Answered step by step

Verified Expert Solution

Question

1 Approved Answer

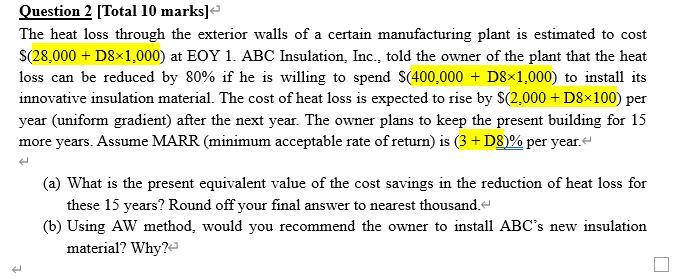

D8=2 Question 2 [Total 10 marks] The heat loss through the exterior walls of a certain manufacturing plant is estimated to cost $(28,000 + D81,000)

D8=2

Question 2 [Total 10 marks] The heat loss through the exterior walls of a certain manufacturing plant is estimated to cost $(28,000 + D81,000) at EOY 1. ABC Insulation, Inc., told the owner of the plant that the heat loss can be reduced by 80% if he is willing to spend $(400,000 + D81.000) to install its innovative insulation material. The cost of heat loss is expected to rise by $(2.000 + D8x100) per year (uniform gradient) after the next year. The owner plans to keep the present building for 15 more years. Assume MARR (minimum acceptable rate of return) is (3 +D8)% per year. (a) What is the present equivalent value of the cost savings in the reduction of heat loss for these 15 years? Round off your final answer to nearest thousand. (b) Using AW method, would you recommend the owner to install ABC's new insulation material? Why? Question 2 [Total 10 marks] The heat loss through the exterior walls of a certain manufacturing plant is estimated to cost $(28,000 + D81,000) at EOY 1. ABC Insulation, Inc., told the owner of the plant that the heat loss can be reduced by 80% if he is willing to spend $(400,000 + D81.000) to install its innovative insulation material. The cost of heat loss is expected to rise by $(2.000 + D8x100) per year (uniform gradient) after the next year. The owner plans to keep the present building for 15 more years. Assume MARR (minimum acceptable rate of return) is (3 +D8)% per year. (a) What is the present equivalent value of the cost savings in the reduction of heat loss for these 15 years? Round off your final answer to nearest thousand. (b) Using AW method, would you recommend the owner to install ABC's new insulation material? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started