Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d: yes or no h: change in capital structure, that is, use less debt or increase its capital budget or increase dividends or declare a

d: yes or no

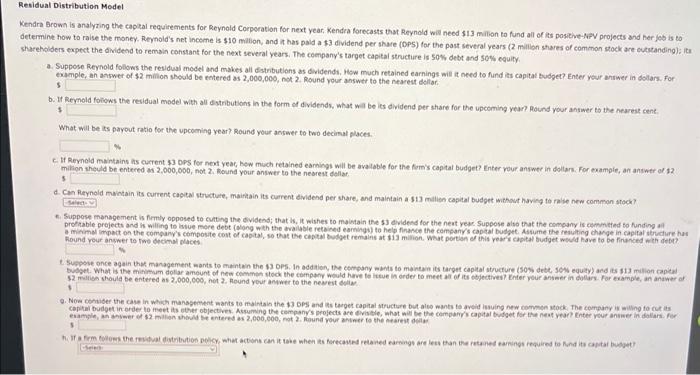

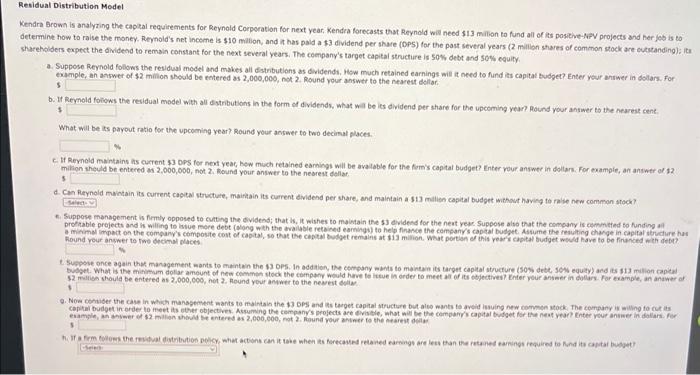

Cendra Brown is analyzing the captal requirements for Reynold Corporation for next year: Kendra forecasts that Reynold will need $13 milion to fund all of iss poseive-kpV projects and her jab is to letermine how to raise the money. Reynold's net income is $10 malion, and it has paid a $3 dividend per share (DPS) for the post several years (2 millon stares of common stock are cutatanding); its thareholders expect the dividend to remain cohssant for the next several years. The coenpany's target capital structure is sow debt and sow equily. a. Suppose Reynold follows the redidual model and makes all dstributions as dividendi. How much retained earnings will it need to fund its capital budget? Enter yeur annwer in dolars. For examolec an answer of $2 minion should be entered as 2,000,000, not 2 . Round your answer to the nearest deltar b. If Revnold foisows the residual model with ail ditributions in the form of dividends, what wat be its dividend per share for the upcoming year? pound your answer ts the neares cene. 3 What wall be its payout ratio for the upcoming year? Round your answer to two decinal places. C. If Reynold mantains is current $3 ops for neat yeac, bew much retained eamingi will be avalable for the fom's captat budget? Enter vour answer in dollars. For example, an antwer of 92 . mikion theuld be entered as 2,000,000, not 2 , tound your answer to the nearest dollar. 13 d. Can Revnold maintain its current cagidi structure, mairhain its current dividend per share, and maintain a 313 mallien caplal budget without having to ralse new common arod? 6. Suppose management is firmly opposed to eutting the dividens; that ik, it wishes to maistain the s3 divdend for the neat yea suppose also that the comgany is espmetid to funding aif. 2. Sugpose once again the management wants to manten the 63DP5. In addaion, the company mants to maintan its target capital atructure (sos dete sest equty) and its 313 malion caped Cendra Brown is analyzing the captal requirements for Reynold Corporation for next year: Kendra forecasts that Reynold will need $13 milion to fund all of iss poseive-kpV projects and her jab is to letermine how to raise the money. Reynold's net income is $10 malion, and it has paid a $3 dividend per share (DPS) for the post several years (2 millon stares of common stock are cutatanding); its thareholders expect the dividend to remain cohssant for the next several years. The coenpany's target capital structure is sow debt and sow equily. a. Suppose Reynold follows the redidual model and makes all dstributions as dividendi. How much retained earnings will it need to fund its capital budget? Enter yeur annwer in dolars. For examolec an answer of $2 minion should be entered as 2,000,000, not 2 . Round your answer to the nearest deltar b. If Revnold foisows the residual model with ail ditributions in the form of dividends, what wat be its dividend per share for the upcoming year? pound your answer ts the neares cene. 3 What wall be its payout ratio for the upcoming year? Round your answer to two decinal places. C. If Reynold mantains is current $3 ops for neat yeac, bew much retained eamingi will be avalable for the fom's captat budget? Enter vour answer in dollars. For example, an antwer of 92 . mikion theuld be entered as 2,000,000, not 2 , tound your answer to the nearest dollar. 13 d. Can Revnold maintain its current cagidi structure, mairhain its current dividend per share, and maintain a 313 mallien caplal budget without having to ralse new common arod? 6. Suppose management is firmly opposed to eutting the dividens; that ik, it wishes to maistain the s3 divdend for the neat yea suppose also that the comgany is espmetid to funding aif. 2. Sugpose once again the management wants to manten the 63DP5. In addaion, the company mants to maintan its target capital atructure (sos dete sest equty) and its 313 malion caped h: change in capital structure, that is, use less debt

or increase its capital budget

or increase dividends

or declare a stock dividend

or issue new common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started