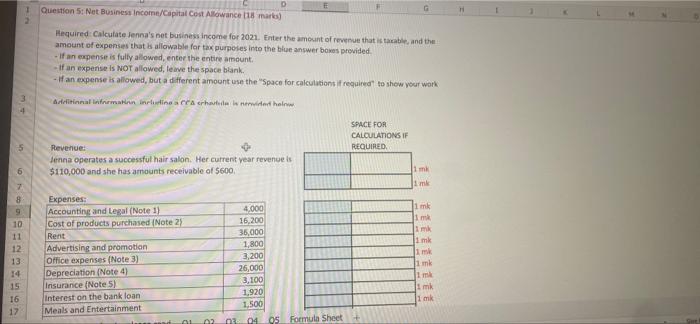

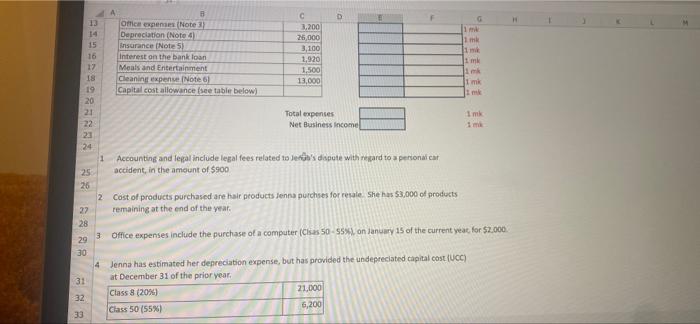

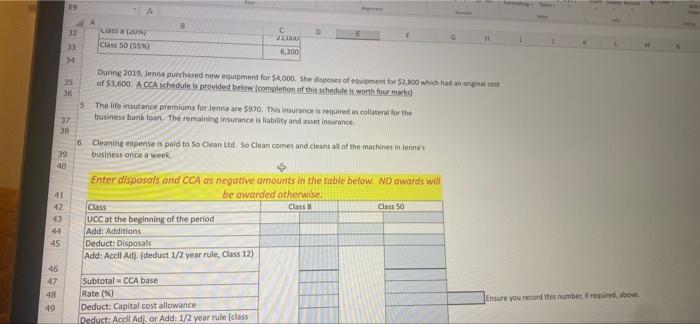

D Question 5: Net Business Income/Capital Cost Allowance 18 marts) 11 1 1 2 Hequired: Calculate Jenna's net business income for 2021. Enter the amount of revenu that is taxable, and the amount of expenses that is allowable for tax purposes into the blue answer bas provided If an expense is fully allowed, enter the entire amount -If an expense is NOT allowed, leave the space blank. -If an expense is allowed, but a different amount use the "Space for calculations if required to show your work 3 4 Altinnal information including Acrhaba wewe hain SPACE FOR CALCULATIONS IF REQUIRED 5 Revenue: Senna operates a successful hair salon. Her current year revenue is $110,000 and she has amounts receivable of 5600 6 imi ml 7 8 9 10 11 12 13 14 15 16 17 Expenses: Accounting and Legal (Note 1) Cost of products purchased Note 2 Rent Advertising and promotion Office expenses (Note 3) Depreciation (Note 4) Insurance Note 5) Interest on the bank loan Meals and Entertainment 1 4,000 16.200 35,000 1,800 3,200 26,000 3,100 1.920 1,500 3 040 Formula Sheet + 11mk 1 im 11.mk imk 11.mk 1m (1 mk 2 B D Office expenses Note 3 3.200 14 Depreciation (Note 4 1 25,000 15 Insurance (Note 5) 1 m 3,100 16 Interest on the bank loan 1,920 17 mi Meals and Entertainment 1,500 18 Cleaning expense Note 1 13,000 imk 19 Capital cost allowance fee table below) 20 21 Total expenses im 22 Net Business Income 22 24 1 Accounting and legal include legal fees related to Jera's dispute with regard to personali cat 25 accident in the amount of $900 26 2 Cost of products purchased are hair products Jenna purchses for resale She has $3,000 of products 27 remaining at the end of the year 28 29 3 Office expenses include the purchase of a computer (Clas 50-95%) on January 15 of the current year for $2.000 30 4 Jenna has estimated her depreciation expense, but has provided the undepreciated capital cost (UCC) 31 at December 31 of the prior year. 21,000 Class 8 (20%) 32 Class 50 (55%) 6.200 33 BW B 32 CS Class 50(5590 C 2. 6,200 33 34 35 36 During 2019, Jenna purchased new equipment for $4.000. She disposes of woment for $2,000 which had of $3,600 A CCA schedule is provided below completion of this schedule is worth four 5 The life insurance premiums for Jenna are $970. This insurance is required as collateral for the business bank loan. The remaining insurance is liability and asset Insurano 37 38 6 Cleaning expense is paid to So Clean tid. So Clean comes and cleans all of the machines in Jenna business once a week -39 40 42 43 44 45 Enter disposals and CCA as negative amounts in the table below. No awards will be awarded otherwise Class Class Clans 50 UCC at the beginning of the period Add: Additions Deduct: Disposals Add: Acell Adj. (deduct 1/2 year rule, Class 12) 46 17 SubtotalCCA base Rate() Deduct: Capital cost allowance Deduct: Acell Ador Add: 1/2 year rule (class Ensure you record this number freund, bove 49 D Question 5: Net Business Income/Capital Cost Allowance 18 marts) 11 1 1 2 Hequired: Calculate Jenna's net business income for 2021. Enter the amount of revenu that is taxable, and the amount of expenses that is allowable for tax purposes into the blue answer bas provided If an expense is fully allowed, enter the entire amount -If an expense is NOT allowed, leave the space blank. -If an expense is allowed, but a different amount use the "Space for calculations if required to show your work 3 4 Altinnal information including Acrhaba wewe hain SPACE FOR CALCULATIONS IF REQUIRED 5 Revenue: Senna operates a successful hair salon. Her current year revenue is $110,000 and she has amounts receivable of 5600 6 imi ml 7 8 9 10 11 12 13 14 15 16 17 Expenses: Accounting and Legal (Note 1) Cost of products purchased Note 2 Rent Advertising and promotion Office expenses (Note 3) Depreciation (Note 4) Insurance Note 5) Interest on the bank loan Meals and Entertainment 1 4,000 16.200 35,000 1,800 3,200 26,000 3,100 1.920 1,500 3 040 Formula Sheet + 11mk 1 im 11.mk imk 11.mk 1m (1 mk 2 B D Office expenses Note 3 3.200 14 Depreciation (Note 4 1 25,000 15 Insurance (Note 5) 1 m 3,100 16 Interest on the bank loan 1,920 17 mi Meals and Entertainment 1,500 18 Cleaning expense Note 1 13,000 imk 19 Capital cost allowance fee table below) 20 21 Total expenses im 22 Net Business Income 22 24 1 Accounting and legal include legal fees related to Jera's dispute with regard to personali cat 25 accident in the amount of $900 26 2 Cost of products purchased are hair products Jenna purchses for resale She has $3,000 of products 27 remaining at the end of the year 28 29 3 Office expenses include the purchase of a computer (Clas 50-95%) on January 15 of the current year for $2.000 30 4 Jenna has estimated her depreciation expense, but has provided the undepreciated capital cost (UCC) 31 at December 31 of the prior year. 21,000 Class 8 (20%) 32 Class 50 (55%) 6.200 33 BW B 32 CS Class 50(5590 C 2. 6,200 33 34 35 36 During 2019, Jenna purchased new equipment for $4.000. She disposes of woment for $2,000 which had of $3,600 A CCA schedule is provided below completion of this schedule is worth four 5 The life insurance premiums for Jenna are $970. This insurance is required as collateral for the business bank loan. The remaining insurance is liability and asset Insurano 37 38 6 Cleaning expense is paid to So Clean tid. So Clean comes and cleans all of the machines in Jenna business once a week -39 40 42 43 44 45 Enter disposals and CCA as negative amounts in the table below. No awards will be awarded otherwise Class Class Clans 50 UCC at the beginning of the period Add: Additions Deduct: Disposals Add: Acell Adj. (deduct 1/2 year rule, Class 12) 46 17 SubtotalCCA base Rate() Deduct: Capital cost allowance Deduct: Acell Ador Add: 1/2 year rule (class Ensure you record this number freund, bove 49