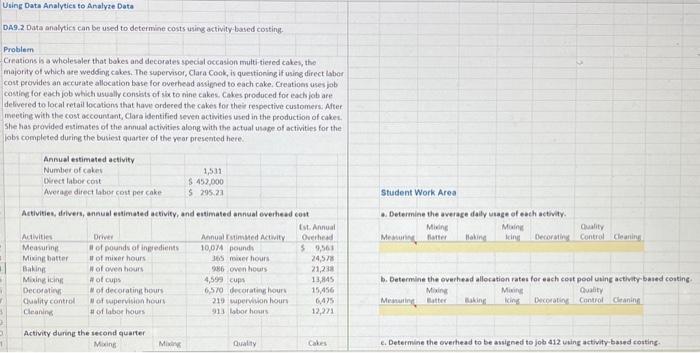

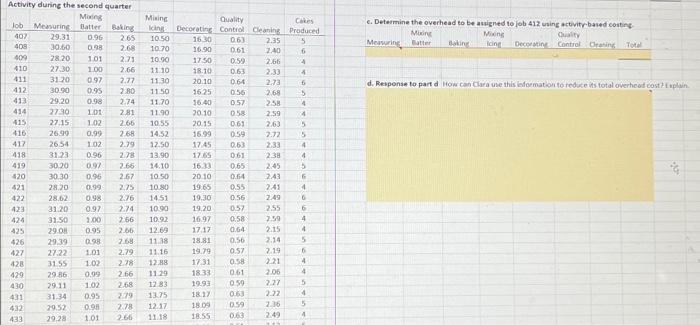

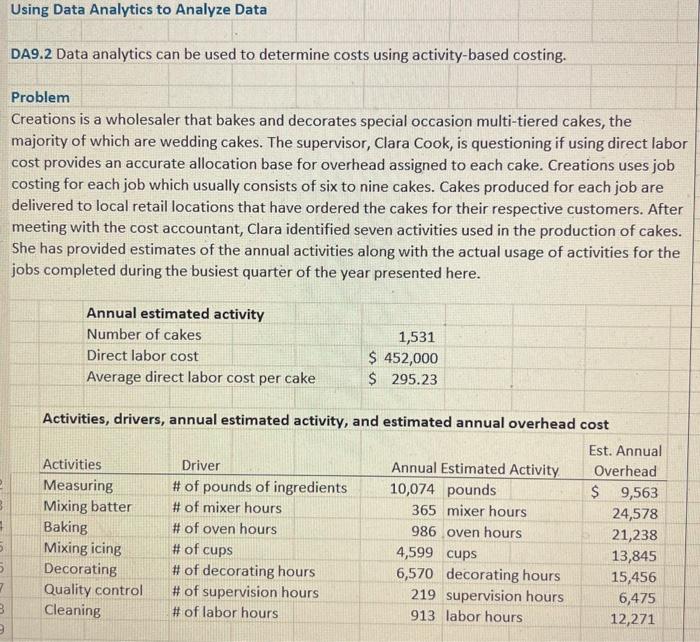

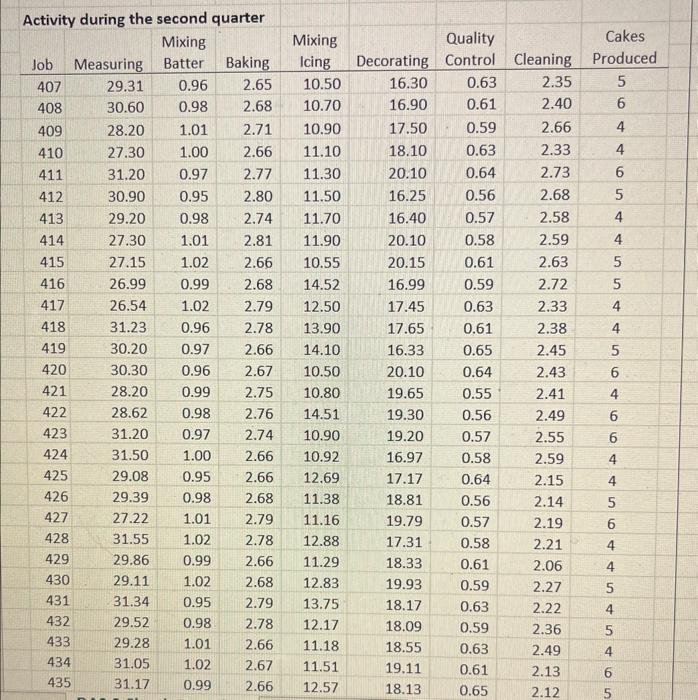

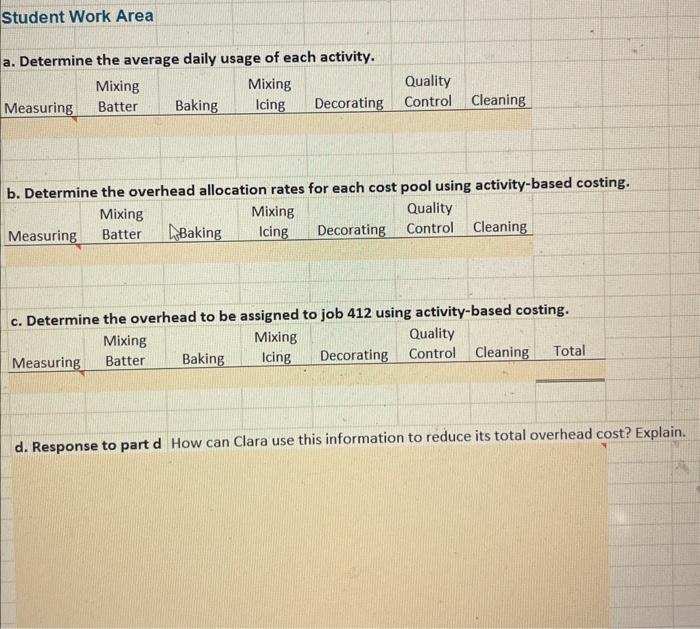

DA9.2. Data analytict can be used to determine costs using activity based costing. Problem Creations h a wholesaler that bobes and decorates special occasion multi-tiered cales, the majority of which are wedding cabes. The supervisor, Clara Cook, is questioning if uning direct labor cort provides an accurate allocation base for overhead assigned to each cake. Creations user job costing for each job which usually consists of six to nine cakes. Cakes nroduced for eack job are defivered to local retail locotions that have ordered the cakes for their respective customers: After meeting with the cost accountant, Clara identified seven activities wsed in the production of cakes. She has provided mimates of the annual activities along with the actual usage of activities for the jobs completed during the busiest quarter of the year presented here. Student Work Area Activities, difivens, annual estimated activity, and estimated annual everties cont a. Determine the averase daily urase of ech settiviy. b. Determine the everhead allocation rates foc each cout pool using activitribased costine. Activity durine the second quarter Maing Mining Quality c. Determine the overitead to be assigned to job 412 using activity-based costing. c. Determine the oyerhead to be astigned to job 412 using activito.based costint. Problem Creations is a wholesaler that bakes and decorates special occasion multi-tiered cakes, the majority of which are wedding cakes. The supervisor, Clara Cook, is questioning if using direct labor cost provides an accurate allocation base for overhead assigned to each cake. Creations uses job costing for each job which usually consists of six to nine cakes. Cakes produced for each job are delivered to local retail locations that have ordered the cakes for their respective customers. After meeting with the cost accountant, Clara identified seven activities used in the production of cakes. She has provided estimates of the annual activities along with the actual usage of activities for the jobs completed during the busiest quarter of the year presented here. Activities, drivers, annual estimated activity, and estimated annual overhead cost Activity during the second quarter a. Determine the average daily usage of each activity. b. Determine the overhead allocation rates for each cost pool using activity-based costing. natermine the overhead to be assigned to job 412 using activity-based costing. d. Response to part d How can Clara use this information to reduce its total overhead cost? Explain. DA9.2. Data analytict can be used to determine costs using activity based costing. Problem Creations h a wholesaler that bobes and decorates special occasion multi-tiered cales, the majority of which are wedding cabes. The supervisor, Clara Cook, is questioning if uning direct labor cort provides an accurate allocation base for overhead assigned to each cake. Creations user job costing for each job which usually consists of six to nine cakes. Cakes nroduced for eack job are defivered to local retail locotions that have ordered the cakes for their respective customers: After meeting with the cost accountant, Clara identified seven activities wsed in the production of cakes. She has provided mimates of the annual activities along with the actual usage of activities for the jobs completed during the busiest quarter of the year presented here. Student Work Area Activities, difivens, annual estimated activity, and estimated annual everties cont a. Determine the averase daily urase of ech settiviy. b. Determine the everhead allocation rates foc each cout pool using activitribased costine. Activity durine the second quarter Maing Mining Quality c. Determine the overitead to be assigned to job 412 using activity-based costing. c. Determine the oyerhead to be astigned to job 412 using activito.based costint. Problem Creations is a wholesaler that bakes and decorates special occasion multi-tiered cakes, the majority of which are wedding cakes. The supervisor, Clara Cook, is questioning if using direct labor cost provides an accurate allocation base for overhead assigned to each cake. Creations uses job costing for each job which usually consists of six to nine cakes. Cakes produced for each job are delivered to local retail locations that have ordered the cakes for their respective customers. After meeting with the cost accountant, Clara identified seven activities used in the production of cakes. She has provided estimates of the annual activities along with the actual usage of activities for the jobs completed during the busiest quarter of the year presented here. Activities, drivers, annual estimated activity, and estimated annual overhead cost Activity during the second quarter a. Determine the average daily usage of each activity. b. Determine the overhead allocation rates for each cost pool using activity-based costing. natermine the overhead to be assigned to job 412 using activity-based costing. d. Response to part d How can Clara use this information to reduce its total overhead cost? Explain