Answered step by step

Verified Expert Solution

Question

1 Approved Answer

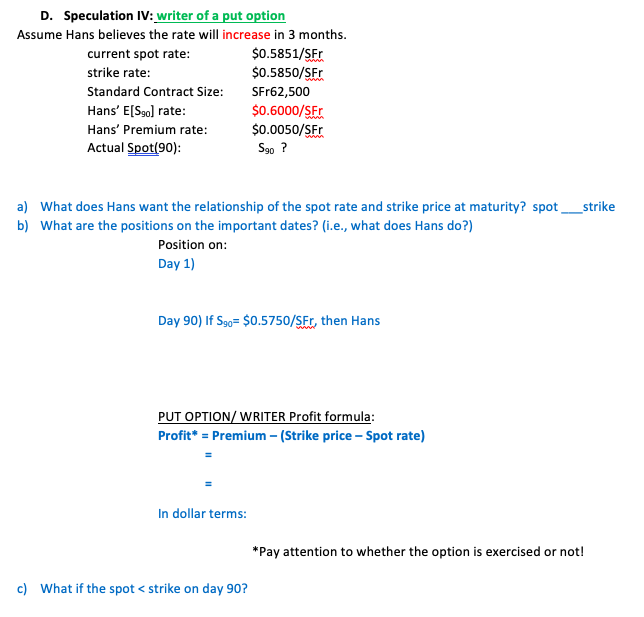

D. Speculation IV: writer of a put option Assume Hans believes the rate will increase in 3 months. current spot rate: $0.5851/SET strike rate: $0.5850/SFr

D. Speculation IV: writer of a put option Assume Hans believes the rate will increase in 3 months. current spot rate: $0.5851/SET strike rate: $0.5850/SFr Standard Contract Size: SFr62,500 Hans' E[S90) rate: $0.6000/SFT Hans' Premium rate: $0.0050/SFT Actual Spot(90): Sgo? a) What does Hans want the relationship of the spot rate and strike price at maturity? spot___strike b) What are the positions on the important dates? (i.e., what does Hans do?) Position on: Day 1) Day 90) If S90= $0.5750/SEr, then Hans PUT OPTION/ WRITER Profit formula: Profit* = Premium - (Strike price - Spot rate) In dollar terms: *Pay attention to whether the option is exercised or not! c) What if the spot

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started