Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(d) Record its year-end closing journal entries. Explanations are NOT required. (12 marks) BUMN2101 2020/21 S2 Assignment Total Marks: 100 marks Question 1 (20 marks)

(d) Record its year-end closing journal entries. Explanations are NOT required. (12 marks)

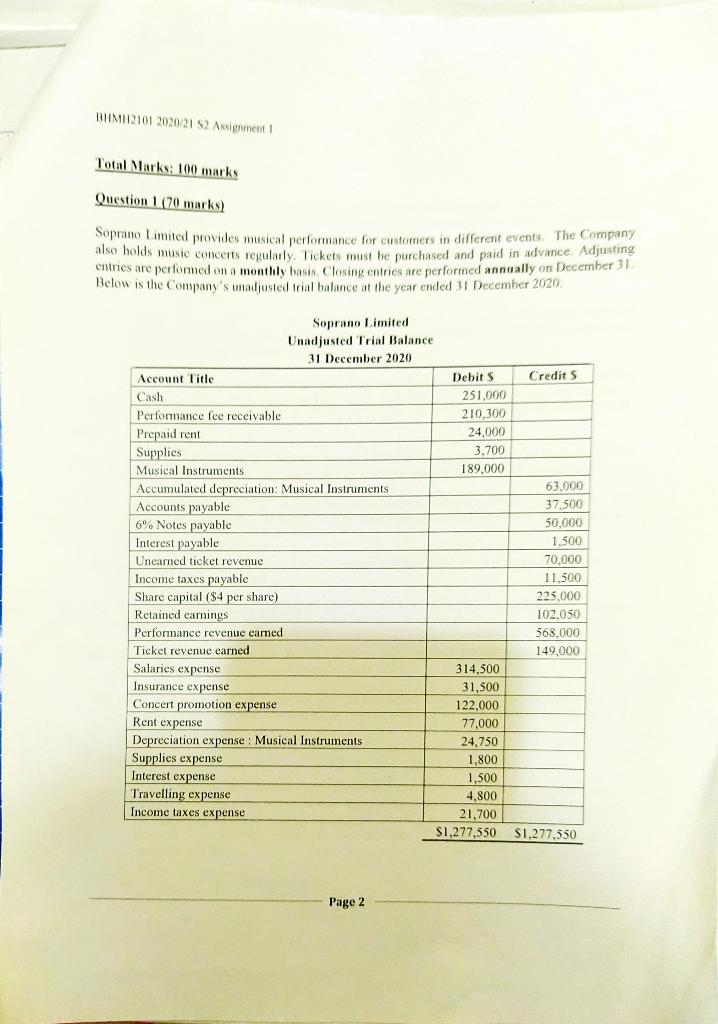

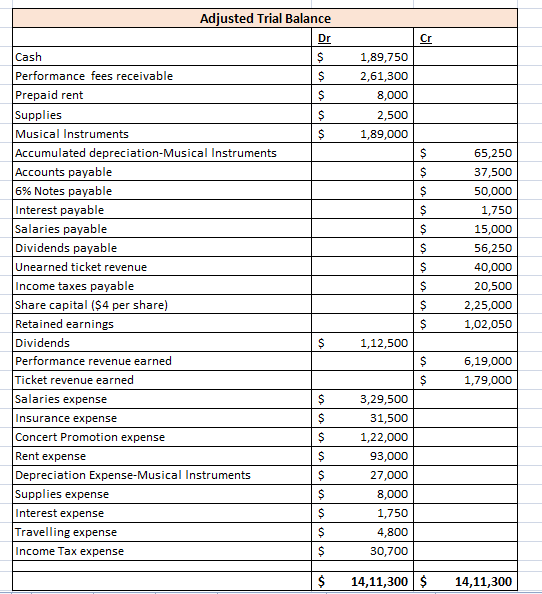

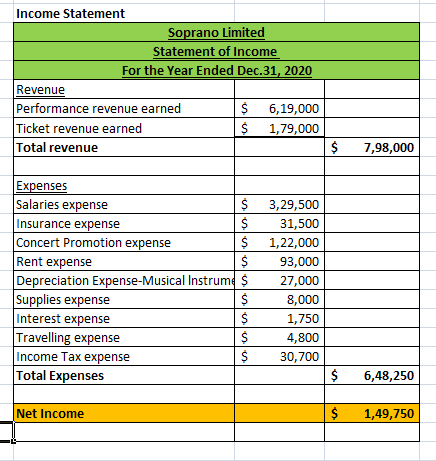

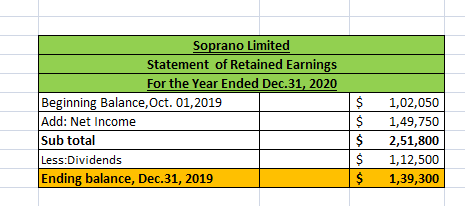

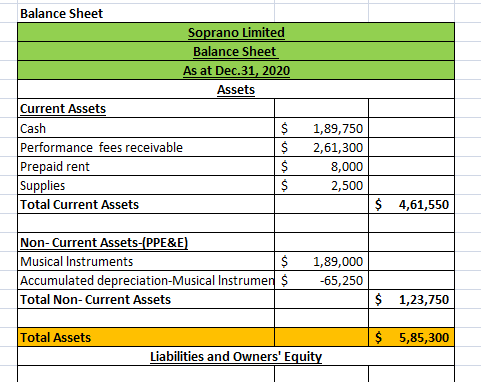

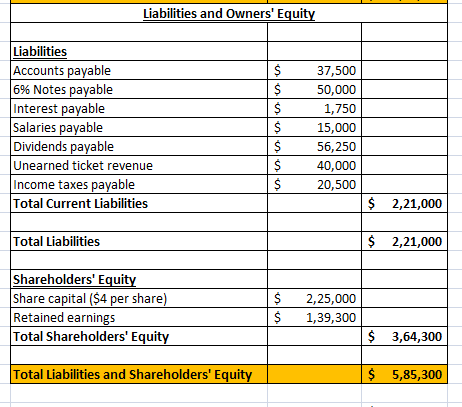

BUMN2101 2020/21 S2 Assignment Total Marks: 100 marks Question 1 (20 marks) Soprano Limited provides musical performance for customers in different events. The Company also holds music concerts regularly. Tickets must be purchased and paid in advance. Adjusting entries are performed on a monthly basis. Closing entries are performed annually on December 31 Below is the Company's unadjusted trial balance at the year ended 31 December 2020 63.000 Soprano Limited Unadjusted Trial Balance 31 December 2020 Account Title Debits Credits Cash 251.000 Performance fee receivable 210,300 Prepaid rent 24,000 Supplies 3,700 Musical Instruments 189,000 Accumulated depreciation: Musical Instruments Accounts payable 37.500 6% Notes payable 50.000 Interest payable 1.500 Unearned ticket revenue 70,000 Income taxes payable 11.500 Share capital ($4 per share) 225.000 Retained earnings 102.050 Performance revenue eamed 568.000 Ticket revenue earned 149,000 Salaries expense 314,500 Insurance expense 31,500 Concert promotion expense 122.000 77,000 Depreciation expense : Musical Instruments 24,750 Supplies expense 1,800 Interest expense 1,500 Travelling expense 4,800 Income taxes expense 21,700 $1,277,550 $1,277,550 Rent expense Page 2 Cr 1,89,750 2,61,300 8,000 2,500 1,89,000 $ $ $ $ $ Adjusted Trial Balance Dr Cash $ Performance fees receivable $ Prepaid rent $ Supplies $ Musical Instruments S Accumulated depreciation-Musical Instruments Accounts payable 6% Notes payable Interest payable Salaries payable Dividends payable Unearned ticket revenue Income taxes payable Share capital ($4 per share) Retained earnings Dividends $ Performance revenue earned Ticket revenue earned Salaries expense $ Insurance expense $ Concert Pron expense $ Rent expense $ Depreciation Expense Musical Instruments $ Supplies expense $ Interest expense $ Travelling expense $ Income Tax expense $ 65,250 37,500 50,000 1,750 15,000 56,250 40,000 20,500 2,25,000 1,02,050 $ $ $ S $ 1,12,500 $ 6,19,000 1,79,000 $ 3,29,500 31,500 1,22,000 93,000 27,000 8,000 1,750 4,800 30,700 $ 14,11,300 $ 14,11,300 Income Statement Soprano Limited Statement of Income For the Year Ended Dec.31, 2020 Revenue Performance revenue earned $ 6,19,000 Ticket revenue earned $ 1,79,000 Total revenue $ 7,98,000 Expenses Salaries expense $ Insurance expense $ Concert Promotion expense $ Rent expense $ Depreciation Expense Musical Instrume $ Supplies expense $ Interest expense $ Travelling expense $ Income Tax expense $ Total Expenses 3,29,500 31,500 1,22,000 93,000 27,000 8,000 1,750 4,800 30,700 $ 6,48,250 Net Income $ 1,49,750 Soprano Limited Statement of Retained Earnings For the Year Ended Dec.31, 2020 Beginning Balance, Oct. 01,2019 Add: Net Income Sub total Less:Dividends Ending balance, Dec.31, 2019 $ $ $ $ $ 1,02,050 1,49,750 2,51,800 1,12,500 1,39,300 Balance Sheet Soprano Limited Balance Sheet As at Dec 31, 2020 Assets Current Assets Cash $ Performance fees receivable $ Prepaid rent $ Supplies $ Total Current Assets 1,89,750 2,61,300 8,000 2,500 $ 4,61,550 Non-Current Assets-(PPE&E) Musical Instruments $ Accumulated depreciation-Musical Instrumen $ Total Non-Current Assets 1,89,000 -65,250 $ 1,23,750 Total Assets $ 5,85,300 Liabilities and Owners' Equity Liabilities and Owners' Equity Liabilities Accounts payable 6% Notes payable Interest payable Salaries payable Dividends payable Unearned ticket revenue Income taxes payable Total Current Liabilities $ $ $ $ $ $ $ 37,500 50,000 1,750 15,000 56,250 40,000 20,500 $ 2,21,000 Total Liabilities $ 2,21,000 Shareholders' Equity Share capital ($4 per share) Retained earnings Total Shareholders' Equity $ $ 2,25,000 1,39,300 $ 3,64,300 Total Liabilities and Shareholders' Equity $ 5,85,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started