Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d . Using the PRICE function on Excel, calculate the price of this bond to the nearest cent ( $ 0 . 0 1 )

d Using the PRICE function on Excel, calculate the price of this bond to the nearest cent

$

e What would the answer to a have been if the day count convention for this bond were

ActualAgain use the PRICE function on Excel. Calculate the price of this bond to the

nearest cent.

Problem

A certain bond's yieldtomaturity, quoted on a semiannual bond basis, is An analyst

has been asked to convert to a monthly periodicity. What is the yieldtomaturity quote in that

case?

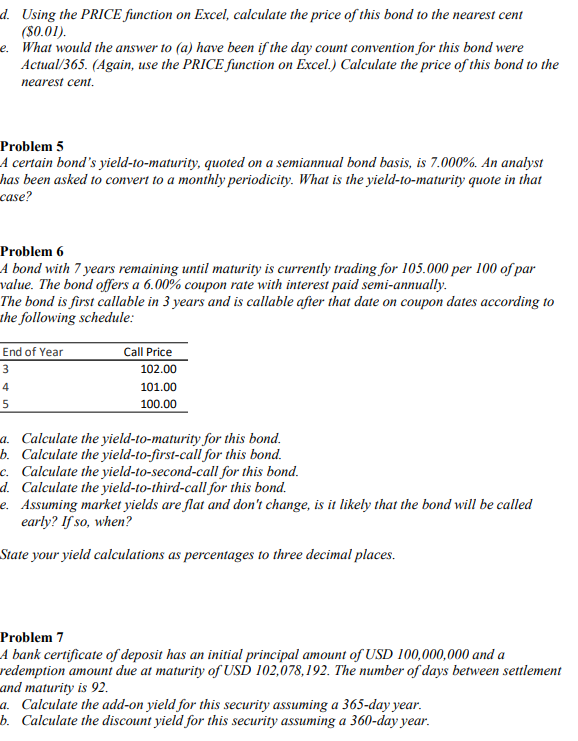

Problem

A bond with years remaining until maturity is currently trading for per of par

value. The bond offers a coupon rate with interest paid semiannually.

The bond is first callable in years and is callable after that date on coupon dates according to

the following schedule:

a Calculate the yieldtomaturity for this bond.

b Calculate the yieldtofirstcall for this bond.

c Calculate the yieldtosecondcall for this bond.

d Calculate the yieldtothirdcall for this bond.

e Assuming market yields are flat and don't change, is it likely that the bond will be called

early? If so when?

State your yield calculations as percentages to three decimal places.

Problem

A bank certificate of deposit has an initial principal amount of USD and a

redemption amount due at maturity of USD The number of days between settlement

and maturity is

a Calculate the addon yield for this security assuming a day year.

b Calculate the discount yield for this security assuming a day year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started