Answered step by step

Verified Expert Solution

Question

1 Approved Answer

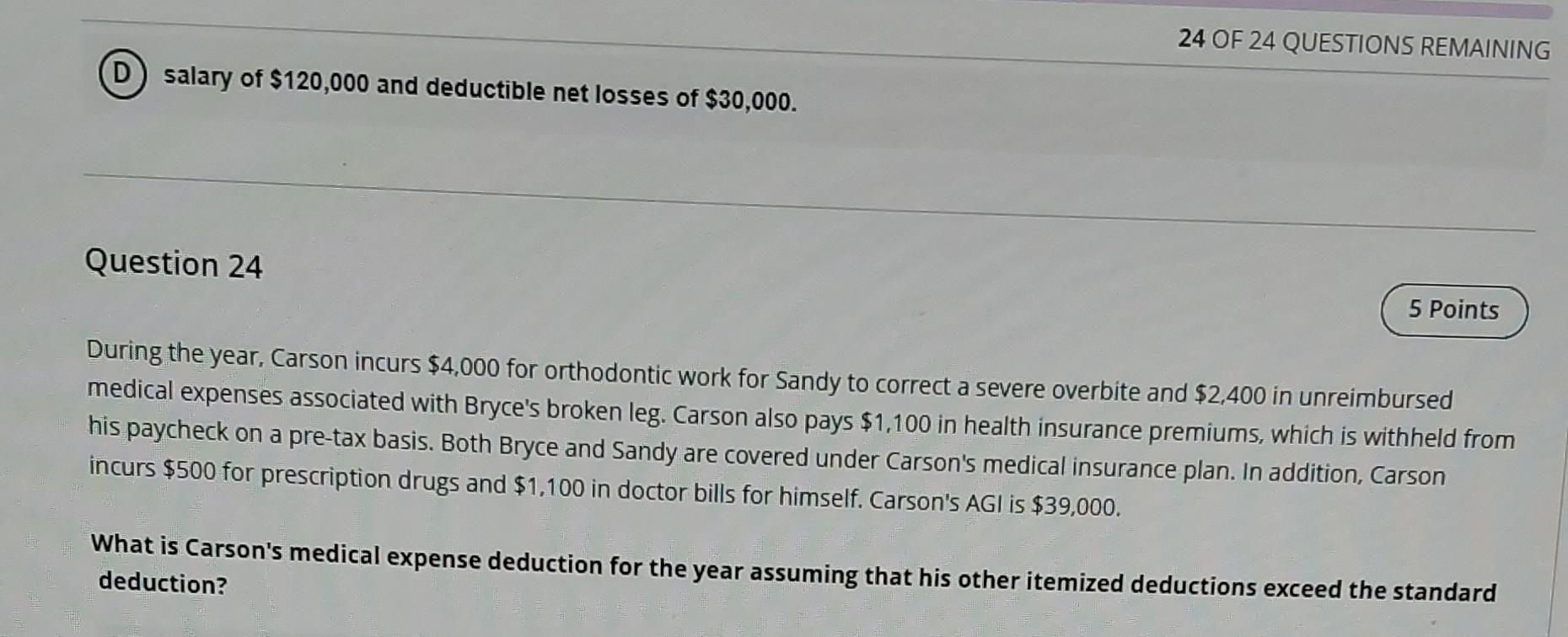

(D) salary of $120,000 and deductible net losses of $30,000. Question 24 During the year, Carson incurs $4,000 for orthodontic work for Sandy to correct

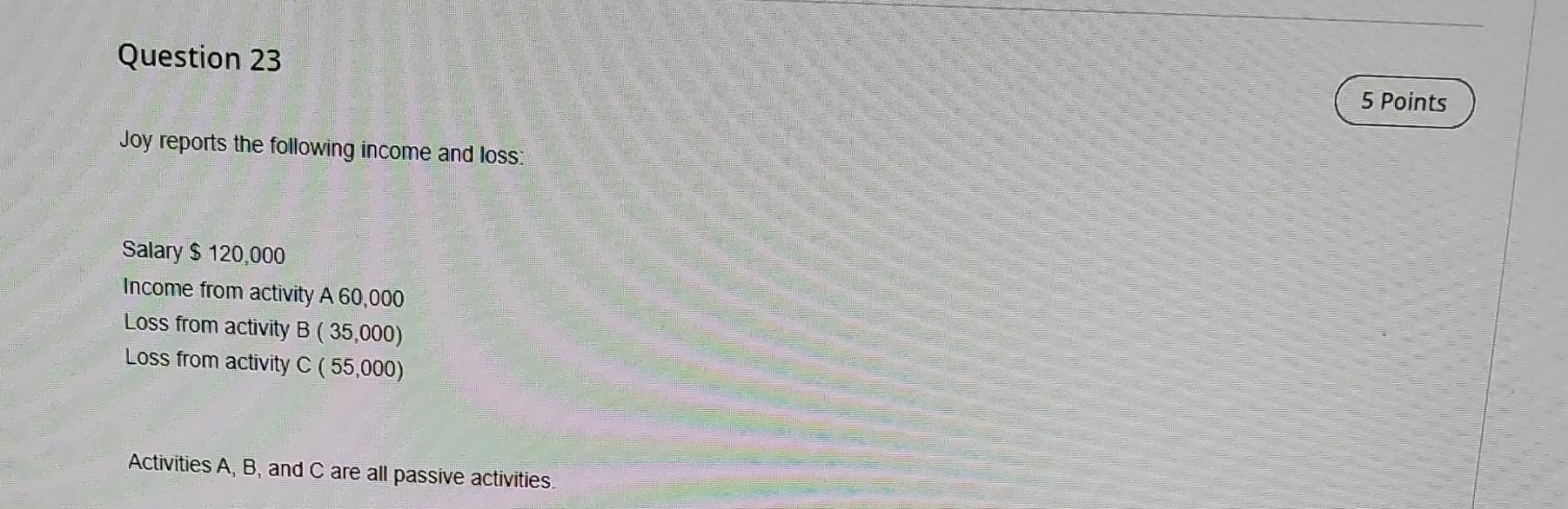

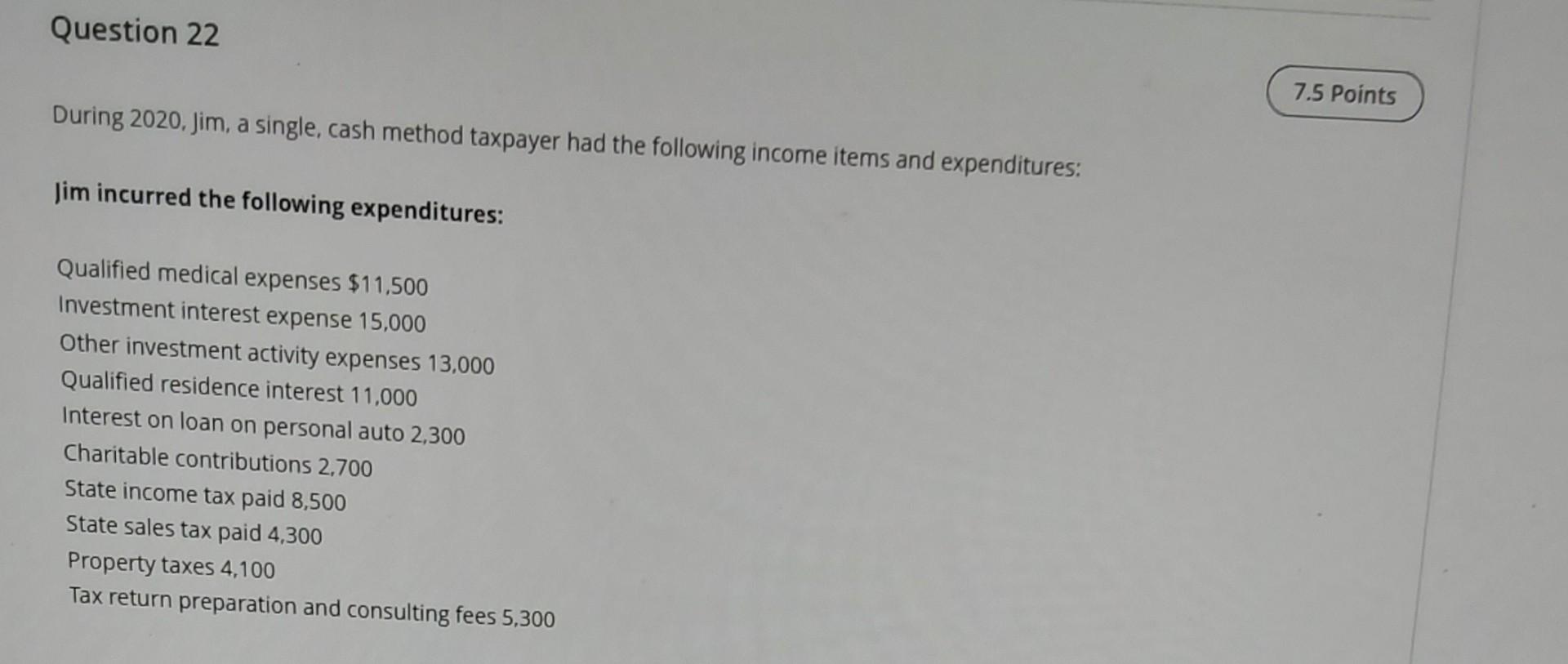

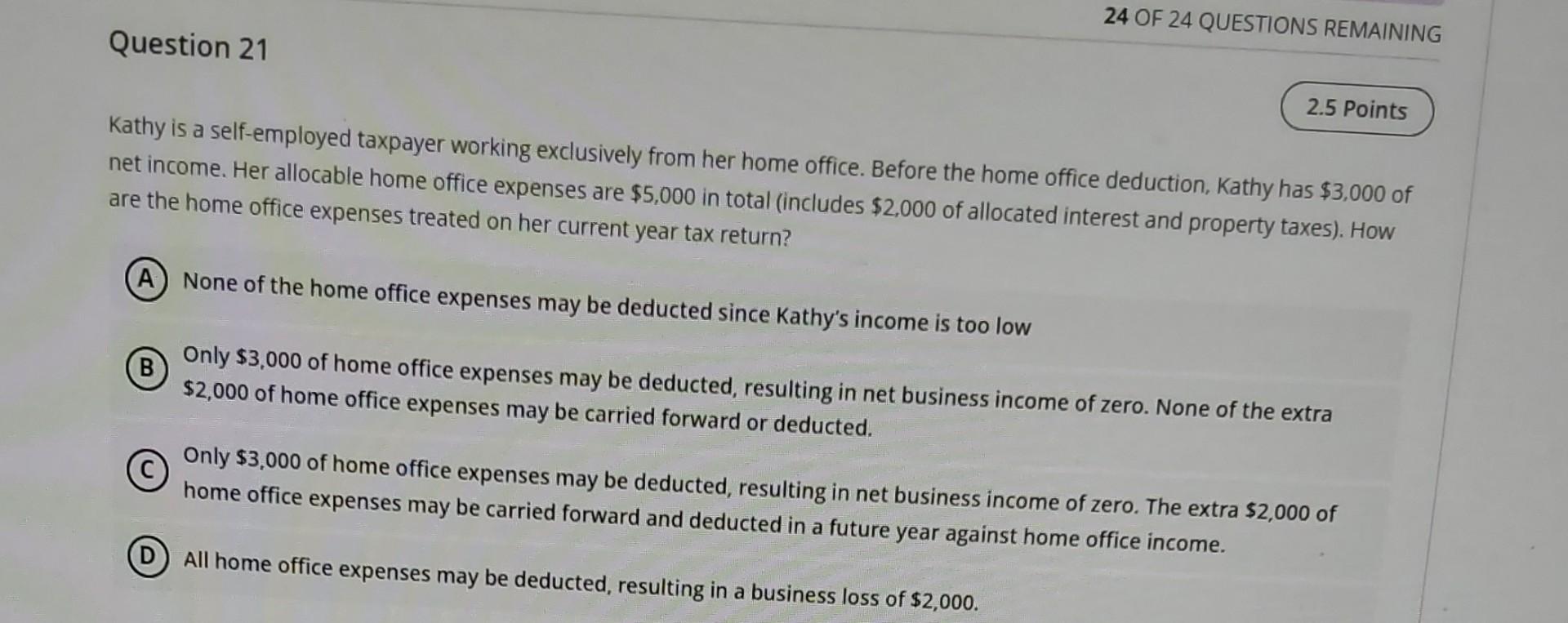

(D) salary of $120,000 and deductible net losses of $30,000. Question 24 During the year, Carson incurs $4,000 for orthodontic work for Sandy to correct a severe overbite and $2,400 in unreimbursed medical expenses associated with Bryce's broken leg. Carson also pays $1,100 in health insurance premiums, which is withheld from his paycheck on a pre-tax basis. Both Bryce and Sandy are covered under Carson's medical insurance plan. In addition, Carson incurs $500 for prescription drugs and $1,100 in doctor bills for himself. Carson's AGI is $39,000. What is Carson's medical expense deduction for the year assuming that his other itemized deductions exceed the standard deduction? Joy reports the following income and loss: Salary $120,000 Income from activity A60,000 Loss from activity B (35,000) Loss from activity C (55,000) Activities A, B, and C are all passive activities. During 2020, Jim, a single, cash method taxpayer had the following income items and expenditures: Jim incurred the following expenditures: Qualified medical expenses $11,500 Investment interest expense 15,000 Other investment activity expenses 13,000 Qualified residence interest 11,000 Interest on loan on personal auto 2,300 Charitable contributions 2,700 State income tax paid 8,500 State sales tax paid 4,300 Property taxes 4,100 Tax return preparation and consulting fees 5,300 Kathy is a self-employed taxpayer working exclusively from her home office. Before the home office deduction, Kathy has $3,000 of net income. Her allocable home office expenses are $5,000 in total (includes $2,000 of allocated interest and property taxes). How are the home office expenses treated on her current year tax return? (A) None of the home office expenses may be deducted since Kathy's income is too low (B) Only $3,000 of home office expenses may be deducted, resulting in net business income of zero. None of the extra $2,000 of home office expenses may be carried forward or deducted. Only $3,000 of home office expenses may be deducted, resulting in net business income of zero. The extra $2,000 of home office expenses may be carried forward and deducted in a future year against home office income. (D) All home office expenses may be deducted, resulting in a business loss of $2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started