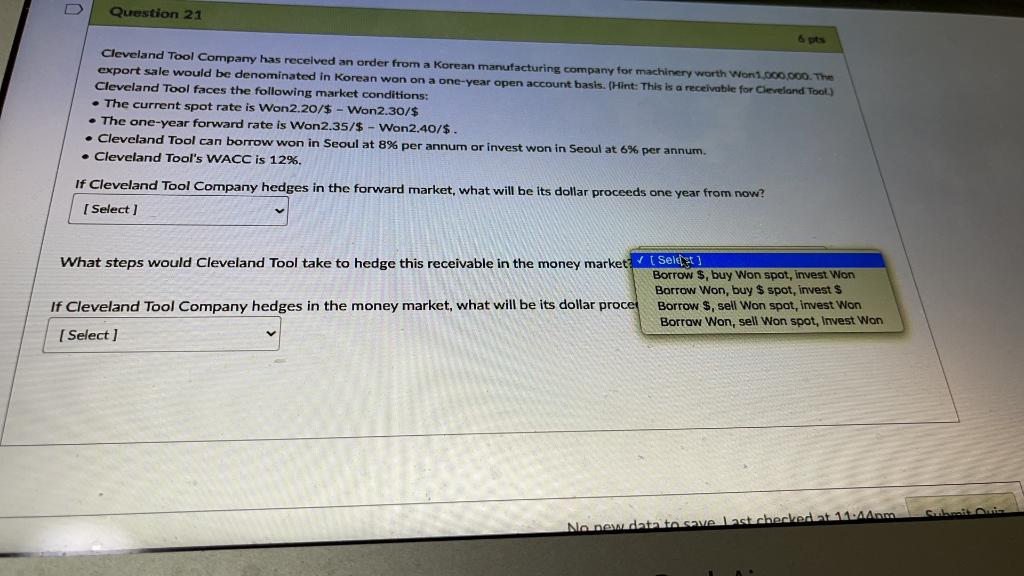

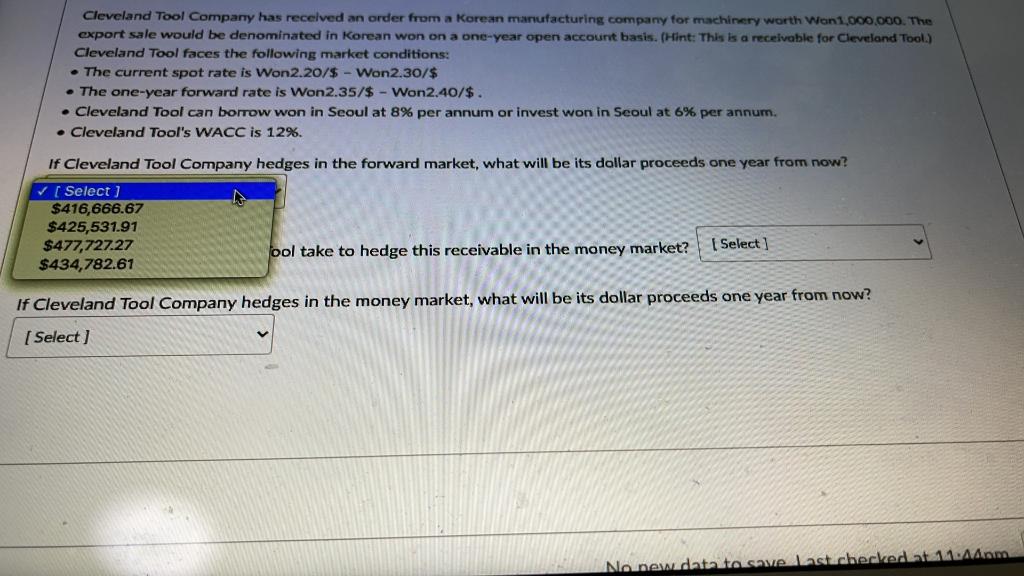

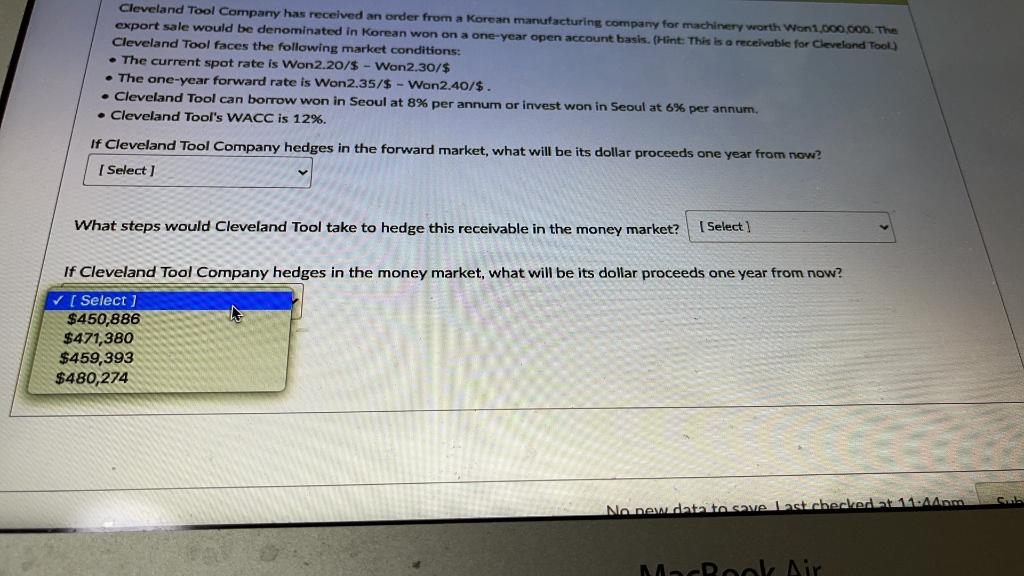

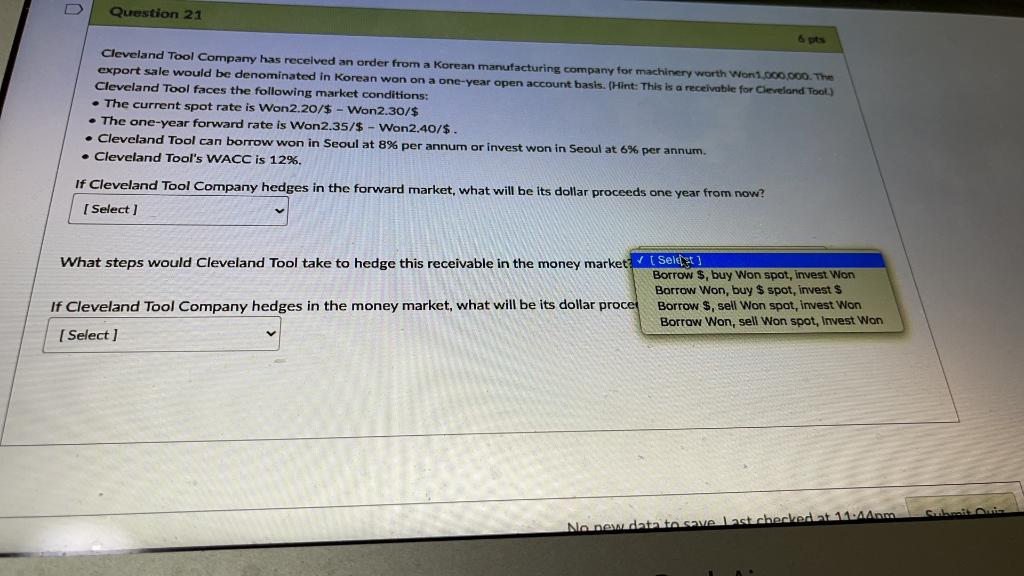

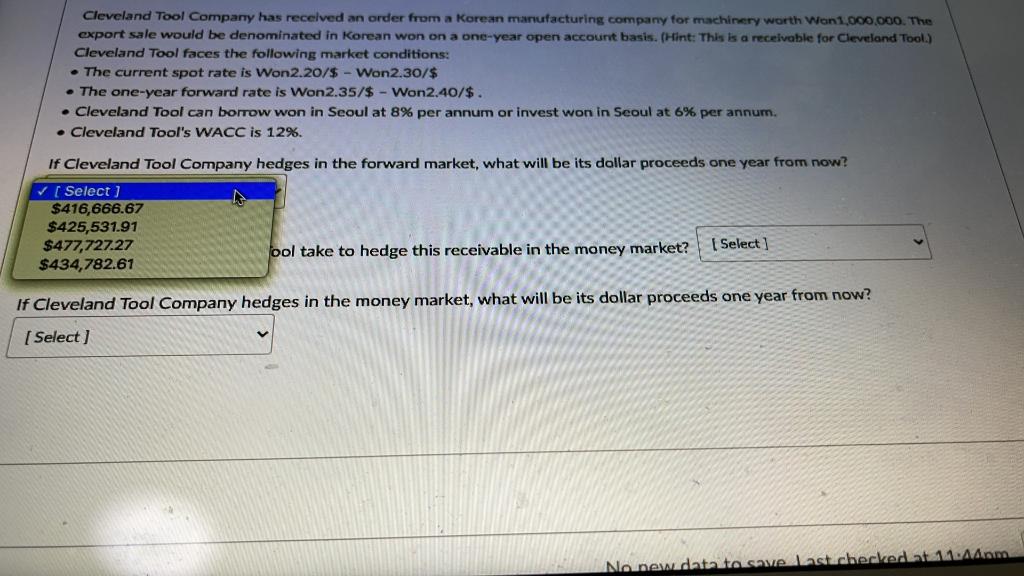

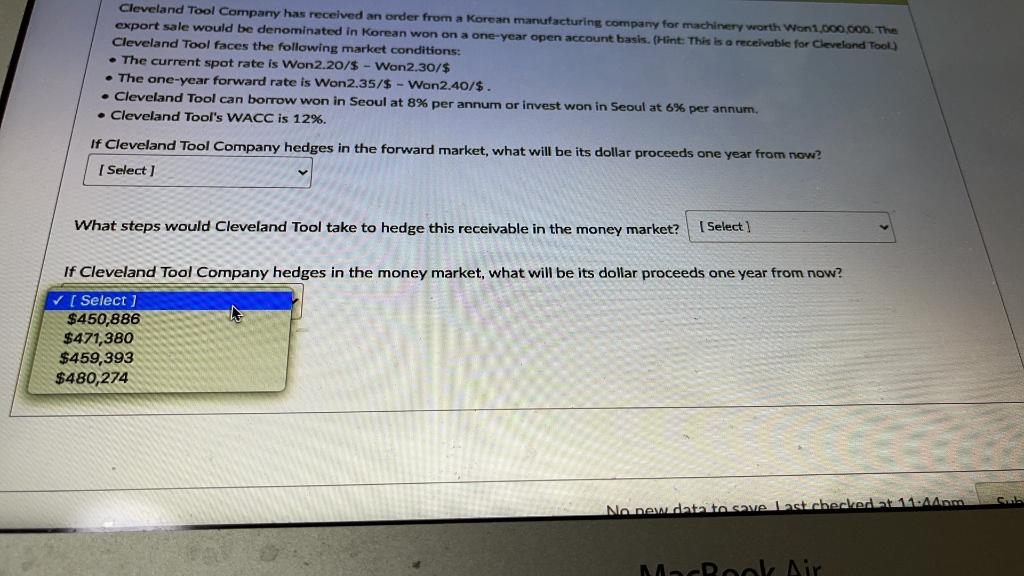

D Question 21 6 pts Cleveland Tool Company has received an order from a Korean manufacturing company for machinery worth Won 1,000,000. The export sale would be denominated in Korean won on a one-year open account basis. (Hint: This is a receivable for Cleveland Tool.) Cleveland Tool faces the following market conditions: The current spot rate is Won2.20/$ - Won2.30/$ The one-year forward rate is Won2.35/$ - Won2.40/$. Cleveland Tool can borrow won in Seoul at 8% per annum or invest won in Seoul at 6% per annum. Cleveland Tool's WACC is 12%. If Cleveland Tool Company hedges in the forward market, what will be its dollar proceeds one year from now? Select) What steps would Cleveland Tool take to hedge this receivable in the money market seldst] Borrow $, buy Won spot, invest Won Borrow Won, buy $ spot, invest $ If Cleveland Tool Company hedges in the money market, what will be its dollar proces Borrow $, sell Won spot, invest Won Borrow Won, sell Won spot, Invest Won (Select] at Aanmail. Ne nedatto save Last cher Cleveland Tool Company has received an order from a Korean manufacturing company for machinery worth Won 1,000,000. The export sale would be denominated in Korean won on a one-year open account basis. (Hint: This is a receivable for Cleveland Tool.) Cleveland Tool faces the following market conditions: The current spot rate is Won2.20/$ - Won2.30/$ The one-year forward rate is Won2.35/$ - Won2.40/$. Cleveland Tool can borrow won in Seoul at 8% per annum or invest won in Seoul at 6% per annum. Cleveland Tool's WACC is 12%. If Cleveland Tool Company hedges in the forward market, what will be its dollar proceeds one year from now? [Select] $416,666.67 $425,531.91 $477,727.27 Select bol take to hedge this receivable in the money market? $434,782.61 If Cleveland Tool Company hedges in the money market, what will be its dollar proceeds one year from now? Select ] No newdata to save Last checked. Mom Cleveland Tool Company has received an order from a Korean manufacturing company for machinery worth Won1.000.000. The export sale would be denominated in Korean won on a one-year open account basis. (Hint: This is a receivable for Cleveland Tool) Cleveland Tool faces the following market conditions: The current spot rate is Won2.20/$ - Won2.30/$ The one-year forward rate is Won2.35/$ - Won2.40/$. Cleveland Tool can borrow won in Seoul at 8% per annum or invest won in Seoul at 6% per annum. Cleveland Tool's WACC is 12%. If Cleveland Tool Company hedges in the forward market, what will be its dollar proceeds one year from now? Select) What steps would Cleveland Tool take to hedge this receivable in the money market? Select) If Cleveland Tool Company hedges in the money market, what will be its dollar proceeds one year from now? [ Select ] $450,886 $471,380 $459,393 $480,274 No new data to save Last checked at 11. Am McDok Air