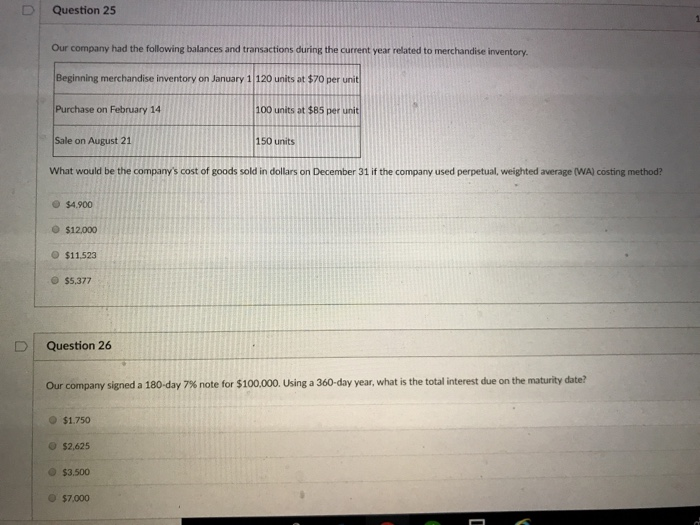

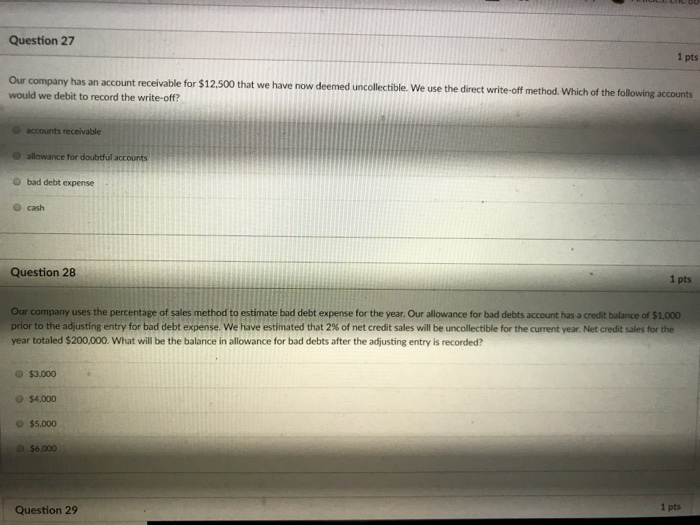

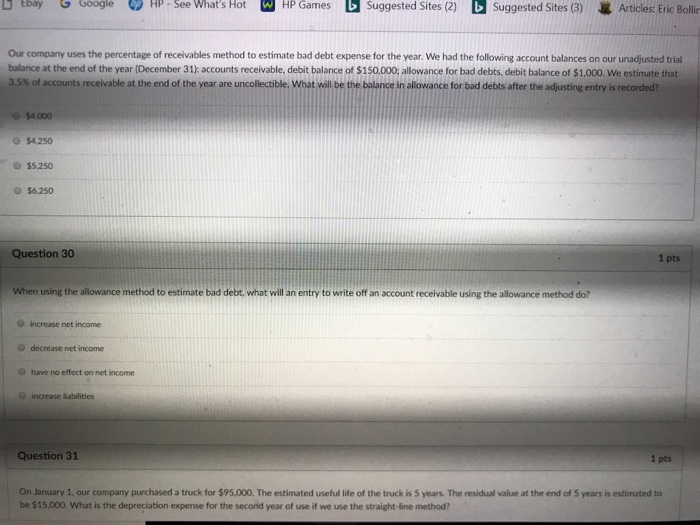

D Question 25 Our company had the following balances and transactions during the current year related to merchandise inventory Beginning merchandise inventory on January 1 120 units at $70 per unit Purchase on February 14 Sale on August 21 What would be the company's cost of goods sold in dollars on December 31 if the company used perpetual, weighted average (WA) costing method? 100 units at $85 per unit 150 units $4,900 $12,000 O $11,523 $5,377 D Question 26 Our company signed a 180-day 7% note for $100,000. Using a 360-day year, what is the total interest due on the maturity date? $1.750 $2,625 $3.500 $7.000 Question 27 1 pts Our company has an account receivable for $12,500 that we ha would we debit to record the write-off? ve now deemed uncollectible We use the direct write-off method. Which of the O accounts receivable O allowance for doubtful acc O bad debt expense O cash Question 28 1 pts Our company uses the percentage of sales method to estimate bad debt expense for the year. Our allowance for bad debts account has a credit balance of $1.000 prior to the a usting entry or bad debt expense. We have estimated that 2% of ne credit sales will be r collectible for the cu ent year. Net ered t sales for the year totaled $200,000. What will be the balance in allowance for bad debts after the adjusting entry is recorded? $3,000 $4,000 $5,000 $6,000 Question 29 1 pts D tbay G Google Hp . See What's Hot HP Games Suggested Sites (2) D Suggested Sites (3) Articles: Eric Bollin Our company uses the percentage of receivables method to estimate bad debt expense for the year. We had the following account balances on our unadjusted trial balance at the end of the year (December 31: accounts receivable, debit balance of $150,000: allowance for bad debts, debit balance of $1,000. We estimate that 3.5% of accounts receivable at the end of the year are uncollectible what will be the balance n allowance for bad debts after the a usting entry is recorded? $4000 O $4250 $5.250 $6.250 Question 30 1 pts When using the allowance method to estimate bad debt, what will an entry to write off an account receivable using the allowance method do? O increase net income O decrease net income O have no effect on net income increase iabilities Question 31 1 pts On January 1. our company purchased a truck for $95,000. The estimated useful life of the truck is 5 years. The residual value at the end of 5 years is estimated to be $15,000. What is the depreciation expense for the second year of use if we use the straight-ine method