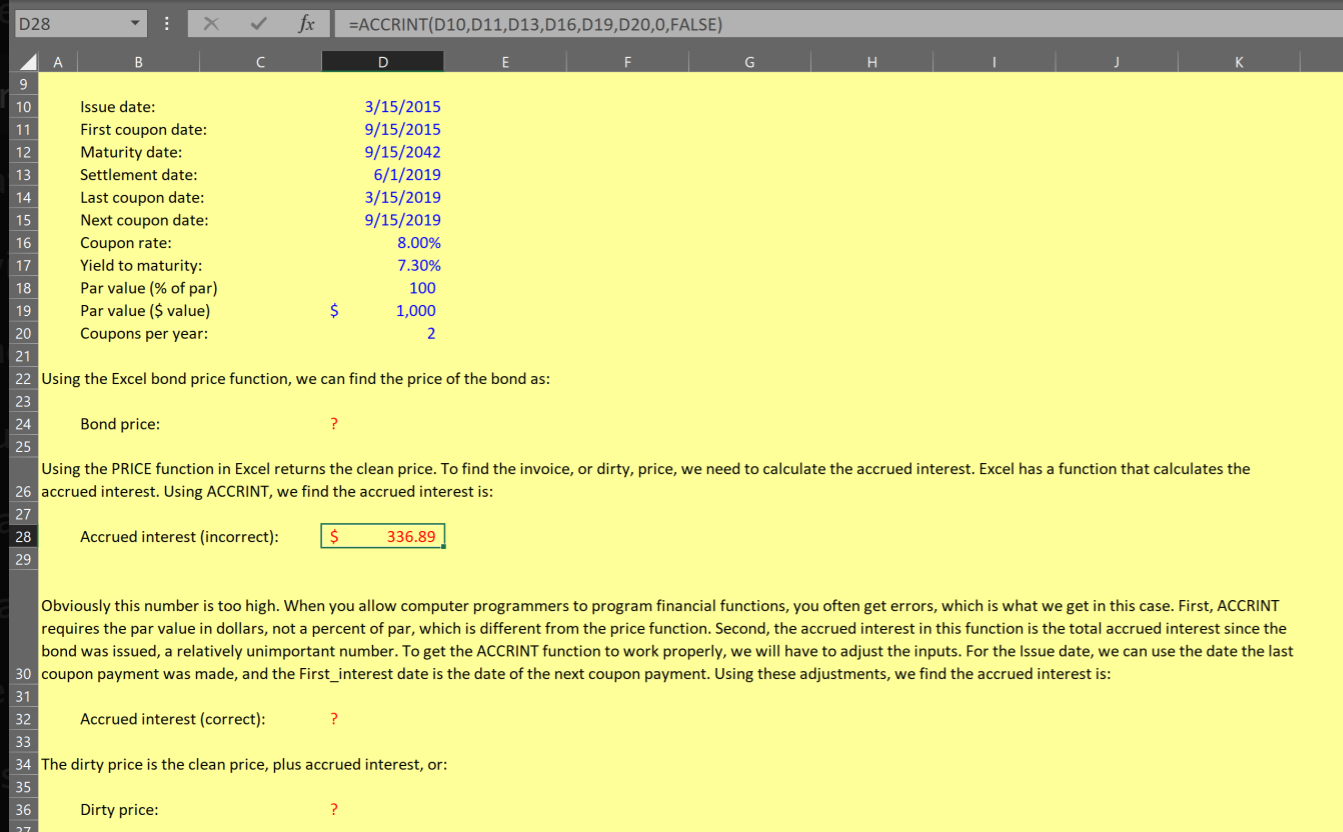

D28 fx =ACCRINT(D10,011,D13,D16,D19,020,0,FALSE) B C D E F G H 9 10 Issue date: 3/15/2015 11 First coupon date: 9/15/2015 12 Maturity date: 9/15/2042 13 Settlement date: 6/1/2019 14 Last coupon date: 3/15/2019 15 Next coupon date: 9/15/2019 16 Coupon rate: 8.00% 17 Yield to maturity: 7.30% 18 Par value % of par) 100 19 Par value ($ value) $ 1,000 20 Coupons per year: 2 21 22 Using the Excel bond price function, we can find the price of the bond as: 23 24 Bond price: ? 25 Using the PRICE function in Excel returns the clean price. To find the invoice, or dirty, price, we need to calculate the accrued interest. Excel has a function that calculates the 26 accrued interest. Using ACCRINT, we find the accrued interest is: 27 28 Accrued interest (incorrect): $ 336.89 29 Obviously this number is too high. When you allow computer programmers to program financial functions, you often get errors, which is what we get in this case. First, ACCRINT requires the par value in dollars, not a percent of par, which is different from the price function. Second, the accrued interest in this function is the total accrued interest since the bond was issued, a relatively unimportant number. To get the ACCRINT function to work properly, we will have to adjust the inputs. For the Issue date, we can use the date the last 30 coupon payment was made, and the First_interest date is the date of the next coupon payment. Using these adjustments, we find the accrued interest is: 31 32 Accrued interest (correct): ? 33 34 The dirty price is the clean price, plus accrued interest, or: 35 36 Dirty price: ? D28 fx =ACCRINT(D10,011,D13,D16,D19,020,0,FALSE) B C D E F G H 9 10 Issue date: 3/15/2015 11 First coupon date: 9/15/2015 12 Maturity date: 9/15/2042 13 Settlement date: 6/1/2019 14 Last coupon date: 3/15/2019 15 Next coupon date: 9/15/2019 16 Coupon rate: 8.00% 17 Yield to maturity: 7.30% 18 Par value % of par) 100 19 Par value ($ value) $ 1,000 20 Coupons per year: 2 21 22 Using the Excel bond price function, we can find the price of the bond as: 23 24 Bond price: ? 25 Using the PRICE function in Excel returns the clean price. To find the invoice, or dirty, price, we need to calculate the accrued interest. Excel has a function that calculates the 26 accrued interest. Using ACCRINT, we find the accrued interest is: 27 28 Accrued interest (incorrect): $ 336.89 29 Obviously this number is too high. When you allow computer programmers to program financial functions, you often get errors, which is what we get in this case. First, ACCRINT requires the par value in dollars, not a percent of par, which is different from the price function. Second, the accrued interest in this function is the total accrued interest since the bond was issued, a relatively unimportant number. To get the ACCRINT function to work properly, we will have to adjust the inputs. For the Issue date, we can use the date the last 30 coupon payment was made, and the First_interest date is the date of the next coupon payment. Using these adjustments, we find the accrued interest is: 31 32 Accrued interest (correct): ? 33 34 The dirty price is the clean price, plus accrued interest, or: 35 36 Dirty price