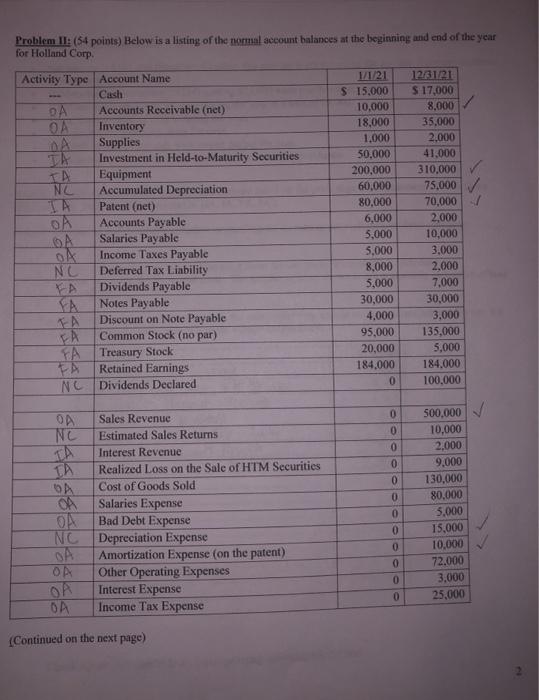

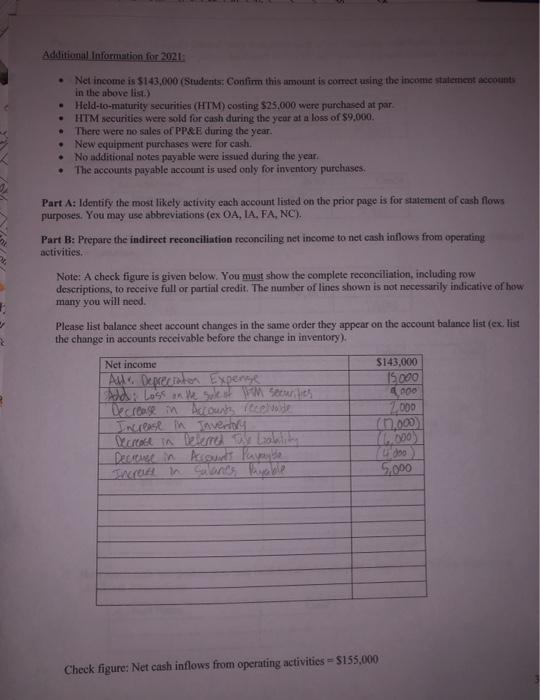

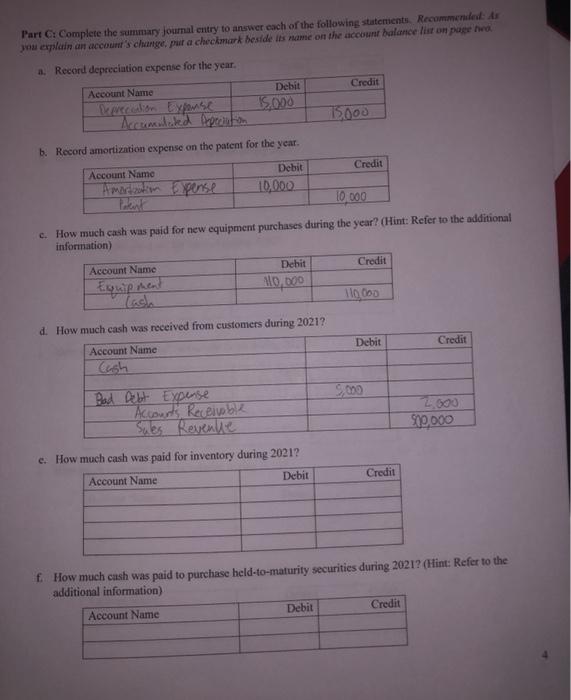

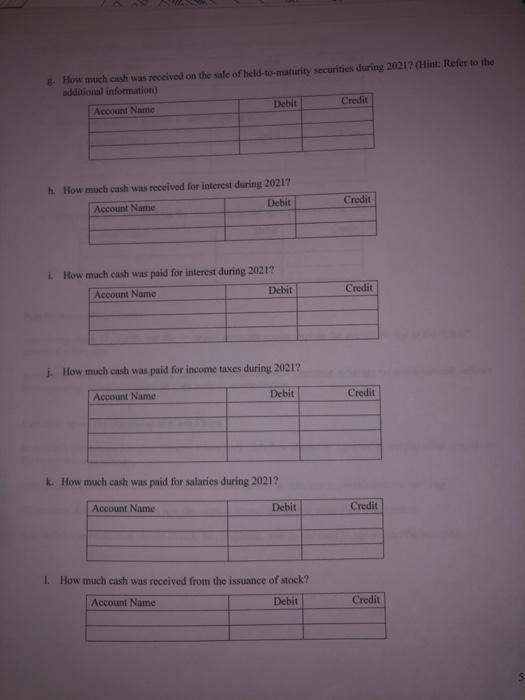

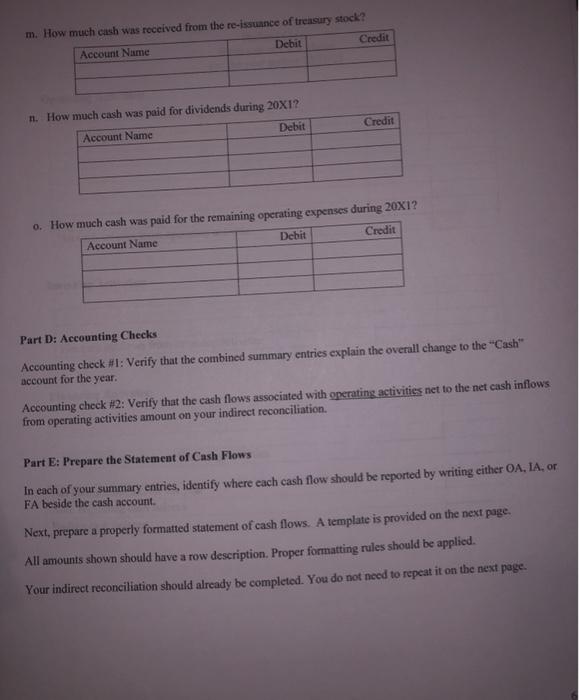

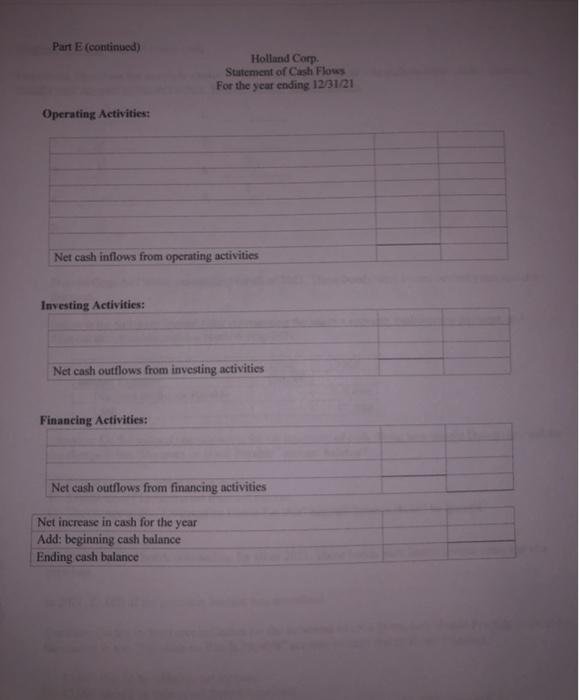

DA DA TA Problem II: (54 points) Below is a listing of the normal account balances at the beginning and end of the year for Holland Corp. Activity Type Account Name 1/1/21 12.3121 Cash $ 15,000 $ 17,000 Accounts Receivable (net) 10,000 8,000 OA Inventory 18,000 35,000 Supplies 1.000 2.000 Investment in Held-to-Maturity Securities 50,000 41.000 Equipment 200,000 310,000 NC Accumulated Depreciation 60,000 75,000 Patent (net) 80,000 70,000/ OA Accounts Payable 6,000 2,000 Salaries Payable 5,000 10,000 Income Taxes Payable 5.000 3.000 NL Deferred Tax Linbility 8,000 2,000 YA Dividends Payable 5,000 7,000 Notes Payable 30,000 30,000 Discount on Note Payable 4,000 3,000 Common Stock (no par) 95.000 135.000 Treasury Stock 20,000 5,000 Retained Earnings 184.000 184,000 NC Dividends Declared 0 100.000 OA 0 0 TA OA 0 0 0 OA Sales Revenue Nc Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities Cost of Goods Sold Salaries Expense ON Bad Debt Expense NC Depreciation Expense Amortization Expense (on the patent) Other Operating Expenses Interest Expense OA Income Tax Expense 500,000 10,000 2.000 9,000 130,000 80.000 5.000 15,000 10,000 72.000 3,000 25,000 0 0 0 OA 0 0 (Continued on the next page) Additional Information for 2021: Net income is $143.000 (Students Confirm this amount is correct using the income statement accounts in the nbove list) Held-to-maturity securities (HTM) costing $25.000 were purchased at par HTM securities were sold for cash during the year at a loss of $9,000 There were no sales of PP&E during the year. New equipment purchases were for cash. No additional notes payable were issued during the year The accounts payable account is used only for inventory purchases. . Part A: Identify the most likely activity each account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA, FA, NC). Part B: Prepare the indirect reconciliation reconciling net income to net cash inflows from operating activities. Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need. Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory). Net income Altr Deprecator Expense $143,000 15.000 Increase in Inventory Decreme in kort le 000 (6.000 10.000 doo 5,000 Check figure: Net cash inflows from operating activities = $155,000 Part C: Complete the summary journal entry to answer each of the following statements. Recommended As you explain an account's change, put a checkmark beside its name on the account balance list on page na a. Record depreciation expense for the year. Debit Credit Account Name Deprecation Exponse b. Record amortization expense on the patent for the year. Account Name Debit Credit Amortization Expense 10.000 10.000 c. How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional information) Account Name Debit Credit 10,000 110.000 d. How much cash was received from customers during 2021? Account Name Debit Credit 30,000 Bad Debt Expense Accounts Receivable Sules Revenue e. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit How much cash was received on the sale of held-to-maturity securities during 20217 (Hint: Refer to the additional information Account Name Debit Credit h. How much cash was received for interest during 20217 Account Name Debit Credit 1. How much cash was paid for interest during 2021? Account Name Debit Credit j. How much cash was paid for income taxes during 2021? Account Name Debit Credit k How much cash was paid for salaries during 2021? Account Name Debit Credit 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Account Name Debit Credit Credit n. How much cash was paid for dividends during 20X1? Account Name Debit 0. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit Part D: Accounting Checks Accounting check #1: Verify that the combined summary entries explain the overall change to the "Cash account for the year. Accounting check #2: Verify that the cash flows associated with operating activities net to the net cash inflows from operating activities amount on your indirect reconciliation. Part E: Prepare the Statement of Cash Flows In each of your summary entries, identify where each cash flow should be reported by writing either OA, IA, or FA beside the cash account. Next, prepare a properly formatted statement of cash flows. A template is provided on the next page. All amounts shown should have a row description. Proper formatting rules should be applied. Your indirect reconciliation should already be completed. You do not need to repeat it on the next page. Part E (continued) Holland Corp. Statement of Cash Flows For the year ending 12/31/21 Operating Activities: Net cash inflows from operating activities Investing Activities: Net cash outflows from investing activities Financing Activities: Net cash outflows from financing activities Net increase in cash for the year Add: beginning cash balance Ending cash balance