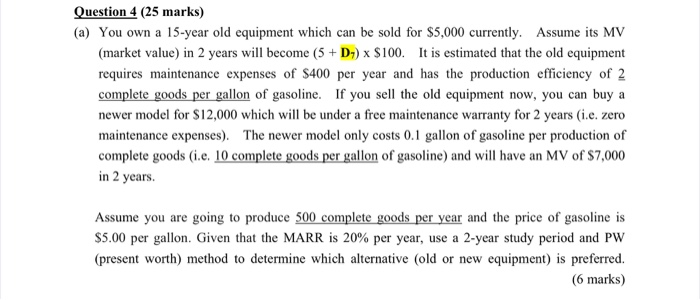

D7 = 8

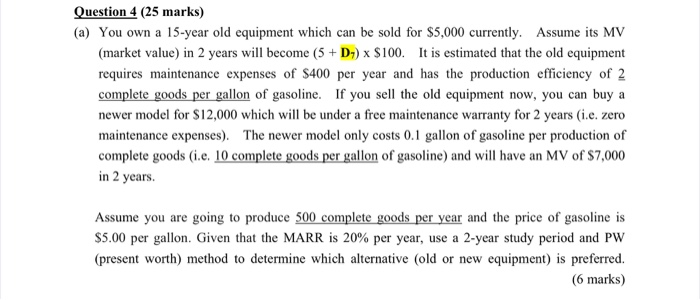

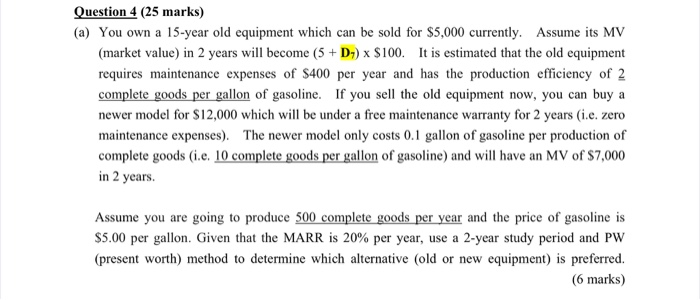

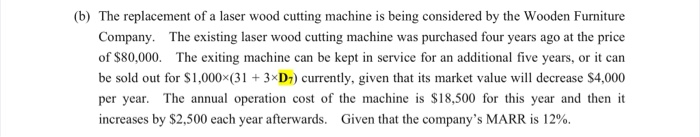

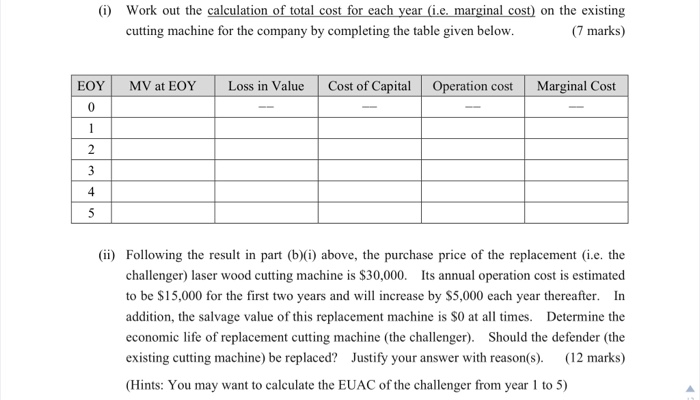

Question 4 (25 marks) (a) You own a 15-year old equipment which can be sold for $5,000 currently. Assume its MV (market value) in 2 years will become (5D)x S100. It is estimated that the old equipment requires maintenance expenses of $400 per year and has the production efficiency of2 complete goods per gallon of gasoline. If you sell the old equipment now, you can buya newer model for S12,000 which will be under a free maintenance warranty for 2 years (i.e. zero maintenance expenses) The newer model only costs 0.1 gallon of gasoline per production of complete goods (i.e. 10 complete goods per gallon of gasoline) and will have an MV of $7,000 in 2 years. Assume you are going to produce 500 complete goods per year and the price of gasoline is $5.00 per gallon. Given that the MARR is 20% per year, use a 2-year study period and PW (present worth) method to determine which alternative (old or new equipment) is preferred. (6 marks) (b) The replacement of a laser wood cutting machine is being considered by the Wooden Furniture Company. The existing laser wood cutting machine was purchased four years ago at the price of $80,000. The exiting machine can be kept in service for an additional five years, or it can be sold out for $1,000x(31 3xD1) currently, given that its market value will decrease $4,000 per year. The annual operation cost of the machine is $18,500 for this year and then it increases by $2,500 each year afterwards. Given that the company's MARR is 12%. i) Work out the calculation of total cost for each year (i.e. marginal cost) on the existing (7 marks) cutting machine for the company by completing the table given below. EOY MV at EOY Loss in Value Cost of Capital Operation cost Marginal Cost 4 (ii) Following the result in part (b)(i) above, the purchase price of the replacement (i.e. the challenger) laser wood cutting machine is $30,000 Its annual operation cost is estimated to be $15,000 for the first two years and wi increase by S5,000 each year thereafter. In addition, the salvage value of this replacement machine is SO at all times. Determine the economic life of replacement cutting machine (the challenger) Should the defender (the existing cutting machine) be replaced? Justify your answer with reason(s). (12 marks) (Hints: You may want to calculate the EUAC of the challenger from year 1 to 5)