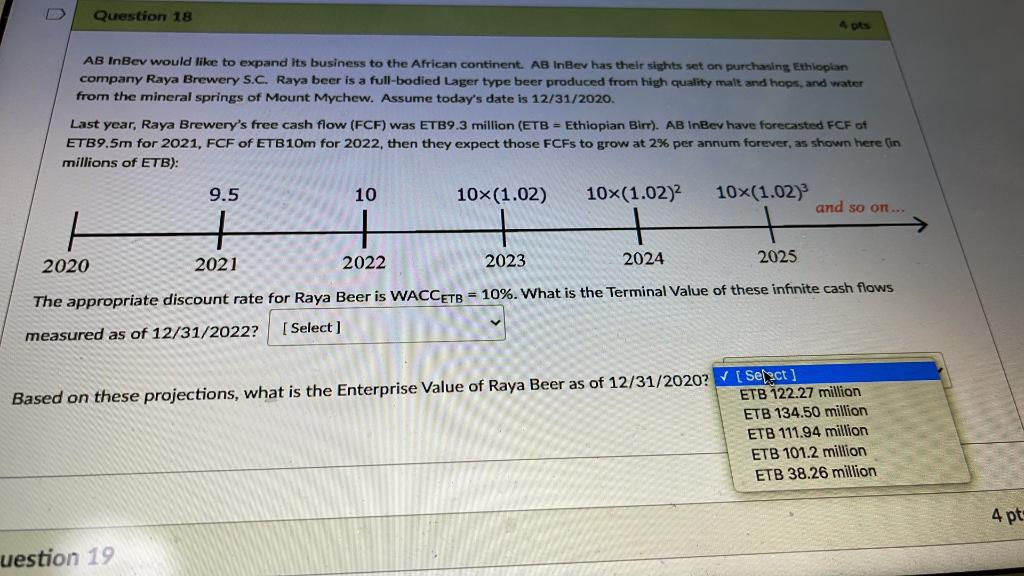

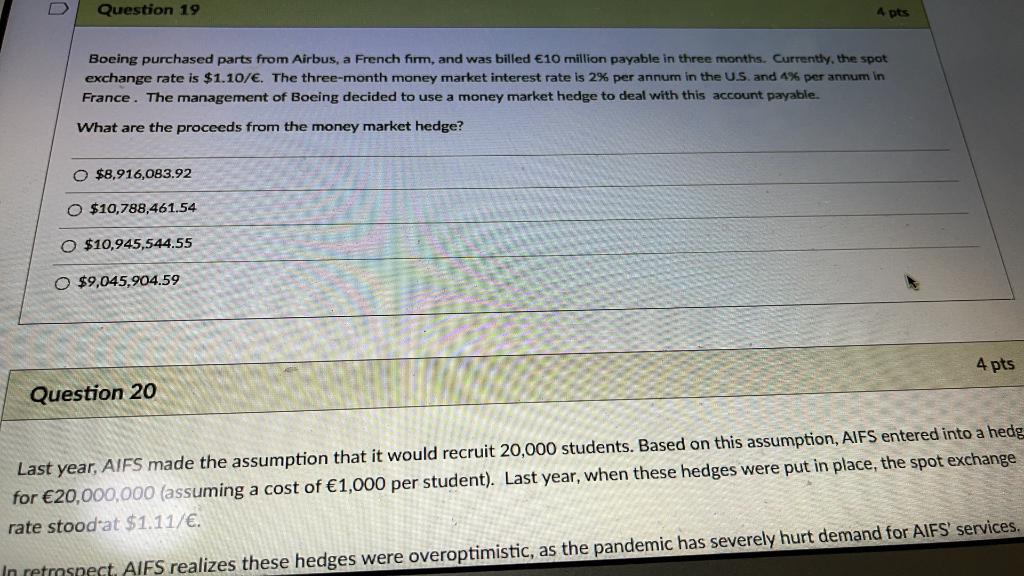

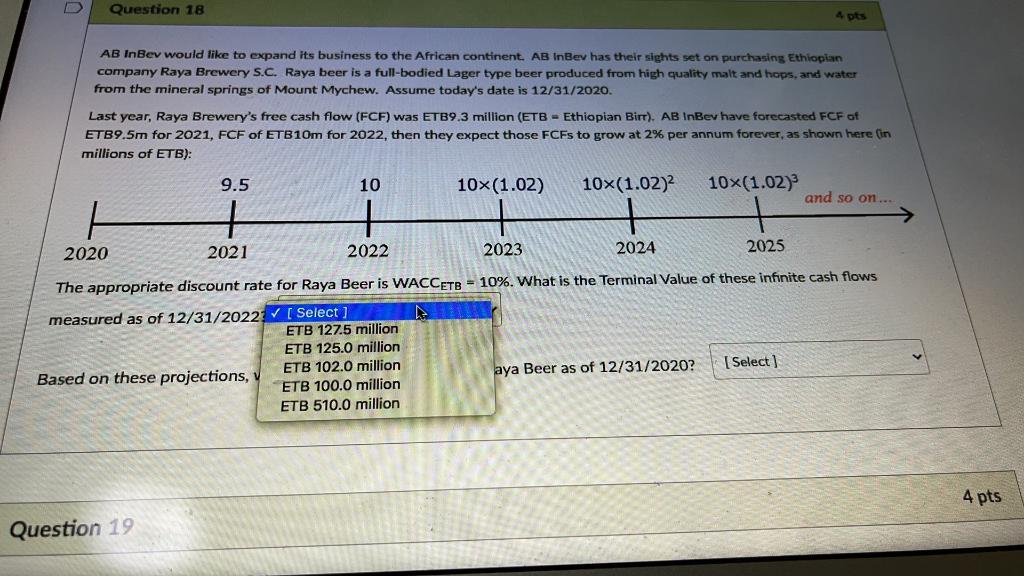

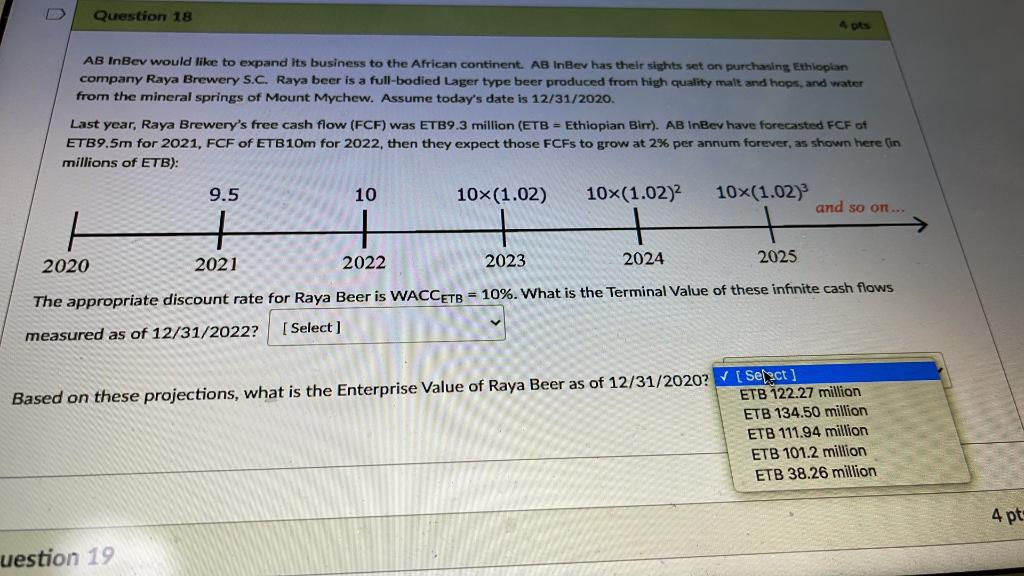

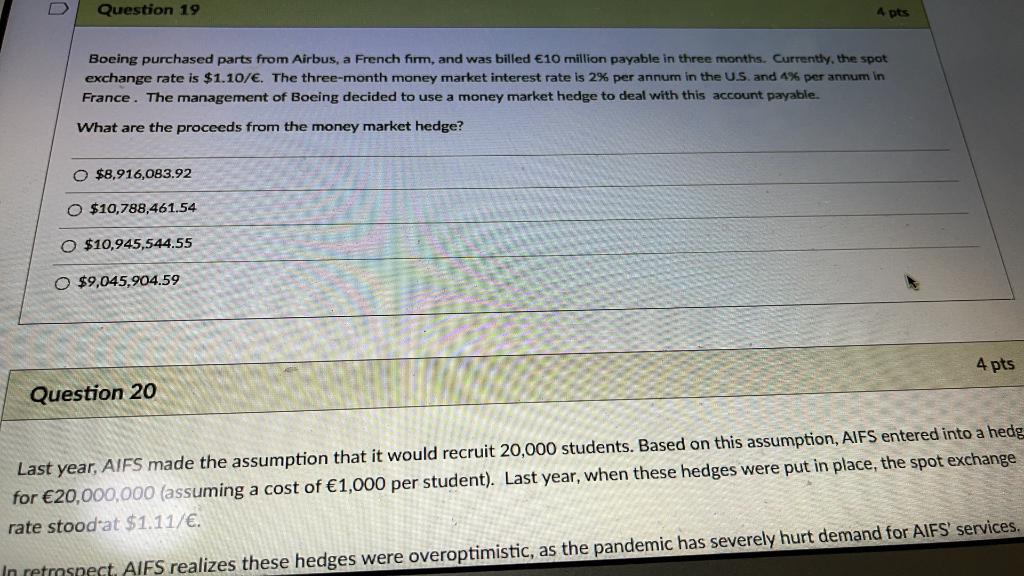

D Question 18 4 pts AB InBev would like to expand its business to the African continent. AB InBev has their sights set on purchasing Ethiopian company Raya Brewery S.C. Raya beer is a full-bodied Lager type beer produced from high quality malt and hops, and water from the mineral springs of Mount Mychew. Assume today's date is 12/31/2020. Last year, Raya Brewery's free cash flow (FCF) was ETB9.3 million (ETB - Ethiopian Birr). AB InBev have forecasted FCF of ETB9.5m for 2021, FCF of ETB10m for 2022, then they expect those FCFs to grow at 2% per annum forever, as shown here in millions of ETB): 9.5 10 10x(1.02) 10x(1.02) 10x(1.02) and so on... + 2020 2021 2022 2023 2024 2025 The appropriate discount rate for Raya Beer is WACCETB = 10%. What is the Terminal Value of these infinite cash flows measured as of 12/31/20227 [ Select ETB 127.5 million ETB 125.0 million Based on these projections, ETB 102.0 million aya Beer as of 12/31/2020? Select) ETB 100.0 million ETB 510.0 million 4 pts Question 19 Question 18 AB InBev would like to expand its business to the African continent. AB InBev has their sights set on purchasing Ethiopian company Raya Brewery S.C. Raya beer is a full-bodied Lager type beer produced from high quality malt and hops, and water from the mineral springs of Mount Mychew. Assume today's date is 12/31/2020. Last year, Raya Brewery's free cash flow (FCF) was ETB9.3 million (ETB - Ethiopian Birr). AB InBev have forecasted FCF of ETB9.5m for 2021, FCF of ETB10m for 2022, then they expect those FCFs to grow at 2% per annum forever, as shown here in millions of ETB): 9.5 10 10X(1.02) 10x(1.02) 10x(1.02) and so on... + + 2021 2020 2022 2023 2024 2025 The appropriate discount rate for Raya Beer is WACCETB = 10%. What is the Terminal Value of these infinite cash flows measured as of 12/31/2022? [Select] Based on these projections, what is the Enterprise Value of Raya Beer as of 12/31/2020? [ Select] ETB 122.27 million ETB 134.50 million ETB 111.94 million ETB 101.2 million ETB 38.26 million 4pt uestion 19 D Question 19 4 pts Boeing purchased parts from Airbus, a French firm, and was billed 10 million payable in three months. Currently, the spot exchange rate is $1.10/. The three-month money market interest rate is 2% per annum in the US and 4% per annum in France. The management of Boeing decided to use a money market hedge to deal with this account payable. What are the proceeds from the money market hedge? O $8,916,083.92 $10,788,461.54 O $10,945,544.55 $9,045,904.59 4 pts Question 20 Last year, AIFS made the assumption that it would recruit 20,000 students. Based on this assumption, AIFS entered into a hedg for 20,000,000 (assuming a cost of 1,000 per student). Last year, when these hedges were put in place, the spot exchange rate stood at $1.11/. In retmspect, AIFS realizes these hedges were overoptimistic, as the pandemic has severely hurt demand for AIFS' services