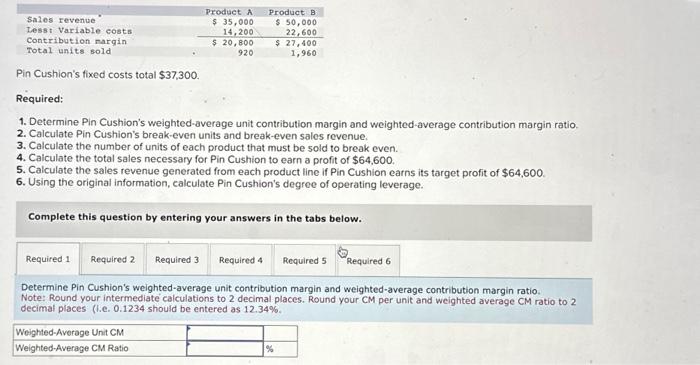

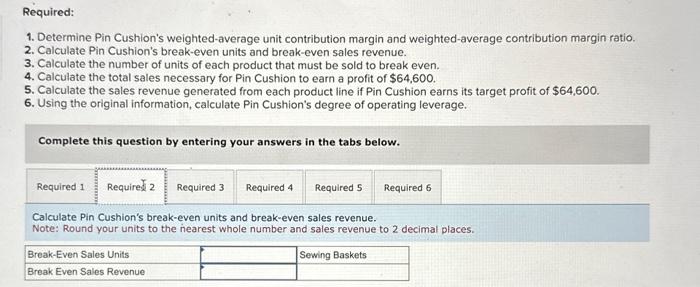

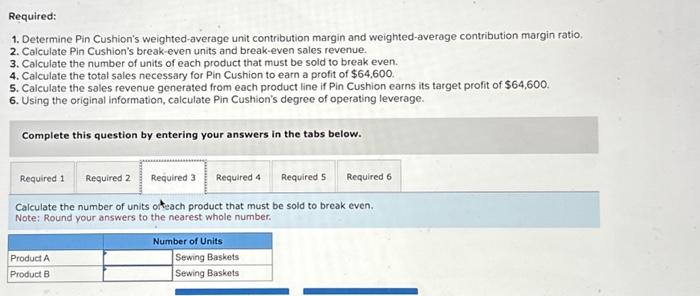

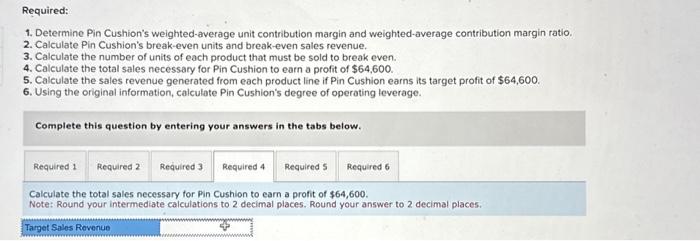

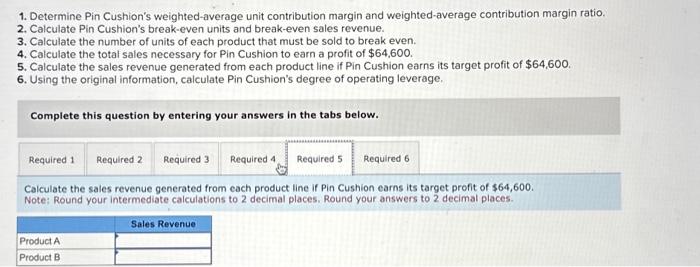

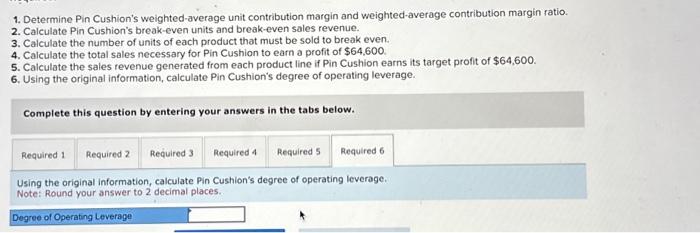

Pin Cushion's fixed costs total $37,300. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Caiculate the total sales necessary for Pin Cushion to earn a profit of $64,600. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. Note: Round your intermediate calculations to 2 decimal places. Round your CM per unit and weighted average CM ratio to 2 decimal places (1.e. 0.1234 should be entered as 12.34%. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $64,600. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Calculate Pin Cushion's break-even units and break-even sales revenue. Note: Round your units to the nearest whole number and sales revenue to 2 decimal places. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $64,600. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Calculate the number of units of each product that must be sold to break even. Note: Round your answers to the nearest whole number. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $64,600. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Calculate the total sales necessary for Pin Cushion to earn a profit of $64,600. Note: Round your intermediate calculations to 2 decimal places. Round your answer to 2 decimal places. 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $64,600. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. Note; Round your intermediate calculations to 2 decimal places. Round your answers to 2 decimal places. 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin fatio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $64,600. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $64,600. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Using the original information, calculate Pin Cushion's degree of operating leverage. Note: Round your answer to 2 decimal places