Question: D. Try to choose the correct answer, note that four wrong answers will cancel one correct answer i.e. each wrong answer will be penalized by

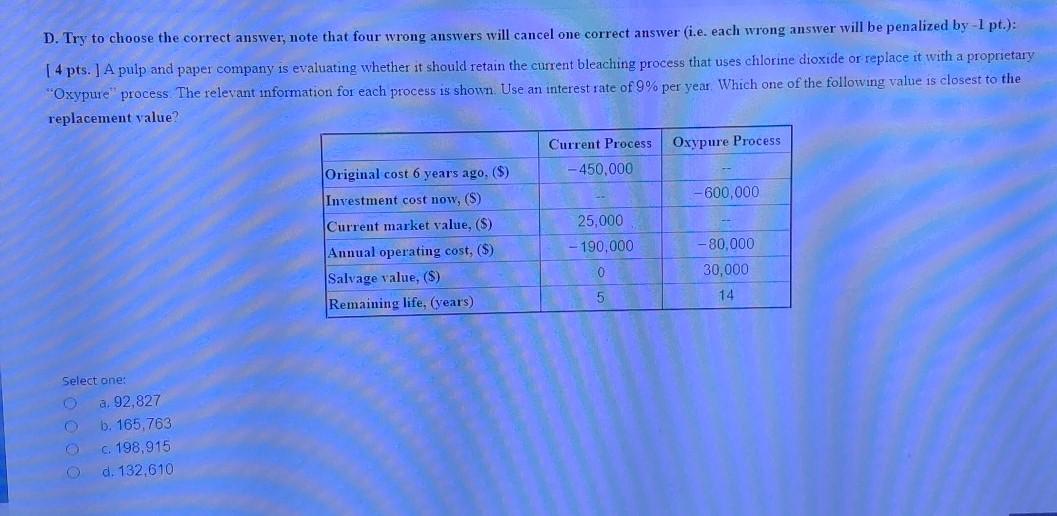

D. Try to choose the correct answer, note that four wrong answers will cancel one correct answer i.e. each wrong answer will be penalized by -1 pt.): [ 4 pts. ] A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprietary "Oxypure process. The relevant information for each process is shown Use an interest rate of 9% per year. Which one of the following value is closest to the replacement value Oxypure Process Current Process -450,000 - 600,000 Original cost 6 years ago. ($) Investment cost now, (S) Current market value, (S) Annual operating cost, ($) Salvage value, (S) Remaining life, (years) 25,000 - 190,000 o 5 -80,000 30,000 14 Select one: a. 92,827 b. 165,763 c. 198,915 d. 132.610 D. Try to choose the correct answer, note that four wrong answers will cancel one correct answer i.e. each wrong answer will be penalized by -1 pt.): [ 4 pts. ] A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprietary "Oxypure process. The relevant information for each process is shown Use an interest rate of 9% per year. Which one of the following value is closest to the replacement value Oxypure Process Current Process -450,000 - 600,000 Original cost 6 years ago. ($) Investment cost now, (S) Current market value, (S) Annual operating cost, ($) Salvage value, (S) Remaining life, (years) 25,000 - 190,000 o 5 -80,000 30,000 14 Select one: a. 92,827 b. 165,763 c. 198,915 d. 132.610

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts