Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2, Year 9, Investor Co. purchased 30% of Investee, Inc.'s outstanding common shares for $400,000, which is equal to the Investor's share

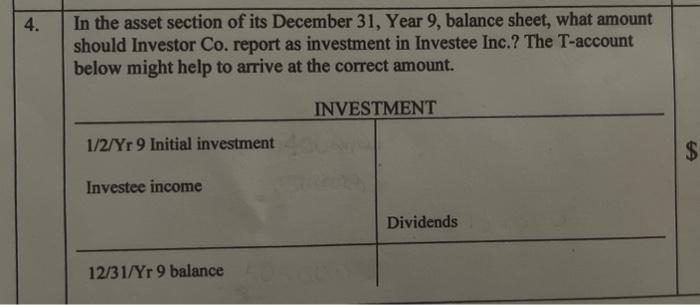

On January 2, Year 9, Investor Co. purchased 30% of Investee, Inc.'s outstanding common shares for $400,000, which is equal to the Investor's share of the fair value of the Investee net assets. Investor Co. acquired significant influence as a result of this transaction and accounts for the investment under the equity method because Investor Co. does not elect the fair value option to report its investment in Investee Inc. For Year 9 Investee Inc. reported total net income of $500,000 and paid total dividends of $150,000. Please answer the questions below. Show supporting calculations below each question. 4. In the asset section of its December 31, Year 9, balance sheet, what amount should Investor Co. report as investment in Investee Inc.? The T-account below might help to arrive at the correct amount. INVESTMENT 1/2/Yr 9 Initial investment Investee income 12/31/Yr 9 balance Dividends $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

4 12Yr 9 Initial Investment Investee Income 500000 x 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started