Question

d) What are the expected value, variance and standard deviation of your profit? Expected return Variance Standard Deviation e)Compare your answers to (b) and (d).

d) What are the expected value, variance and standard deviation of your profit?

d) What are the expected value, variance and standard deviation of your profit?

Expected return Variance Standard Deviation

e)Compare your answers to (b) and (d). Did risk pooling increase or decrease the variance of your profit?

Risk Pooling ______________ the total variance of profit

f) Continue to assume the company has issued two policies, but now assume you take on a partner, so that you each own one-half of the firm. Make a table of your share of the possible payouts the company may have to make on the two policies, along with their associated probabilities. (Round your "Probability" answers to 4 decimal places.) Outcome no fire outcome 1 fire outcome two fires

Payouts

Probability

g)What are the expected value and variance of your profit?

Expected return, Variance, Standard Deviation

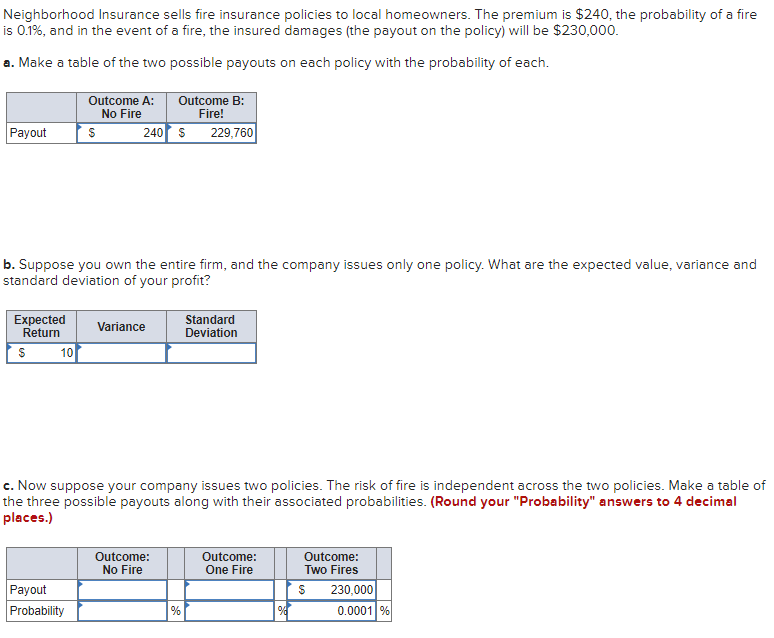

Neighborhood Insurance sells fire insurance policies to local homeowners. The premium is $240, the probability of a fire is 0.1%, and in the event of a fire, the insured damages (the payout on the policy) will be $230,000. a. Make a table of the two possible payouts on each policy with the probability of each. Outcome A: Outcome B: No Fire Fire! $ 240 s 229,760 Payout b. Suppose you own the entire firm, and the company issues only one policy. What are the expected value, variance and standard deviation of your profit? Variance Expected Return $ 10 Standard Deviation c. Now suppose your company issues two policies. The risk of fire is independent across the two policies. Make a table of the three possible payouts along with their associated probabilities. (Round your "Probability" answers to 4 decimal places.) Outcome: No Fire Outcome: One Fire Outcome: Two Fires S 230,000 0.0001% Payout Probability % Neighborhood Insurance sells fire insurance policies to local homeowners. The premium is $240, the probability of a fire is 0.1%, and in the event of a fire, the insured damages (the payout on the policy) will be $230,000. a. Make a table of the two possible payouts on each policy with the probability of each. Outcome A: Outcome B: No Fire Fire! $ 240 s 229,760 Payout b. Suppose you own the entire firm, and the company issues only one policy. What are the expected value, variance and standard deviation of your profit? Variance Expected Return $ 10 Standard Deviation c. Now suppose your company issues two policies. The risk of fire is independent across the two policies. Make a table of the three possible payouts along with their associated probabilities. (Round your "Probability" answers to 4 decimal places.) Outcome: No Fire Outcome: One Fire Outcome: Two Fires S 230,000 0.0001% Payout Probability %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started