Question

D. What are the lower and upper breakeven stock prices for a long straddle with a strike price of 30.00? (a long straddle is one

D. What are the lower and upper breakeven stock prices for a long straddle with a strike price of 30.00? (a long straddle is one long call and one long put)

E. What is the maximum profit for a short straddle (one short call and one short put) with a strike price of 32.00, and what would the ending stock price need to be to realize that maximum profit?

F. A butterfly spread is constructed using one long 28.00strike call, two short 30.00 strike calls, and one long 32.00 strike call. 1. construct a payoff diagram 2. What is the total cost of the combination? 3. what is the profit if the stock price in one quarter is 31.00? 4. What is the maximum profit and what would the ending stock price need to be to realize that profit?

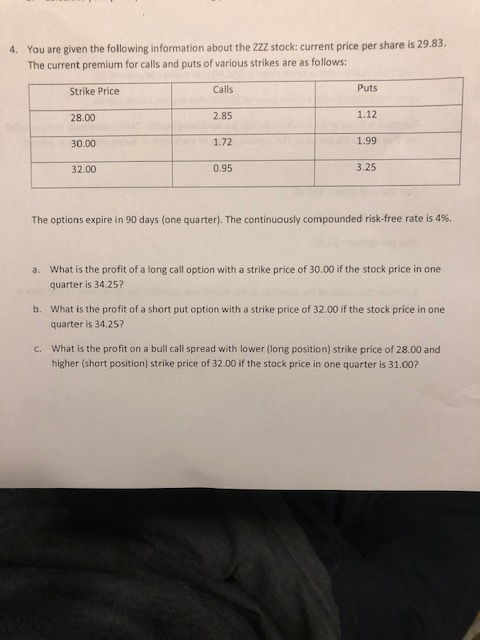

You are given the following information about the ZZZ stock: current price per share is 29.83 The current premium for calls and puts of various strikes are as follows 4. Strike Price 28.00 30.00 32.00 Calls 2.85 1.72 0.95 Puts 1.12 1.99 3.25 The options expire in 90 days (one quarter). The continuously compounded risk-free rate is 4%. What is the profit of a long call option with a strike price of 30.00 if the stock price in one quarter is 34.25? a. b. What is the profit of a short put option with a strike price of 32.00 if the stock price in one quarter is 34.25? What is the profit on a bull call spread with lower (long position) strike price of 28.00 and higher (short position) strike price of 32.00 if the stock price in one quarter is 31.00? c. You are given the following information about the ZZZ stock: current price per share is 29.83 The current premium for calls and puts of various strikes are as follows 4. Strike Price 28.00 30.00 32.00 Calls 2.85 1.72 0.95 Puts 1.12 1.99 3.25 The options expire in 90 days (one quarter). The continuously compounded risk-free rate is 4%. What is the profit of a long call option with a strike price of 30.00 if the stock price in one quarter is 34.25? a. b. What is the profit of a short put option with a strike price of 32.00 if the stock price in one quarter is 34.25? What is the profit on a bull call spread with lower (long position) strike price of 28.00 and higher (short position) strike price of 32.00 if the stock price in one quarter is 31.00? cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started