Answered step by step

Verified Expert Solution

Question

1 Approved Answer

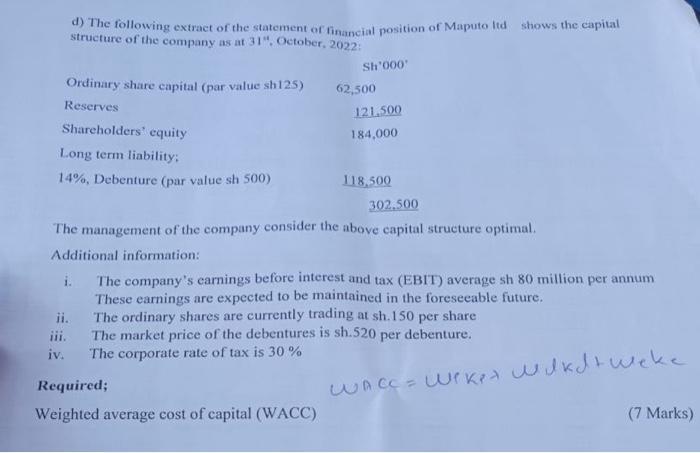

d) The following extract of the statement of financial position of Maputo Itd structure of the company as at 31, October, 2022: Ordinary share

d) The following extract of the statement of financial position of Maputo Itd structure of the company as at 31", October, 2022: Ordinary share capital (par value sh125) Reserves Shareholders' equity Long term liability; 14%, Debenture (par value sh 500) i. iv. Sh'000' Required; Weighted average cost of capital (WACC) 62,500 121,500 184,000 302.500 The management of the company consider the above capital structure optimal. Additional information: The company's earnings before interest and tax (EBIT) average sh 80 million per annum These earnings are expected to be maintained in the foreseeable future. The ordinary shares are currently trading at sh. 150 per share The market price of the debentures is sh.520 per debenture. The corporate rate of tax is 30% WACC = WIKet wirdt weke 118,500 shows the capital (7 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started