Answered step by step

Verified Expert Solution

Question

1 Approved Answer

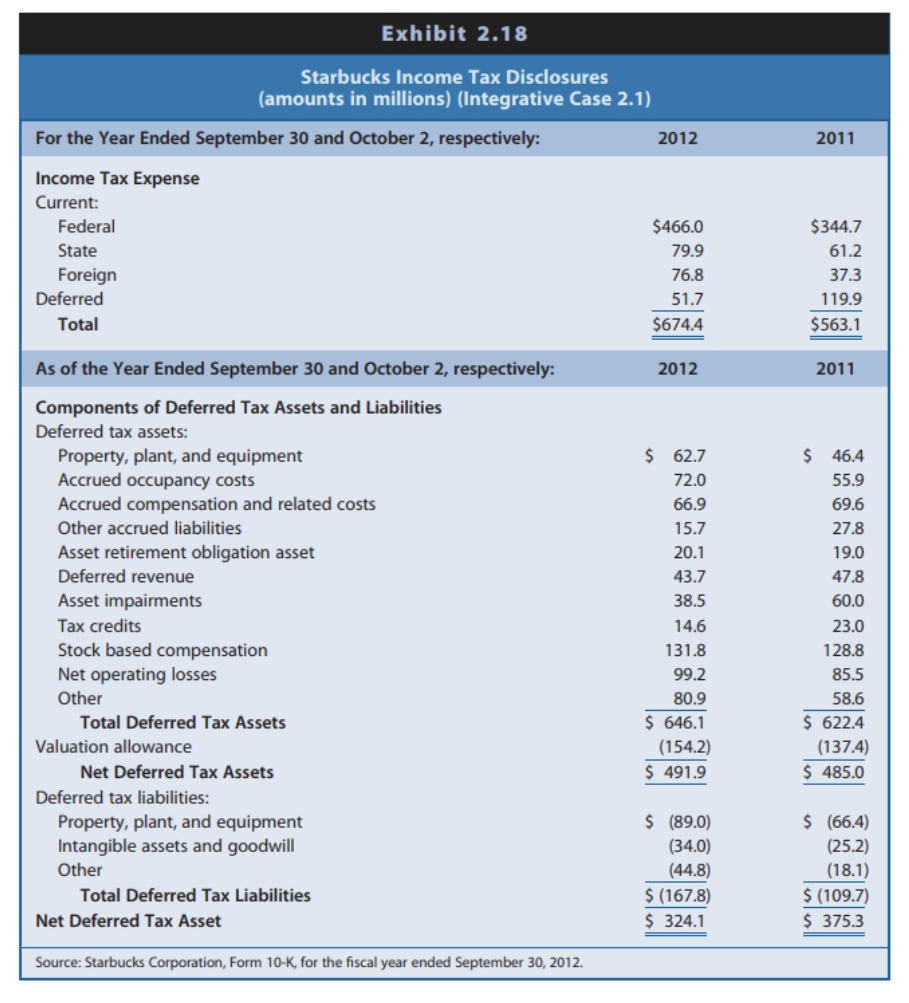

d. Starbucks recognizes an expense related to retirement benefits as employees rendered services but cannot claim an income tax deduction until it pays cash to

d. Starbucks recognizes an expense related to retirement benefits as employees rendered services but cannot claim an income tax deduction until it pays cash to a retirement fund. Why do the deferred taxes for deferred compensation appear as a deferred tax asset (Accrued compensation and related costs)? Suggest possible reasons why the deferred tax asset decreased slightly between the end of 2011 and the end of 2012.

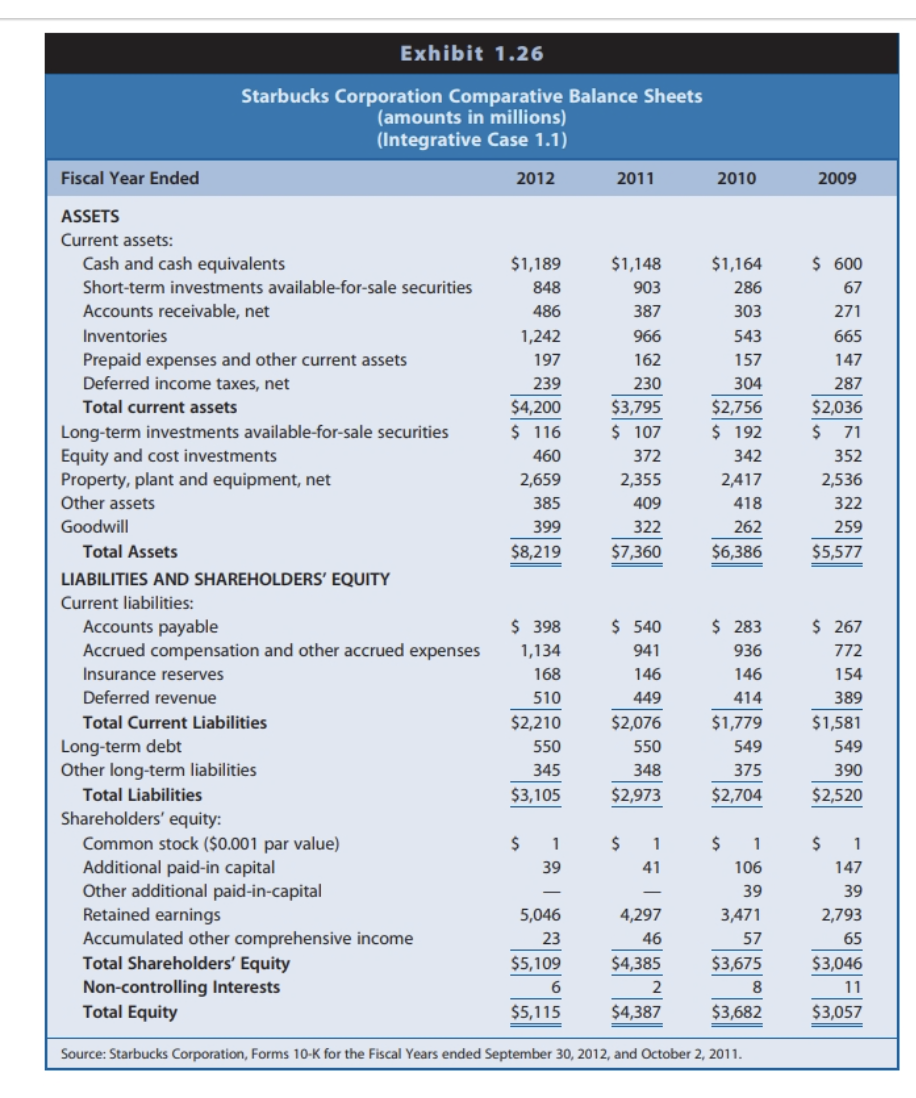

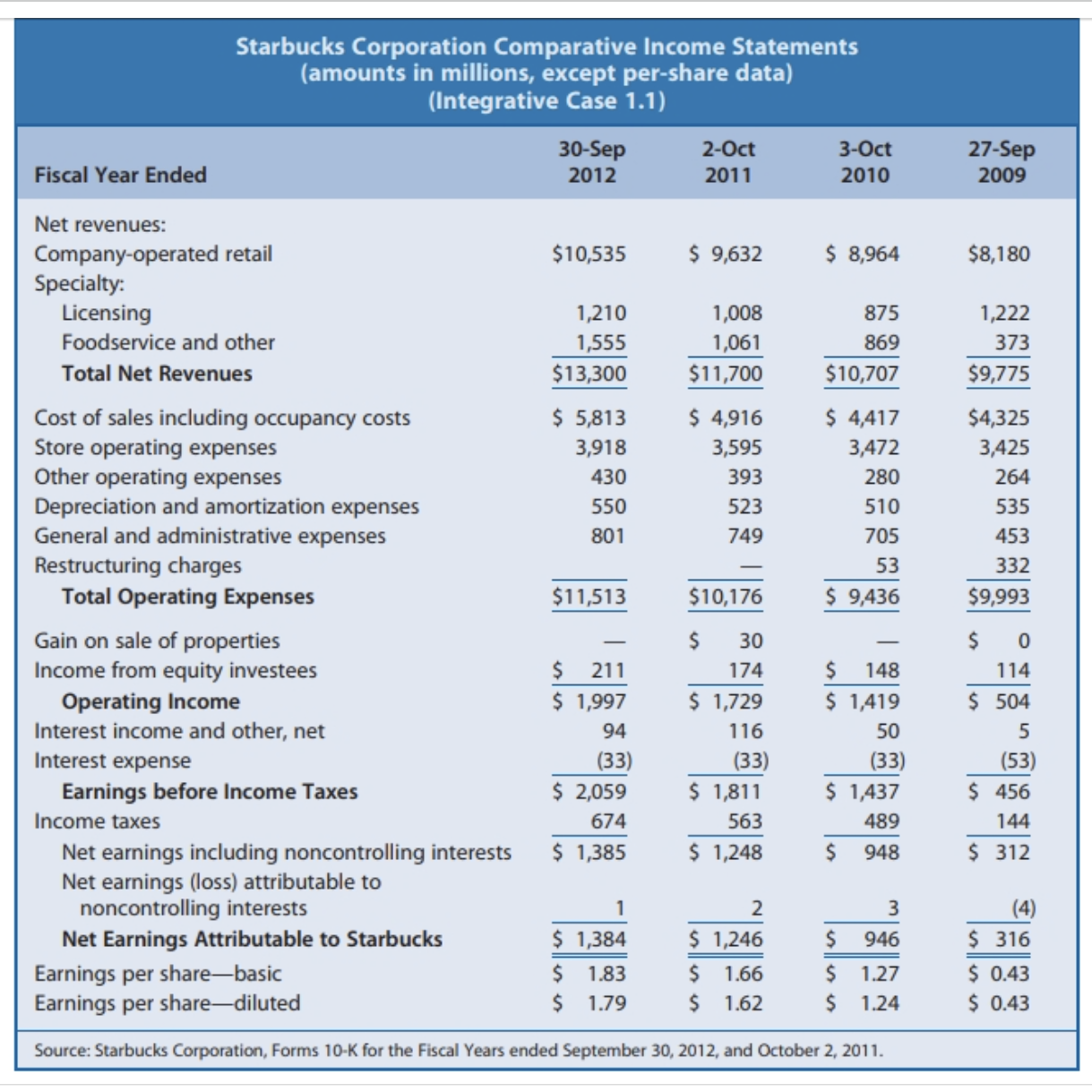

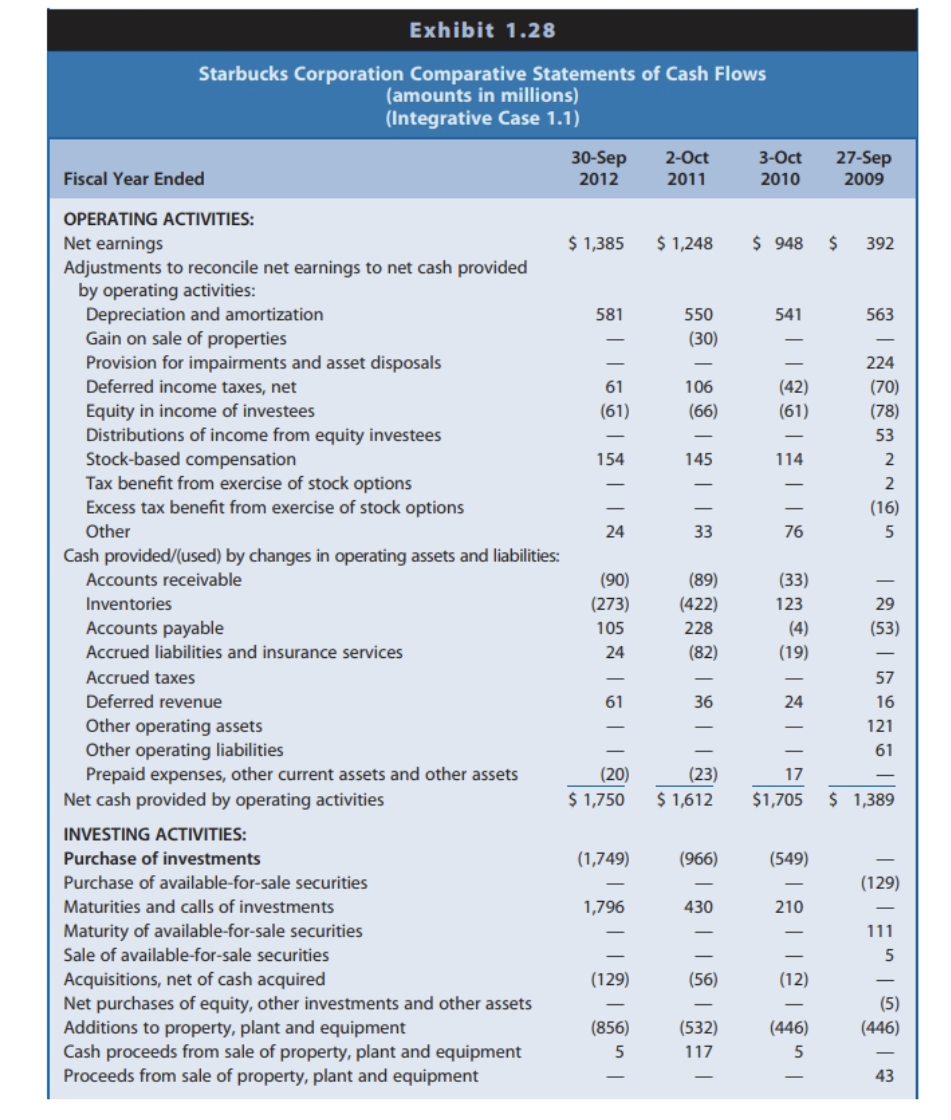

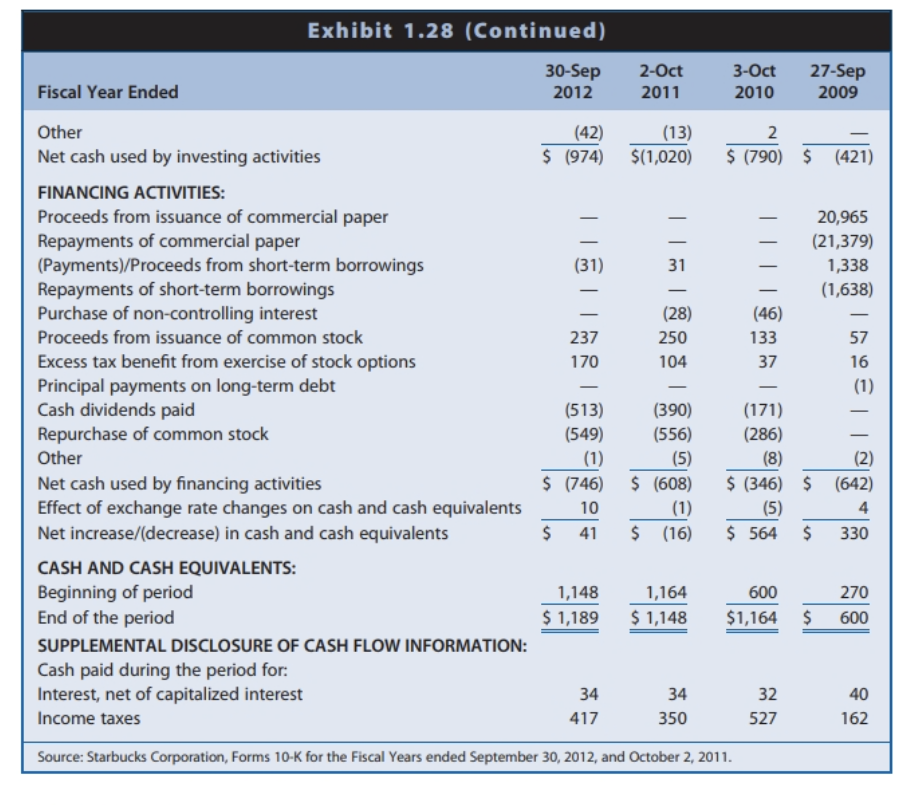

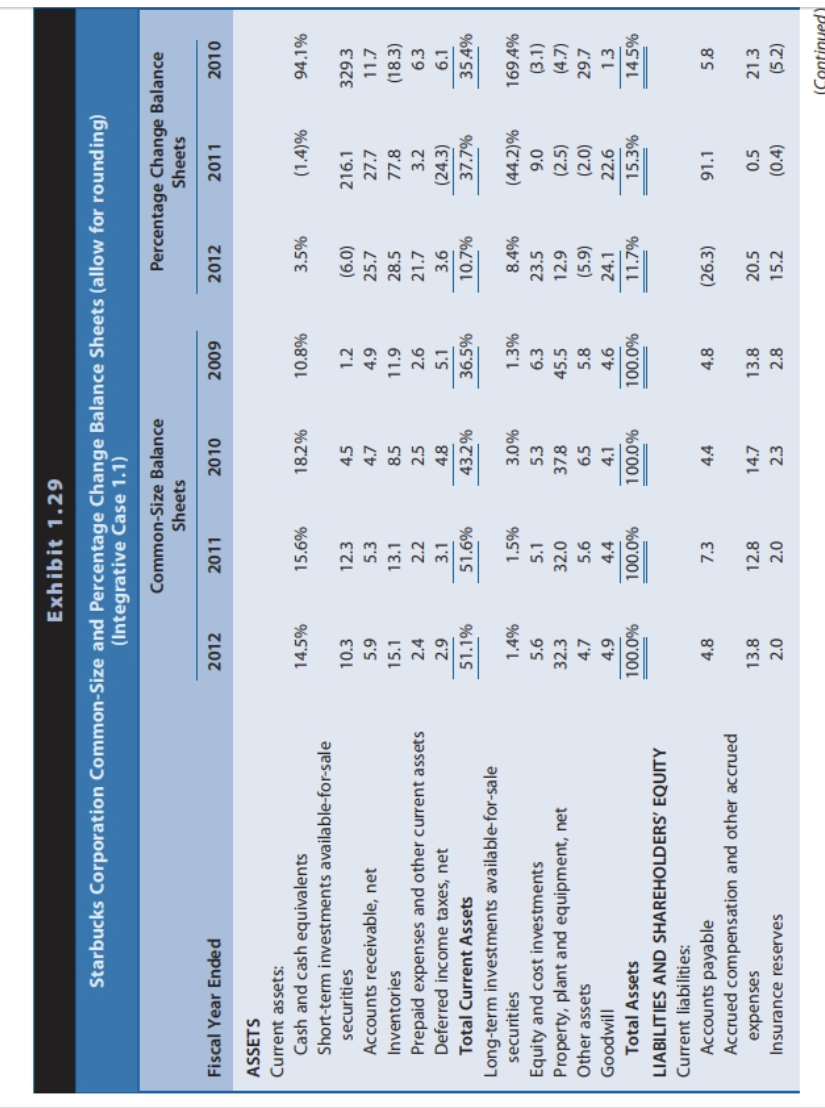

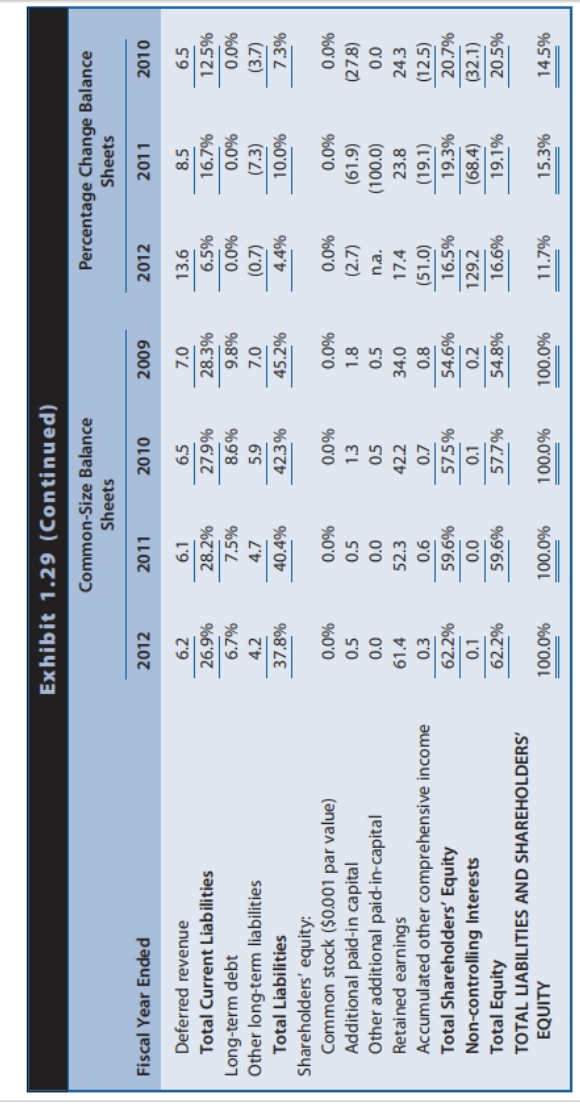

Exhibit 1.28 Starbucks Corporation Comparative Statements of Cash Flows (amounts in millions) (Integrative Case 1.1) Exhibit 1.29 Starbucks Corporation Common-Size and Percentage Change Balance Sheets (allow for rounding) (Integrative Case 1.1) Exhibit 2.18 Starbucks Income Tax Disclosures (amounts in millions) (Integrative Case 2.1)

Exhibit 1.28 Starbucks Corporation Comparative Statements of Cash Flows (amounts in millions) (Integrative Case 1.1) Exhibit 1.29 Starbucks Corporation Common-Size and Percentage Change Balance Sheets (allow for rounding) (Integrative Case 1.1) Exhibit 2.18 Starbucks Income Tax Disclosures (amounts in millions) (Integrative Case 2.1) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started