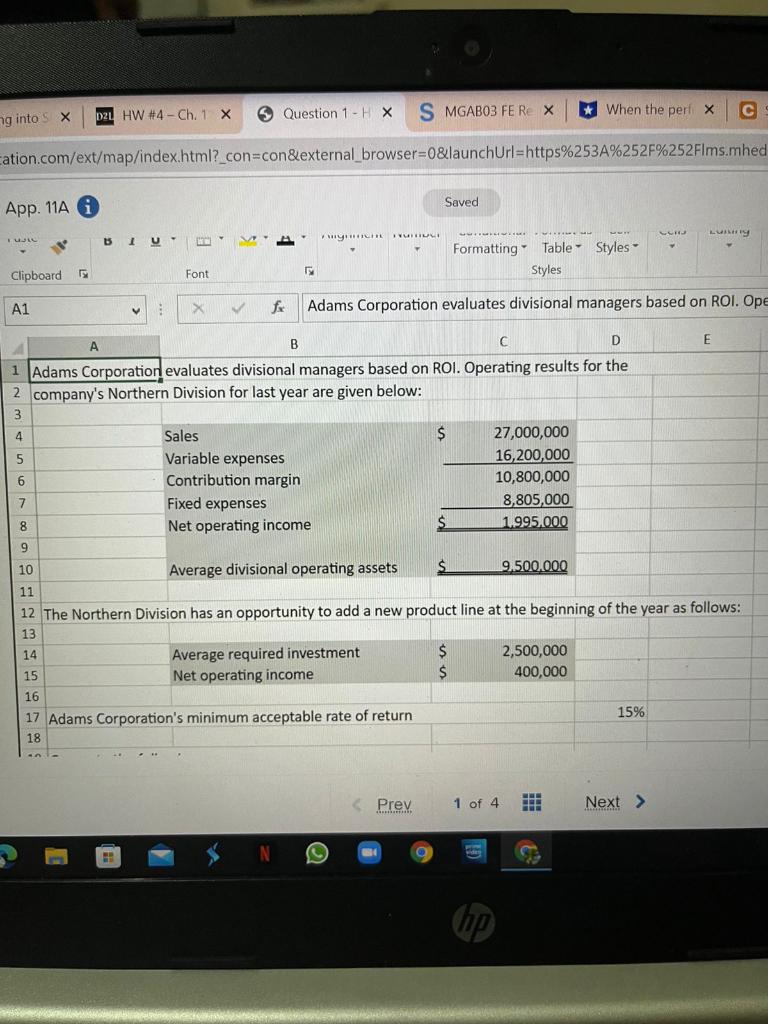

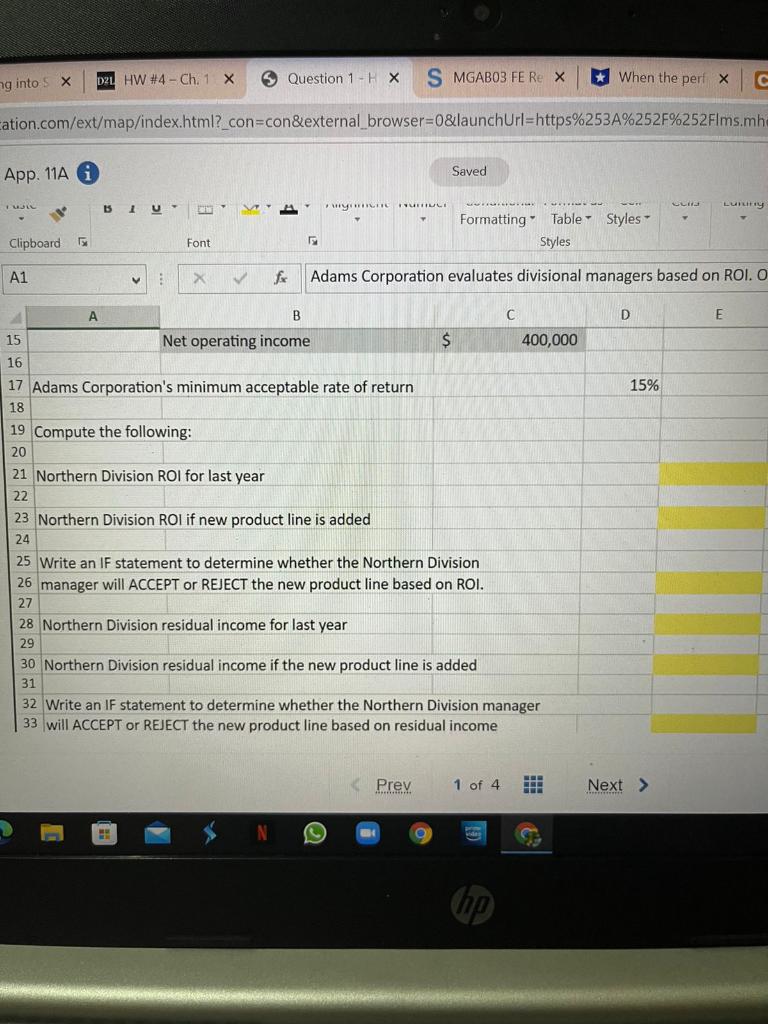

D2 HW #4 - Ch.1 X Question 1 - H X S MGABO3 FE Re X * When the per x ng into S x cation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mhed Saved App. 11A A VURUL ULL LUARY Hy!!! B5 1 U Formatting Table Styles - Styles Clipboard 1 Font A1 X for Adams Corporation evaluates divisional managers based on ROI. Ope D E B 1 Adams Corporation evaluates divisional managers based on ROI. Operating results for the 2 company's Northern Division for last year are given below: 3 4 $ 5 6 Sales Variable expenses Contribution margin Fixed expenses Net operating income 27,000,000 16,200,000 10,800,000 8,805,000 1.995.000 7 8 $ 9 10 Average divisional operating assets $ 9.500.000 11 12 The Northern Division has an opportunity to add a new product line at the beginning of the year as follows: 13 14 $ $ 2,500,000 400,000 Average required investment 15 Net operating income 16 17 Adams Corporation's minimum acceptable rate of return 18 15% D2L HW #4 - Ch.1 X ng into SX 5 Question 1-H X S MGABO3 FE Re x * When the perf X cation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mh App. 11A Saved FULL MY ULI HUULI 1 LUI Formatting Table Styles - Styles Clipboard Font A1 X Adams Corporation evaluates divisional managers based on ROI. O B C D E 15 Net operating income $ 400,000 16 15% 17 Adams Corporation's minimum acceptable rate of return 18 19 Compute the following: 20 21 Northern Division ROI for last year 22 23 Northern Division ROI if new product line is added 24 25 Write an IF statement to determine whether the Northern Division 26 manager will ACCEPT or REJECT the new product line based on ROI. 27 28 Northern Division residual income for last year 29 30 Northern Division residual income if the new product line is added 31 32 Write an IF statement to determine whether the Northern Division manager 33 will ACCEPT or REJECT the new product line based on residual income Prey 1 of 4 te Next > D2 HW #4 - Ch.1 X Question 1 - H X S MGABO3 FE Re X * When the per x ng into S x cation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mhed Saved App. 11A A VURUL ULL LUARY Hy!!! B5 1 U Formatting Table Styles - Styles Clipboard 1 Font A1 X for Adams Corporation evaluates divisional managers based on ROI. Ope D E B 1 Adams Corporation evaluates divisional managers based on ROI. Operating results for the 2 company's Northern Division for last year are given below: 3 4 $ 5 6 Sales Variable expenses Contribution margin Fixed expenses Net operating income 27,000,000 16,200,000 10,800,000 8,805,000 1.995.000 7 8 $ 9 10 Average divisional operating assets $ 9.500.000 11 12 The Northern Division has an opportunity to add a new product line at the beginning of the year as follows: 13 14 $ $ 2,500,000 400,000 Average required investment 15 Net operating income 16 17 Adams Corporation's minimum acceptable rate of return 18 15% D2L HW #4 - Ch.1 X ng into SX 5 Question 1-H X S MGABO3 FE Re x * When the perf X cation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mh App. 11A Saved FULL MY ULI HUULI 1 LUI Formatting Table Styles - Styles Clipboard Font A1 X Adams Corporation evaluates divisional managers based on ROI. O B C D E 15 Net operating income $ 400,000 16 15% 17 Adams Corporation's minimum acceptable rate of return 18 19 Compute the following: 20 21 Northern Division ROI for last year 22 23 Northern Division ROI if new product line is added 24 25 Write an IF statement to determine whether the Northern Division 26 manager will ACCEPT or REJECT the new product line based on ROI. 27 28 Northern Division residual income for last year 29 30 Northern Division residual income if the new product line is added 31 32 Write an IF statement to determine whether the Northern Division manager 33 will ACCEPT or REJECT the new product line based on residual income Prey 1 of 4 te Next >