Answered step by step

Verified Expert Solution

Question

1 Approved Answer

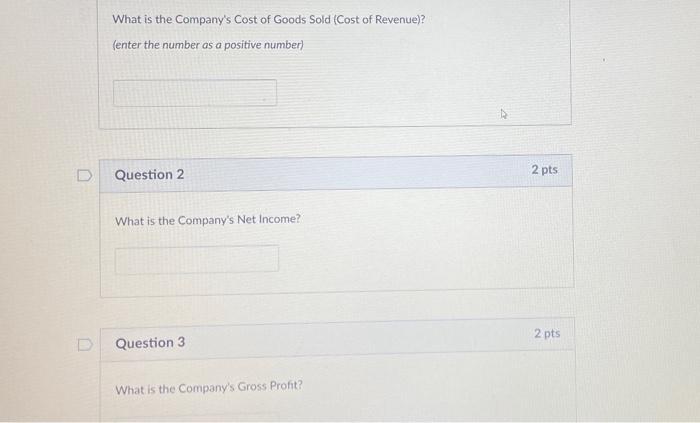

D What is the Company's Cost of Goods Sold (Cost of Revenue)? (enter the number as a positive number) Question 2 What is the

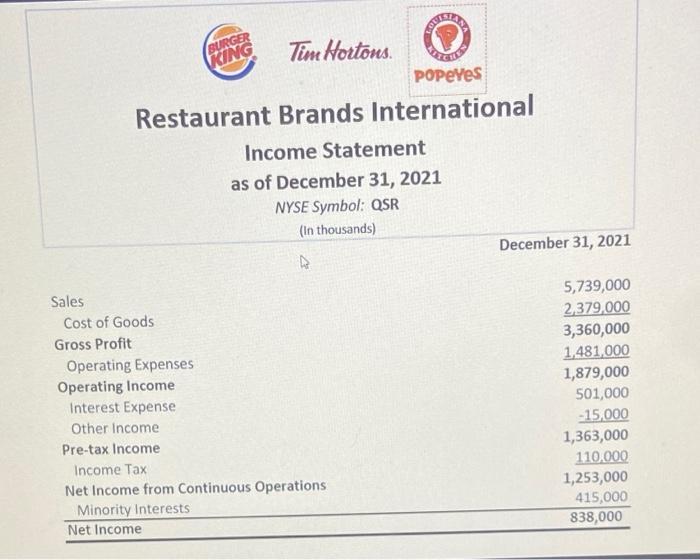

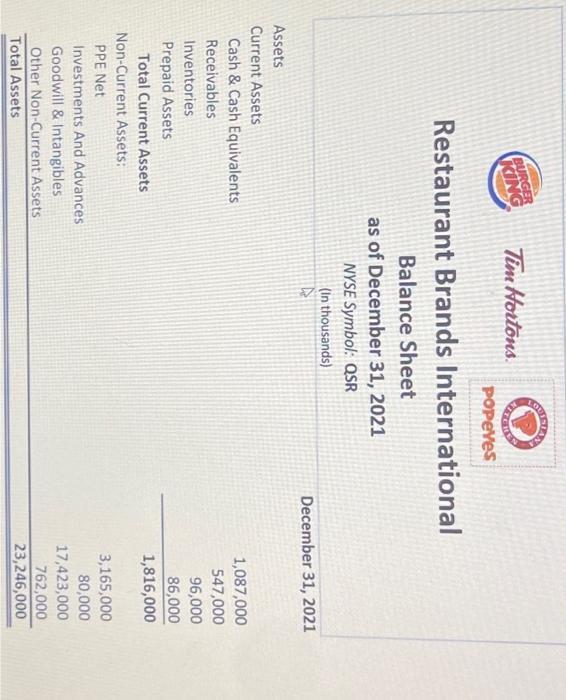

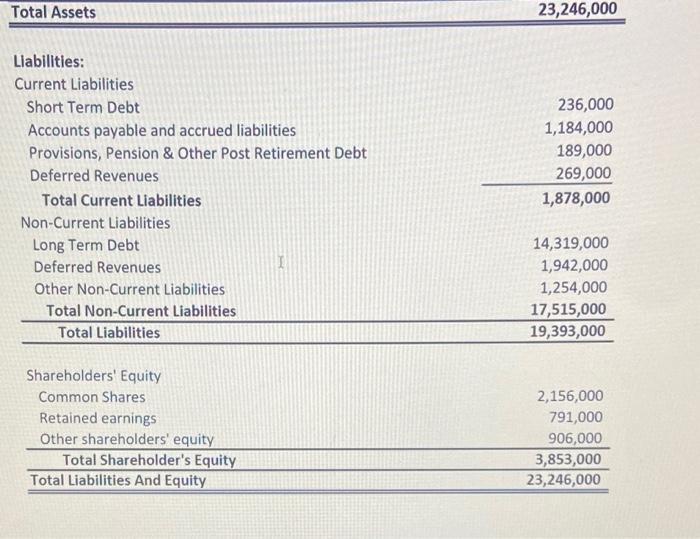

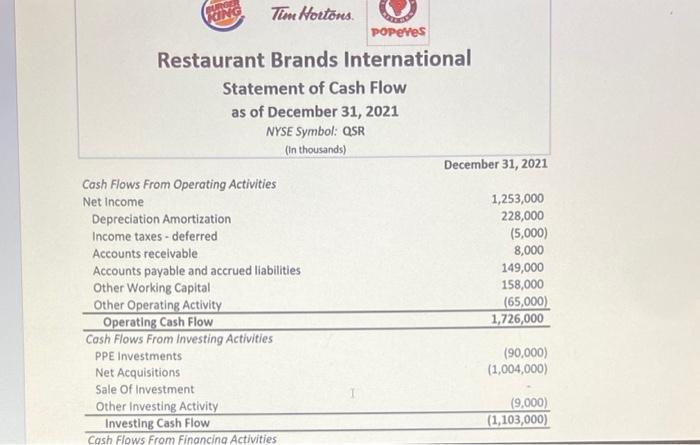

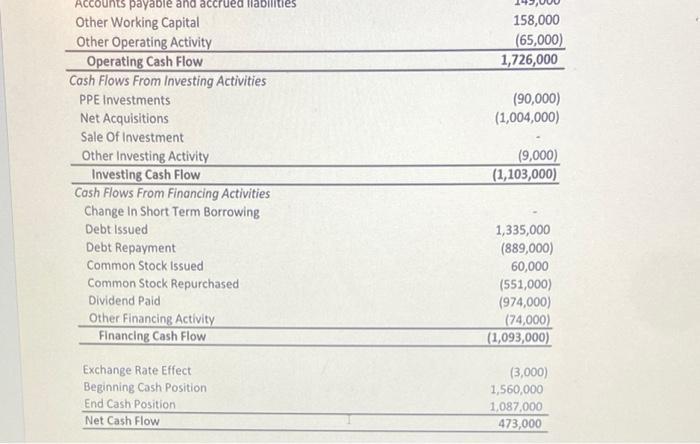

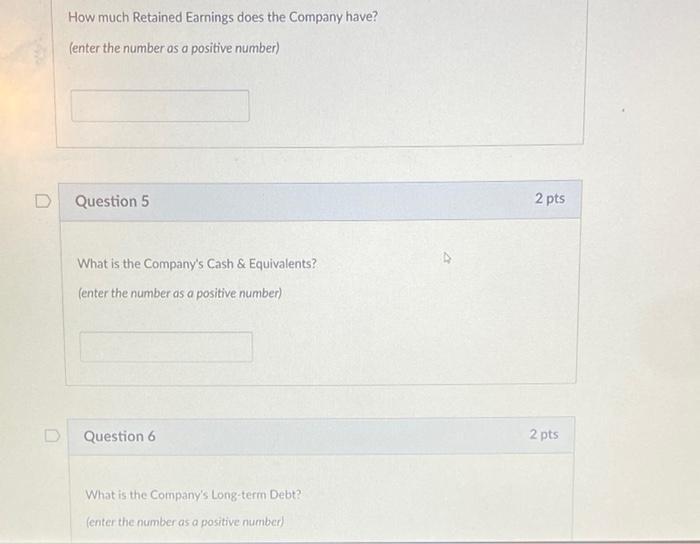

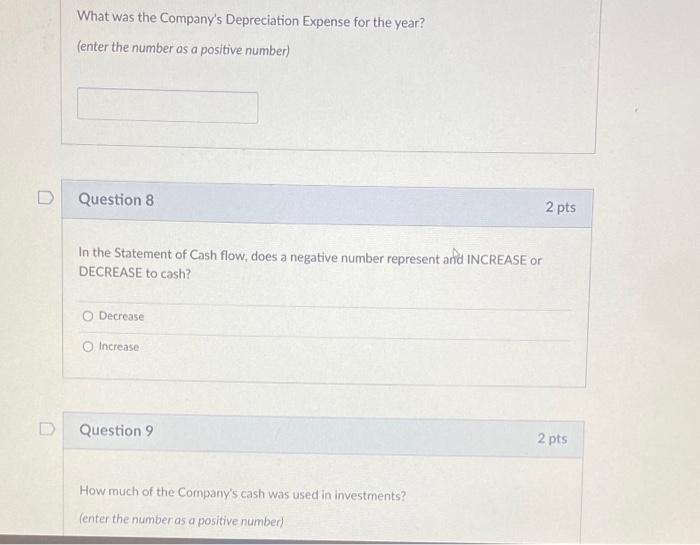

D What is the Company's Cost of Goods Sold (Cost of Revenue)? (enter the number as a positive number) Question 2 What is the Company's Net Income? Question 3 What is the Company's Gross Profit? 2 pts 2 pts Sales Cost of Goods Gross Profit POPeves Restaurant Brands International Operating Expenses Operating Income Interest Expense BURGER KING Other Income Pre-tax Income Income Tax Tim Hortons Income Statement as of December 31, 2021 NYSE Symbol: QSR (In thousands) A Net Income from Continuous Operations Minority Interests Net Income December 31, 2021 5,739,000 2,379,000 3,360,000 1,481,000 1,879,000 501,000 -15,000 1,363,000 110,000 1,253,000 415,000 838,000 BURGER KING Popeyes Restaurant Brands International Balance Sheet as of December 31, 2021 NYSE Symbol: QSR (In thousands) Assets Current Assets Cash & Cash Equivalents Receivables Inventories Prepaid Assets Total Current Assets Non-Current Assets: Tim Hortons PPE Net Investments And Advances Goodwill & Intangibles Other Non-Current Assets Total Assets December 31, 2021 1,087,000 547,000 96,000 86,000 1,816,000 3,165,000 80,000 17,423,000 762,000 23,246,000 Total Assets Liabilities: Current Liabilities Short Term Debt Accounts payable and accrued liabilities Provisions, Pension & Other Post Retirement Debt Deferred Revenues Total Current Liabilities Non-Current Liabilities Long Term Debt Deferred Revenues Other Non-Current Liabilities Total Non-Current Liabilities Total Liabilities Shareholders' Equity Common Shares Retained earnings Other shareholders' equity Total Shareholder's Equity Total Liabilities And Equity 23,246,000 236,000 1,184,000 189,000 269,000 1,878,000 14,319,000 1,942,000 1,254,000 17,515,000 19,393,000 2,156,000 791,000 906,000 3,853,000 23,246,000 BURGE KING Tim Hortons POPEYES Restaurant Brands International PPE Investments Net Acquisitions Sale Of Investment Statement of Cash Flow as of December 31, 2021 NYSE Symbol: QSR (in thousands) Cash Flows From Operating Activities Net Income Depreciation Amortization Income taxes - deferred Accounts receivable Accounts payable and accrued liabilities Other Working Capital Other Operating Activity Operating Cash Flow Cash Flows From Investing Activities Other Investing Activity Investing Cash Flow Cash Flows From Financing Activities December 31, 2021 1,253,000 228,000 (5,000) 8,000 149,000 158,000 (65,000) 1,726,000 (90,000) (1,004,000) (9,000) (1,103,000) Accounts payable and accrued liabilities Other Working Capital Other Operating Activity Operating Cash Flow Cash Flows From Investing Activities PPE Investments Net Acquisitions Sale Of Investment Other Investing Activity Investing Cash Flow Cash Flows From Financing Activities Change In Short Term Borrowing Debt Issued Debt Repayment Common Stock Issued Common Stock Repurchased Dividend Paid Other Financing Activity Financing Cash Flow Exchange Rate Effect Beginning Cash Position End Cash Position Net Cash Flow 158,000 (65,000) 1,726,000 (90,000) (1,004,000) (9,000) (1,103,000) 1,335,000 (889,000) 60,000 (551,000) (974,000) (74,000) (1,093,000) (3,000) 1,560,000 1,087,000 473,000 D How much Retained Earnings does the Company have? (enter the number as a positive number) Question 5 What is the Company's Cash & Equivalents? (enter the number as a positive number) Question 6 What is the Company's Long-term Debt? (enter the number as a positive number) 2 pts 2 pts D What was the Company's Depreciation Expense for the year? (enter the number as a positive number) Question 8 In the Statement of Cash flow, does a negative number represent and INCREASE or DECREASE to cash? Decrease Increase Question 9 How much of the Company's cash was used in investments? (enter the number as a positive number) 2 pts 2 pts

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2 3 4 251 Description What is the companys Center the number Q...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started