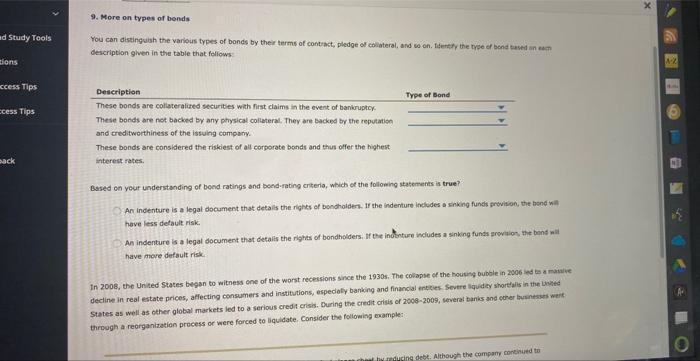

d Study Tools cions ccess Tips xcess Tips pack 9. More on types of bonds You can distinguish the various types of bonds by their terms of contract, pledge of collateral, and so on. Identify the type of bond based on each description given in the table that follows: Description These bonds are collateralized securities with first claims in the event of bankruptcy These bonds are not backed by any physical collateral. They are backed by the reputation and creditworthiness of the issuing company. These bonds are considered the riskiest of all corporate bonds and thus offer the highest interest rates. Type of Bond Based on your understanding of bond ratings and bond-rating criteria, which of the following statements is true? An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have less default risk. An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have more default risk. In 2008, the United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: cheat by reducing debt. Although the company continued to X AZ e S S P ty Tools Tips ips An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have less default risk. An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond wil have more default risk. In 2008, the United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: In December 2008, Hawaiian Telcom took action to strengthen its balance sheet by reducing debt. Although the company continued to operate, its creditors could not collect their debts or loan payments that were due prior to the legal action that the company took However, on November 30, 2009, the company had $75 million in cash on hand. This is an example of: Liquidation Reorganization Grade It Now Save & Continue Continue without saving