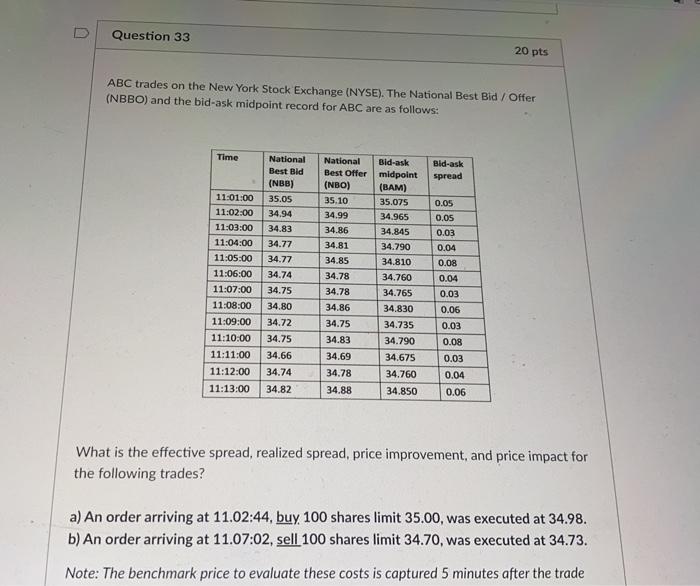

D Question 33 20 pts ABC trades on the New York Stock Exchange (NYSE). The National Best Bid / Offer (NBBO) and the bid-ask midpoint record for ABC are as follows: Time Bid-ask spread 0.05 National Best Bid (NBB) 35.05 34.94 34.83 34.77 34.77 34.74 34.75 34.80 34.72 34.75 34.66 11:01:00 11:02:00 11:03:00 11:04:00 11:05:00 11:06:00 11:07:00 11:08:00 11:09:00 11:10.00 11:11:00 11:12:00 11:13:00 National Best Offer (NBO) 35.10 34.99 34.86 34.81 34.85 34.78 34.78 34.86 34.75 0.05 0.03 0.04 0.08 Bid-ask midpoint (BAM) 35.075 34.965 34.845 34.790 34.810 34.760 34.765 34.830 34.735 34.790 34.675 34.760 34.850 0.04 0.03 0.06 0.03 0.08 0.03 34.83 34.69 34.78 34.88 34.74 34.82 0.04 0.06 What is the effective spread, realized spread, price improvement, and price impact for the following trades? a) An order arriving at 11.02:44, buy 100 shares limit 35.00, was executed at 34.98. b) An order arriving at 11.07:02, sell 100 shares limit 34.70, was executed at 34.73. Note: The benchmark price to evaluate these costs is captured 5 minutes after the trade D Question 33 20 pts ABC trades on the New York Stock Exchange (NYSE). The National Best Bid / Offer (NBBO) and the bid-ask midpoint record for ABC are as follows: Time Bid-ask spread 0.05 National Best Bid (NBB) 35.05 34.94 34.83 34.77 34.77 34.74 34.75 34.80 34.72 34.75 34.66 11:01:00 11:02:00 11:03:00 11:04:00 11:05:00 11:06:00 11:07:00 11:08:00 11:09:00 11:10.00 11:11:00 11:12:00 11:13:00 National Best Offer (NBO) 35.10 34.99 34.86 34.81 34.85 34.78 34.78 34.86 34.75 0.05 0.03 0.04 0.08 Bid-ask midpoint (BAM) 35.075 34.965 34.845 34.790 34.810 34.760 34.765 34.830 34.735 34.790 34.675 34.760 34.850 0.04 0.03 0.06 0.03 0.08 0.03 34.83 34.69 34.78 34.88 34.74 34.82 0.04 0.06 What is the effective spread, realized spread, price improvement, and price impact for the following trades? a) An order arriving at 11.02:44, buy 100 shares limit 35.00, was executed at 34.98. b) An order arriving at 11.07:02, sell 100 shares limit 34.70, was executed at 34.73. Note: The benchmark price to evaluate these costs is captured 5 minutes after the trade