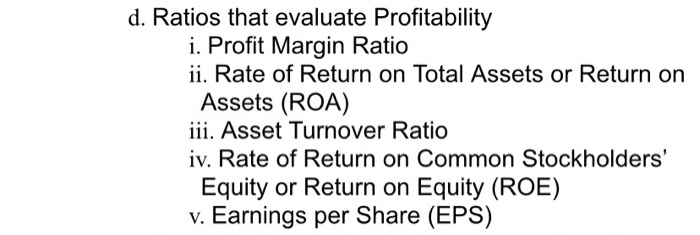

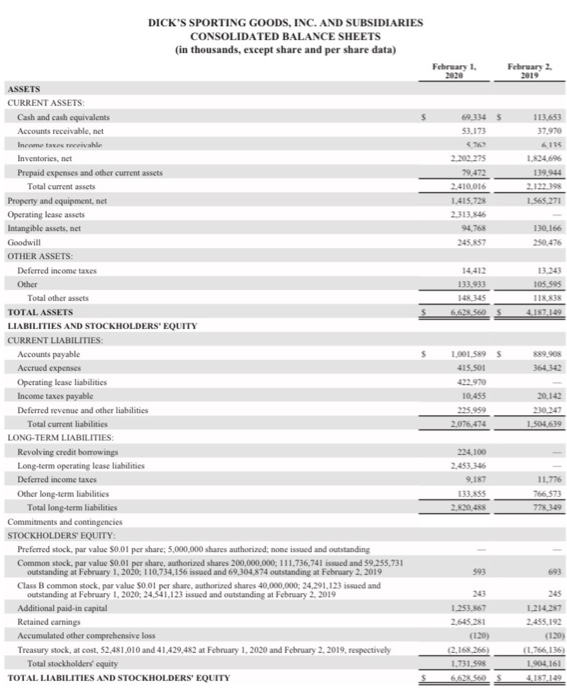

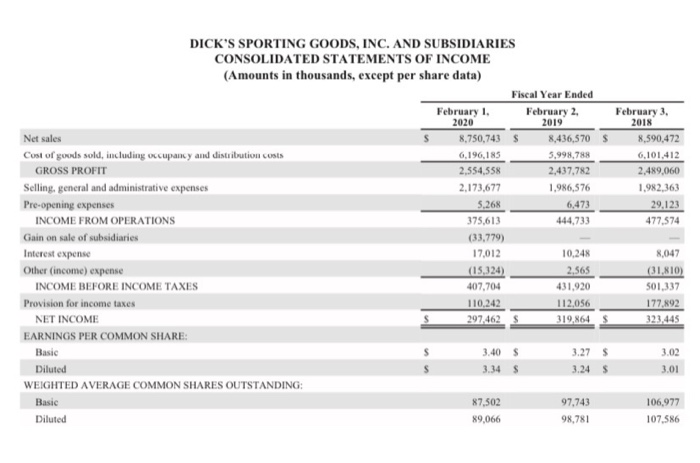

d. Ratios that evaluate Profitability i. Profit Margin Ratio ii. Rate of Return on Total Assets or Return on Assets (ROA) iii. Asset Turnover Ratio iv. Rate of Return on Common Stockholders' Equity or Return on Equity (ROE) v. Earnings per Share (EPS) DICK'S SPORTING GOODS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share data) February 1. 2020 February 2 2019 113.653 37.970 69,334 5 53.173 576 2.202.275 79.472 2.410 016 1.415.728 2.313.846 94.768 245.857 1.824.696 139944 2.122398 1.565.271 130,166 250.476 14,412 133.933 13.243 105.595 118.838 4.187.149 1345 6628560 $ ASSETS CURRENT ASSETS: Cash and cash equivalents Accounts receivable, net Income taxes revival Inventories, net Prepaid expenses and other current assets Total current assets Property and equipment, net Operating lease assets Intangible assets, net Goodwill OTHER ASSETS: Deferred income taxes Other Total other assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable Accrued expenses Operating lease liabilities Income taxes payable Deferred revenue and other liabilities Total current liabilities LONG-TERM LIABILITIES: Revolving credit borrowings Long-term operating lease liabilities Deferred income taxes Other long-term liabilities Total long-term liabilities Commitments and contingencies STOCKHOLDERS' EQUITY: Preferred stock, par value $0.01 per share: 5.000.000 shares authorized: none issued and outstanding Common stock, par value 0.01 per share, authorized shares 200,000,000; 111,736,741 issued and 59.255,731 outstanding at February 1, 2020: 110,734,156 issued and 69,304,874 outstanding at February 2, 2019 Class B common stock par value $0.01 per share, authorized shares 40,000,000; 24.291.123 issued and outstanding at February 1, 2020:24,541.123 issued and outstanding at February 2, 2019 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 52,481,010 and 41,429,482 at February 1, 2020 and February 2, 2019, respectively Total stockholders' equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1.001.5895 415.501 422.970 10.455 225.959 2,076,474 20.142 230-247 1,504.639 224.100 2.453.346 9.187 133.SS 2.820.45 11.776 766 573 778 349 593 693 1.253.867 2.645.281 (120) 2.168.266 1.731.59 1.214287 2,455,192 (120) (1.766, 136) 1.904.161 4.187.149 Solve these February 3, 2018 8.590,472 6,101,412 2,489,060 1.982,363 29,123 477,574 DICK'S SPORTING GOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (Amounts in thousands, except per share data) Fiscal Year Ended February 1. February 2, 2020 2019 Net sales 8,750,743 $ 8,436,570 $ Cost of goods sold, including occupancy and distribution costs 6,196,185 5.998,788 GROSS PROFIT 2,554,558 2,437,782 Selling, general and administrative expenses 2,173,677 1.986,576 Pre-opening expenses 5,268 6,473 INCOME FROM OPERATIONS 375,613 444,733 Gain on sale of subsidiaries (33,779) Interest expense 17,012 10,248 Other (income) expense (15,324) 2,565 INCOME BEFORE INCOME TAXES 407,704 431,920 Provision for income taxes 110,242 112,056 NET INCOME 297.462 319,864 $ EARNINGS PER COMMON SHARE: Basic 3.40 $ 3.27 $ Diluted 3.34 $ 3.24 $ WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: Basic 87,502 97,743 Diluted 89,066 98,781 8,047 (31.810) 501,337 177,892 323,445 3.02 3.01 106,977 107,586