Question

(d) Two identical firms engaging in identical projects differ in their level of debt. A has no debt and B has debt of $10,000

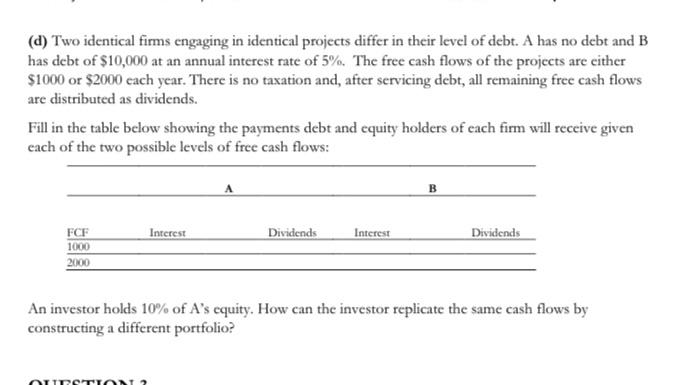

(d) Two identical firms engaging in identical projects differ in their level of debt. A has no debt and B has debt of $10,000 at an annual interest rate of 5%. The free cash flows of the projects are either $1000 or $2000 each year. There is no taxation and, after servicing debt, all remaining free cash flows are distributed as dividends. Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows: FCF 1000 2000 Interest QUESTION ? A Dividends Interest B Dividends An investor holds 10% of A's equity. How can the investor replicate the same cash flows by constructing a different portfolio?

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets first calculate the interest payment that firm B needs to make each year on its debt of 10000 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

8th Edition

1285190904, 978-1305176348, 1305176340, 978-1285190907

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App