Question: D. Try to choose the correct answer, note that four wrong answers will cancel one correct answer (i.e. each wrong answer will be penalized by

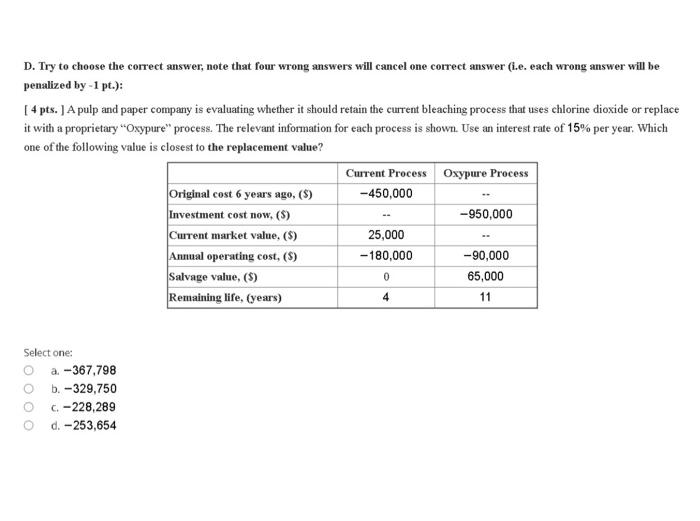

D. Try to choose the correct answer, note that four wrong answers will cancel one correct answer (i.e. each wrong answer will be penalized by - 1 pt.): [ 4 pts. J A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprietary Oxypure" process. The relevant information for each process is shown. Use an interest rate of 15% per year. Which one of the following value is closest to the replacement value? Current Process Oxypure Process Original cost 6 years ago, ($) -450,000 Investment cost now, (8) -950,000 Current market value, (S) 25,000 Annual operating cost, () -180,000 -90,000 Salvage value, () 65,000 Remaining life. (years) 4 11 0 Select one: a. -367,798 b.-329,750 -228,289 d. - 253,654 D. Try to choose the correct answer, note that four wrong answers will cancel one correct answer (i.e. each wrong answer will be penalized by - 1 pt.): [ 4 pts. J A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprietary Oxypure" process. The relevant information for each process is shown. Use an interest rate of 15% per year. Which one of the following value is closest to the replacement value? Current Process Oxypure Process Original cost 6 years ago, ($) -450,000 Investment cost now, (8) -950,000 Current market value, (S) 25,000 Annual operating cost, () -180,000 -90,000 Salvage value, () 65,000 Remaining life. (years) 4 11 0 Select one: a. -367,798 b.-329,750 -228,289 d. - 253,654

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts